A pivotal Government Reform Proposal Unveiled, from State-Owned Sector, Tariff Reduction, to Global FTA ambitions; Plans for alternative to SWIFT; A-Shares Bull Run; A Facial Recognition Unicorn

Intelligence and Insights on China's government actions, foreign policy, economy, and the capital market.

Today we take a close examination of a pivotal Government Reform proposal, including State-owned sector reforms, rural reforms, income and tax reforms, Tariff reduction, China’s global FTA ambitions, and the construction of a domestic full supply-demand cycle. China urges alternative CIPS system to SWIFT in global monetary clearance, and A-share Bull market. We also zoom in to China’s only Facial Recognition unicorn that is not currently on the US entities list.

Government Reform Agenda

10,000-word policy document outlines China’s structural reform agenda in 2020, proposed by China’s leading policy maker Huang Qifan, currently capturing wide national exposure. China BIG Idea selects the top areas. (read more)

Divest a portion of SOE assets into the formation of State-Owned Investment and Asset Management firms.

China’s state-owned equity reached nearly $8.4 trillion in 2018. The proposal is to divest $1.5 Trillion out of the SOEs to form a number of investment and asset management firms, comparable to Singapore’s Temasek.

The advantages of such reform are:

The separation and creation of state-owned investment firms will enhance the return on state assets by directing state investments into various higher growth targets.

The yield generated on such investments will supplant the much needed social and public expenditure in China.

State assets will become more efficiently run and higher yielding.

The assets removed from the state-controlled real economy will provide incentives for the private sector to enter, boost market competition in such areas and overall economic growth.

The new state-backed investment funds will in turn invest in the vibrant private companies that come into the competitive landscape. The actions further create effectively more mixed-ownership corporates, a hybrid between SOEs and private companies in the Chinese economy.

2. Per Capita income rise as a key policy imperative to overcome the Middle Income Trap

China’s per capita annual GDP broke $10,000 in 2019. There are currently 400 million middle income class and 600 million hovering on the lower bound of the middle income category according to the World Bank ( recently referred to by Chinese premier Li Keqiang with an annual income less than $1,700) in China.

China currently sits on the top bound of the middle income trap. Post COVID19, fallback to the Middle Income Trap remains a genuine risk.

Personal and Corporate Tax Cuts

The top bracket of China’s personal tax rate reaches 45%, remaining one of the highest in the world.

《关于贯彻落实进一步扩大小型微利企业所得税优惠政策范围有关征管问题的公告》(国家税务总局公告2018年第40号)。】:对年应纳税所得额低于100万元(含100万元)的小型微利企业,其所得减按50%计入应纳税所得额,按20%的税率缴纳企业所得税;优惠时间自2018年1月1日至2020年12月31日。

70% of China’s employment are generated by small and micro-sized companies. In 2018, new tax incentives were offered to this market segment, effectively making 50% of their revenues tax free, and the remaining 50% at a 20% tax bracket through end of 2020.

Establish and Interpret Innovation-led Domestic Economic Cycle( 经济内循环).

牢牢抓住创新这个驱动发展的不竭动力,尽快打通支撑科技强国的全流程创新链条,以创新创业“引领”内循环

Innovation on the supply side will eventually create new market demands. Once capital, resources, and human capital start to concentrate in creating new innovation-based market supplies, traditional supplies will fade out of the economic system. This implements the supply side reform, and at the same time, takes the whole economic system to a new and upgraded equilibrium.

Innovation-led economic growth should strengthen in three phases.

第一阶段是“0—1”,是原始创新、基础创新、无中生有的科技创新。

The first phase is from “0-1”, in basic science and research;

创新的第二阶段是“1—100”,是技术转化创新.

The second phase is from “1-100”, in IP conversion and commercialization;

创新的第三阶段是“100—100万”,是将转化成果变成大规模生产能力的过程。

The third phase is from “100-1 million”, in mass production of tech products.

Lower China’s overall tariff level from 7.5% to 5% over the next 3-5 years, in line with tariff levels of developed countries.

Promote RMB’s usage in global trade as a unit of account, and medium of exchange currency, by establishing more pricing power as China expands as a global import nation.

New Infrastructure Investment plan gives China the historic opportunity to lead in the 4th round of the Industrial Revolution, centered on AI.

Digital innovation has penetrated well in the consumer sectors. The bigger opportunity lies in the application of digital technologies in the industrial sectors.

Enable a secondary market for rural assets (land and housing) to be exchanged, collateralized and transacted.

Enhance logistics industry reforms. China’s total logistics cost stands at 15% of China’s GDP. In the US, the figure is 7% of its GDP. And in Europe and Japan, 6-7%.

Effective logistics transportation through the old railway networks replaced by the new high speed rail will provide the most cost efficient logistics transportation means.

Cross-border E-commerce regulatory reform. Cross-border e-commerce takes up less than 2% of China’s total exports.

Regulatory restrictions are still widely available in cross-border e-commerce trades, for example, segregation of wholesale and retail trades, and further divisions of trade and custom requirements by products. The benchmark should be an Amazon-like unified cross-border e-commerce trade framework.

New Urbanization Plans enable more efficient and more coordinated inter-regional and intra-regional developments.

China is to expedite its FTA negotiations when the US and Europe continues to sift through this crisis, including the completion of the CJK (China-Japan-ROK) FTA, RCEP, China-EU BIT, China-UK BIT negotiations.

China will look at potentially starting the CPTPP negotiations. (read more)

The poison pill term (a term restricting free trade agreements with non-market economies) under the USMCA is targeted towards China. US’s FTA negotiations with the EU, the UK and Japan may incorporate the same poison pill terms against China.

Government in Action

China urges to enhance usage of its own financial messaging network (CIPS) in lieu of SWIFT

Report from Bank of China International urges that China should increase its own financial messaging network usage for cross-border transactions in the mainland, Hong Kong and Macau, in preparation for potential US sanctions. (read more)

Reasons:

- It was anticipated that U.S. legislation could penalise banks for serving officials who implement the new national security for Hong Kong. (read more)

- Greater use of the Cross-Border Interbank Payment System (CIPS) instead of the Belgium based SWIFT system would reduce exposure of China’s global payments data to the United States (BOC International said in a report, which was co-authored by a former foreign exchange regulator, Guan Tao)

About the CIPS system:

- China launched the CIPS clearing and settlement services system in 2015 to help internationalize use of the RMB. Supervised by the Central Bank, CIPS said it processed 135.7 billion yuan ($19.4 billion) a day in 2019, with participation from 96 countries and regions. (read more)

- -The CIPS (Phase I) was launched on 8th October, 2015. There were 19 commercial banks in mainland China in the first batch of direct participants and 176 indirect participants from more than 50 countries and regions all over 6 continents.(read more)

President Xi Outlines China’s new multilateral Bank’s mission at the Asian Infrastructure Investment Bank (AIIB) Council Meeting Opening (read more)

On 28th July, President Xi made a video opening speech at the 5th AIIB Council meeting.

Four expectations for AIIB future developments were laid out.

聚焦共同发展,把亚投行打造成推动全球共同发展的新型多边开发银行

Focus on collective development as a new type of multilateral development bank.

AIIB should devote to serve the development needs of its members, by providing high quality, low cost, and sustainable infrastructure investments. Support should be provided for both traditional and new infrastructures.

勇于开拓创新,把亚投行打造成与时俱进的新型发展实践平台

Drive innovation as a development practice platform.

AIIB should innovate in development ideas, business models, and institution governance. AIIB Should motivate connectivity, promote green developments, support technological advances via diversification of financing products.

创造最佳实践,把亚投行打造成高标准的新型国际合作机构

Incorporate best practices as an international cooperative institution.

AIIB should abide by international standards, respect general development patterns and value its members’ individual development needs.

坚持开放包容,把亚投行打造成国际多边合作新典范

Embrace openness and inclusiveness as a model of multilateral cooperation.

AIIB should uphold the principle of joint business and joint construction, engage in cooperation with diverse partners, provide public good at domestic and global levels and promote closer economic integration.

Liqun Jin was re-elected to be the governor of Asian Infrastructure Investment Bank, for a second five-year term. He has been the governor of AIIB since its establishment in 2016. Mr Jin’s next 5-year tenure will start from 16th January 2021.

Capital Market

Crazy Bull, again?

China A-share market refers to RMB-denominated ordinary shares that are traded on the Shanghai Stock Exchange (SSE) and the Shenzhen Stock Exchange (SZSE).

2020 Performance

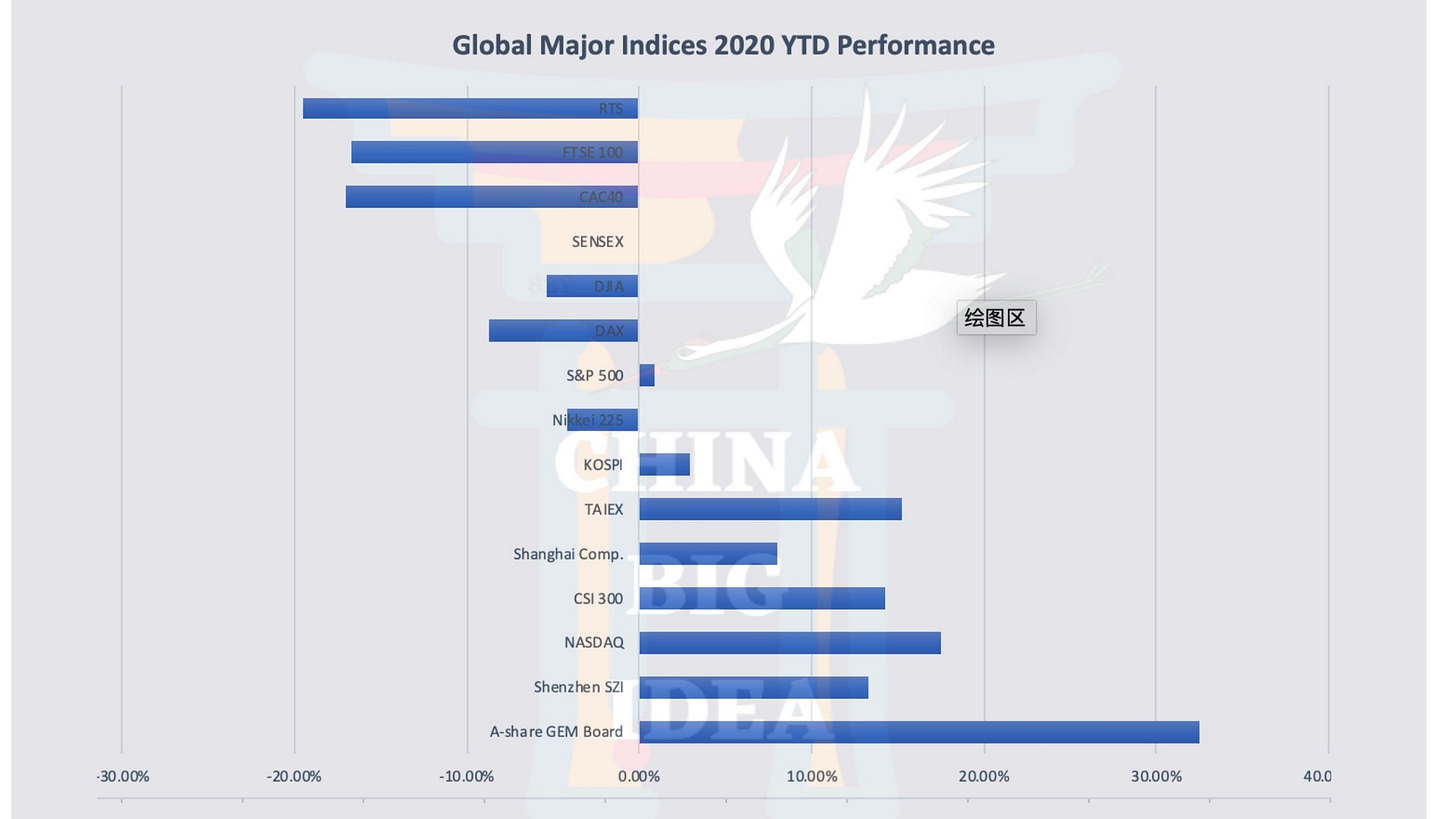

Shenzhen GEM Board (Growth Enterprise Market Board) topped global stock market performance this year, marking nearly 35% return YTD.

Shanghai and Shenzhen composites also ranked among world’s top 5 best performing equity indices.

Reasons for such performance

China’s monetary easing so far this year, the inclusion of A shares in the FTSE Index, and domestic policies on curbing real estate prices of late all become contributing factors to the stock market bull run.

Meanwhile, with global monetary easing and flood of liquidity globally, offshore capital enters Chinese capital market through China’s QFII program. Dollar capital looks for growth opportunities in the Chinese markets in 2020, reflecting China’s early economic recovery.

MSCI’s A-Share inclusion

In June 2017, the MSCI Emerging Markets Index announced a two-phase plan in which it would gradually add 222 China A large-cap stocks. In May 2018, the index began to partially include China large-cap A shares, which make up 5% of the index. Full inclusion would make up 40% of the index.

FTSE’s A-Share inclusion

FTSE Russell completes the phase one inclusion of China A-shares into its global equity benchmarks in June 2020.

The phase one completion means China A-Shares make-up approximately 6% of the FTSE Emerging index, which is tracked by $140bn assets.

Some 1,051 large, medium and small-cap China A-Shares have now been added to the FTSE Emerging All Cap index over the past year. (read more)

QFII (RQFII)

Since 2003, select foreign institutions have been able to purchase these shares through the QFII system. Launched in 2002, QFII allows certain licensed international investors to invest in China’s stock exchanges with specified quotas. Prior to June 2018, foreign institutions invested in China’s stock or bond markets through the QFII program could only repatriate up to 20% of its investments every month. As of mid-June 2018, China lifted both the 20% remittance ceiling and the three-month lock-up period for all new and existing QFII participants.

As an attempt to stimulate foreign investment, QFII quota was also increased from $30 billion to $80 billion in April 2012, and was completely eliminated in September 2019. At the same time,China's securities regulator announced plans to eventually combine the QFII and RQFII (a similar program with fewer restrictions on overseas investors) programs as part of its reforms to further increase foreign investor participation.

Net New Investment Account Increase Post COVID

From January to June 2020, the number of newly opened A-shares accounts in Shanghai increased by 13.49 million, up by 7% YoY. Same data from June increased by 53% YoY. Even if the market is facing a major adjustment, it will still draw continuous attention from individual investors.

The absolute number of new accounts increase is similar to that in March 2015 (2.46 million), which shortly led to a major stock market correction of over 50%.

China Unicorn Spotlight

CloudWalk (CN: 云从科技), a Guangzhou-based developer of Chinese facial recognition software company, and the primary supplier of facial recognition technology to major Chinese state-owned enterprises including Bank of China, Shanghai Pudong Airport, Haitong Securities, and China Mobile’s brick and mortar stores.

Valuation: $3.3B

Total Funding: $517M (as of May, 2020)

Company History:

CloudWalk was founded by Zhou Xi, a graduate of the University of Science and Technology of China with an academic background in artificial intelligence and pattern recognition in April 2015.

The computer vision company CloudWalk develops hardware and software-based AI facial recognition technology. Its tech has been widely deployed for security applications in the financial, public security and aviation sectors, including passenger and ticket scanning for air travel, door entry scanning, and law enforcement strategies.

In May, 2020, CloudWalk raised RMB 1.8 billion (US$254 million) in funding from a group of provincial and municipal funds in China to become the fourth most well-funded biometric facial recognition company in the country. According to the Chinese publication 36Kr, CloudWalk intends to launch an IPO on Shanghai’s Star Market by the end of 2020 (read more).

CloudWalk is the youngest of the ‘Four Dragons of Chinese AI Technology (CN: 国内人工智能领域AI四小龙)’, along with SenseTime (CN: 商汤)、MEGVII (CN: 旷视)、Yitu (CN: 依图). The company’s success was partially due to the fact that it had seized an opportunity to supply state-owned businesses in 2015 – when the ‘3.15’ (Day of Consumers’ Rights) campaign exposed banks’ inability to detect fake ID’s (read more). Having solely secured state-backed funds, the company has yet to receive any overseas funding and was speculated to have delayed its plan to launch a $7.5B IPO in Hong Kong, which the company had denied(read more).

Over the past year, Chinese mobile applications and online transactions had seen a drastic increase in facial-recognition requirements for security reasons. It will not be a surprise when such requirements soon become mandatory.

So far, the intelligence company is operating solely within the RMB framework but has participated in international projects initiated by the Chinese government.

As part of the Belt and Road Initiative, CloudWalk was the first AI company to have exported its services to Africa in a strategic partnership with Zimbabwe in 2018 (read more). CloudWalk is also the only one of the four Chinese biometrics unicorns who is not named on the U.S. Entity List for alleged involvement in human rights violations (read more).

Select investors: Shunwei Capital Partners, Oriza Holdings, Guangdong Technology Financial Group, Atlas Capital.