Consumption over Chinese NY; RMB Exchange Rate; Restrictions on Cash; China-Russia Deal; NSA on China/Russia; 33 Companies on "Unverified List"

Intelligence and insights on China's government actions, foreign policy, economy, and the capital markets

China sees considerable tension with the West, a stronger alliance with Russia, and a soft rebound of the consumer economy.

Government in Action

New Retail Banking Procedure Affects Residents’ Cash Transactions

The People’s Bank of China, the Banking and Insurance Regulatory Commission, and the China Securities Regulatory Commission jointly issued the Action Plan on Banking Client Due Diligence, Identity, and Transaction Record-keeping Procedures. (《金融机构客户尽职调查和客户身份资料及交易记录保存管理办法》). The Action Plan lowered the threshold that triggers client due diligence reviews. The new threshold is now for any cash deposits or withdrawals over RMB 50,000 or US$10,000.

Starting March 1, any banking client who deposits or withdraws cash over the threshold will be subject to personal identification reviews, due diligence reviews on the source of the cash deposit, and the use of the withdrawal.

What is the objective?

In recent months, China has seen a wave of crackdown on money laundering activities. In the past months, the Chinese government arrested Macau’s casino moguls, charged with illegal money laundering through gambling channels. In the past few months, China has also completely closed and deemed illegal any crypto-currency mining, transactions, and brokerage operations in China. Both businesses have long been the grey channels for money laundering.

According to the official statement, the restrictions on cash use through the banking system are intended to control money laundering with cash.

Some believe that the tightened cash-control measure is to prepare China for the final launch of the sovereign digital currency (DC/EP). DC/EP’s launch will enhance the traceability and verifiability of all Chinese savings and financial transactions via the digital currency platform. Cash will be an alternative with which the digital tracing process will not work. Therefore, it pays off to enhance the usage and adaptation of the DC/EP.

Cash monitoring is also a way to control corruption.

China has intensified its systemic anti-corruption campaign, seeing several arrests of corrupt officials early in 2022. The anti-corruption campaign will likely intensify throughout the year. Cash is usually the opted medium for bribery.

Economy

China’s Spring Festival Consumption Warmed, but at around Half Compared to 2019 Level

Over the Chinese New Year holiday ( Jan 31- Feb. 6), 251 million domestic trips have been recorded, generating RMB 290 Billion in revenue. The number of trips accounted for 73.9%, and the revenue reached 56.3% of the 2019 Chinese New Year.

The Chinese box office hit nearly $1 Billion (RMB 5.9B) in revenue, the second-highest box office revenue in history.

Real Estate Continues to suffer over the Chinese New Year

Shenzhen, often considered the barometer of the Chinese real estate market, saw zero transactions on new properties,

and one transaction on second-hand properties.

Based on the key-city residential property transaction index, the transaction value over the 2022 Chinese New Year came in at 49% of 2021’s, indicating no pick up in residential property demand despite the aggressive Central Bank loosening policies adopted in December and January.

CF40 on Foreign Exchange & US-China Monetary Policies

CF40 Column warns of a likely yet controlled devaluation of RMB on the horizon. ( Read full.)

The column cited the large bilateral trade surplus during COVID between China and the US, continued foreign financial capital inflow, and the sizeable interest premium to explain the rare appreciation of the RMB and the USD against all other major global currencies in the past few months. The piece also highlighted three reasons why the RMB will likely devalue modestly in the near future.

1. Chinese export competitiveness is diminishing.

On the one hand, the trade surplus in 2021 was largely due to production shut-downs in the rest of the world. Easing COVID restrictions brings local productions back and reduces the need for Chinese exports. On the other hand, a large portion of the trade surplus is in durable goods, whose high demand is unlikely to continue for much longer. On the supply side, Southeast Asian countries are also resuming production, further competing with China on export.

2. Continued strength of the USD

Due to the continued inflation expectations and continued recovery of the US economy, the Fed’s rate hike, possibly by up to 7 times this year, will lead to an even stronger dollar and a weaker Yuan relatively.

3. Decoupled monetary policy cycles

The monetary policy cycle in China is de-synced when compared to the US and the West, and other Asian and developing economies. South Korea, Malaysia, and India have all signaled to raise interest rates in 2022, further narrowing the interest rate gap between these economies and China’s.

Why is the RMB exchange rate manageable?

1. Incomplete settlements offering support

According to CF40 estimates, as much as 500-600 billion USD worth of foreign trade is yet to be settled, as exporters were unwilling to settle at a bad rate. If the Yuan peaks and starts to decline, businesses might be more willing to settle and support the exchange rate.

2. Limited impact of the US-China interest differential

Comparing the interest rate differential, the confidence in the Chinese economic fundamentals is an important factor in the resilience of the RMB. The RMB will unlikely suffer large losses from a temporary narrowing rate gap as the Chinese economy remains solid.

3. Secular capital inflows

The piece argued the main driver for capital inflows into China comes from long-term asset allocation decisions of foreign investors, which are largely independent of the exchange rate. The trend is likely to continue, offering further support to the RMB on its decline.

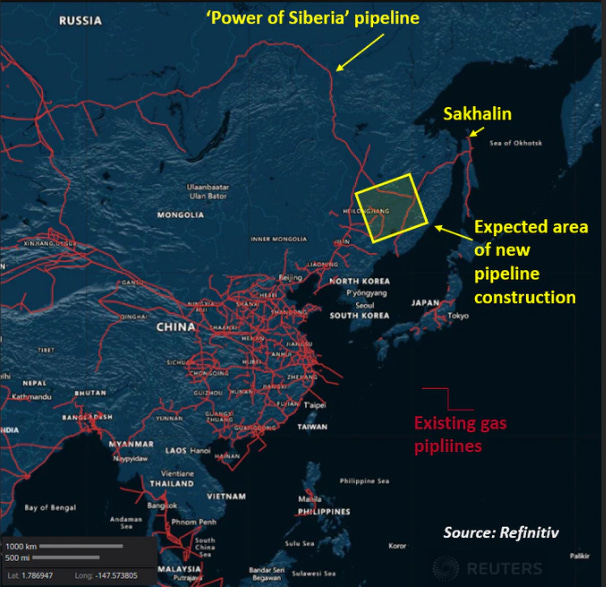

China and Russia Enter into a 30-year Gas Deal via New Pipeline

On February 4, Gazprom, “a monopoly on Russian gas exports by pipelines,” has agreed to supply CNPC, a large Chinese state-owned energy supplier, with 10 billion cubic meters (bcm) of gas a year, for 30 years, according to the Chinese release ( 25 years according to the Russian release). (Read more)

This will be on top of the existing “Power of Siberia” pipeline, which exported 16.5 bcm of liquefied natural gas to China in 2021. Russia plans to supply China with 38 bcm of gas by 2025.

The deal was announced hours after Putin landed in China for the opening of the Winter Olympics and was part of a broader display of increased China-Russia partnership in “entering a new era and global sustainable development.”

Keep reading with a 7-day free trial

Subscribe to China BIG Idea to keep reading this post and get 7 days of free access to the full post archives.