Digital Gordian Knot, Trade, 11.11: a Special Weekend Edition of Weekly Highlights

Intelligence and Insights on China's government actions, foreign policy, economy and the capital market

Letter from the Editor

This week, China has demonstrated its willingness to rein in its tech giants such as Alibaba, Tencent, and ByteDance to preserve the spirit of digital competition, vital to safeguarding innovation, one of China’s pivotal policy goals. China introduced an Antitrust Guideline draft aiming at digital and tech behemoths. Designing well-functioning guidelines, however, won’t be an easy task: the Chinese new economy is propelled by the power of technology. It has been made clear by this year’s Nov. 11 e-commerce shopping spree (Chinese equivalent of Black Friday) which is record breaking both in terms of transaction volumes and participation.

By choosing to put its digital giants in checks and balances, China sliced a Gordian knot in its development path: digital governance has been a notorious puzzle for regulators across the globe. Not only is there no existing path to follow here as China is at the forefront of digitalization and thus one of the fist countries developing a substantial legal framework for the digital era, the digital economy has disruption inscribed in its DNA.

“Governments of the Industrial World, you weary giants of flesh and steel, I come from Cyberspace, the new home of Mind. On behalf of the future, I ask you of the past to leave us alone.”

— declared John Perry Barlow in defiance in A Declaration of the Independence of Cyberspace, 1996

The monumental task is in the hands of Chinese policymakers, and sympathy for them is found even on the other side of the fence. When asked about Ant Group IPO’s unexpected overhaul, founder of $ 138 billion hedge fund, Ray Dalio commented, “almost always, I found them (Chinese regulators) to be reasonable, caring, and highly informed people, who are now in an environment changing at an extremely fast pace. ”

As we discussed in previous weekend newsletters, Socialism with Chinese characteristics remains yet to define, with the authority’s recent moves to set boundaries on digital frontier, be it the recent regulation on micro-lending, revised Data Security Law, or prevention of digital monopoly, China, in the current era, is signaling its will to place social inclusion above wealth accumulation. Let its digital flagships serve the society in exchange for years of favorable, emboldening digital competitive landscape.

With the election opening a door to possibility and uncertainty, China remains cautious and expects tensions with the US will continue to increase, although at a slower pace. This cautiousness is indeed not only found in China’s foreign policy expectations but also directly impacts its domestic policy planning: the proposal for the 14th FYP puts a strong emphasis on self-sufficiency, a theme that once more appeared in an outline on China’s goals for the coming five years presented by the renowned Chinese scholar Yao Yang.

What then remains of globalization to which China reiterated its commitment? By the time you read our newsletter, a gigantic regional integration framework is set in motion: the largest free trade bloc in the world, the Regional Comprehensive Economic Partnership (RCEP) has gone through 8 years of negotiations, and negotiating parties, China, Japan, ASEAN, Republic of Korea, Australia, New Zealand, have achieved consensus in the agreement. Furthermore, Chinese Deputy Minister of Commerce revealed China’s will to join the pact by the end of 2020, meaning that China will stay true to the spirit of free trade. Representing 45% of the world’s population, some of the youngest nonetheless, and 40% of the global trade, the world will see a stronger emergence of the Asian Century.

Amidst mounting global uncertainties with prolonged economic lockdowns in the coming months, and a US election that defines the destiny of America, China seems to be on the side of calm and resolution. It is embracing the external world in a stronger, assertive posture.

I’d like to thank all our global team of contributors and editors. Please subscribe and join us for the broader and deeper insights and intelligence we bring you daily. Look forward to seeing you.

I. National Development

Key Messages at the China Development Forum

On Agricultural Security

Han ChangFu, Minister of Agriculture and Rural Affairs,stated that “China’s agricultural security is at its best in history.”

“中国粮食安全形势处在历史上最好时期”。

China’s crop supply per capita is at around 470 kilograms per annum, running higher than the 400 kilograms per annum global standard for food security.

十三五”以来,我国粮食连年丰收,产量一直稳定在1.3万亿斤以上,人均粮食占有量稳 定在470公斤左右,高于人均400公斤的国际安全的标准线。

On 5G and Applications

Liu Liehong, vice minister of Ministry of Industry and IT, introduced that:

700,000 5G base stations have been established, a scale more than twice as big as the 5G stations in the rest of the world ex-China combined.

5G connections have already reached 180million in China.

今年中国已经建成了近70万个基站,这个数字比中国之外的全球加起来的总量还多,基本上是中国之外5G基站总量的2倍多,5G终端的连接数现在已经超过1.8亿。

5G infrastructure has already enabled new technology applications and ecosystems, including 5G+online education systems, AR/VR education, and holographic classrooms.

On Consumption and Urbanization

Tang Dengjie, Deputy director of the NDRC briefed that:

Consumption has contributed over 60% to China’s GDP growth since 2016.

China’s urbanization has reached 60%. 850 Million people live and work in China’s urban areas.

on further financial liberalization of the factors market

Tang Dengjie, deputy director of the NDRC, explained that China explores to expand the scope of financing options for companies, including:

Supply chain financing by the large companies for its upstream and downstream suppliers;

Accounts receivable, inventory, invoice, and lease right financing;

Energy use rights, carbon emission rights, pollution emission rights, energy performance contract financing;

IP rights and trade mark financing.

II. Tech Governance

Antitrust Guideline Takes Aim at China’s Digital Giants

A day before the Chinese 11.11 Singles’ Day shopping spree, China State Administration for Market Regulation launched draft Antitrust Guidelines for the Digital and internet giants.

This is the first time the market regulator in China has attempted to define what constitutes anti-competition practices among internet companies under the law.

Impact:

E-commerce, online food delivery service and ride hailing apps will be the center of the storm by the antitrust act. Alibaba, Tencent and Meituan (ATM stocks), China’s e-commerce, gaming & social media, and online food delivery giants respectively, have collectively shrunk by $100 Billion in market cap on the Hong Kong Stock Exchange on the news.

What do the Antitrust clauses address?

The Antitrust guideline focuses on monopolistic contracts, price-abusing behaviors, limitations to new market entries, and government interventions to market mechanisms.

征求意见稿从“垄断协议”“滥用市场支配地位行为”“经营者集中”“滥用行政权力排除、限制竞争”这四个方面作为切入点.

In the Chinese context, the draft law targets specifically

internet companies who force vendors to agree to mutually exclusive platform contracts;

varied prices offered to different consumers based on their consumption patterns, big data algorithms, and data manipulations;

rebates, discounts, and subsidies that contribute to market monopoly.

平台要求商家“二选一”、对消费者进行大数据“杀熟”,利用规则、算法、技术、流量分配等无正当理由拒绝进行交易,明显低于或高于其他平台在相似条件下的商品,低成品销售,或者通过补贴、折扣、优惠、流量资源支持等激励性方式限定交易,都有可能被认定为存在垄断行为。

The New Issues with Digital Companies

Industry monopolies have traditionally been determined by market shares or revenue. The challenge for the digital economy is that monopolies might arise from the ownership of information and data, which do not immediately translate to market share or revenue. Chinese government is now trying to update its laws for the internet era, which might be among the world’s first due to the scale of its digital economy and the massive Digital ecosystems run by dominant platforms.

The antitrust draft specifically state that companies under VIE structures must abide by China’s antitrust rules. Alibaba, Tencent, Meituan, as well as some of the biggest Chinese Internet companies have adopted a VIE structure in order to list overseas.

This is the second draft, following the data security law, that China clearly states that VIE-structured companies must comply with the same law of the land.

China’s Path to Rein in the Power of the Digital Giants

China has published the e-commerce law in 2018 and the most recent data security draft law in October 2020.

Data security draft law restricts Chinese companies from exporting technologies and data that threaten China’s national security. Many believe it was a measure to prevent TikTok’s sale of its sensitive algorithmic technologies and data contained in the technology to the US Oracle consortium.

Representatives from Alibaba, Tencent, TikTok-owner ByteDance, and 24 other tech giants attended a meeting with regulators from the antitrust and cyberspace authorities earlier this month to discuss issues ranging from unfair competition to counterfeiting. “Internet platforms are not outside the reach of antitrust laws, nor are they the breeding ground for unfair competition.” (read more)

On November 2, Chinese regulators summoned Ant Group’s controlling representatives, which led to the suspension of the record-breaking dual listing.

III. Tech Power

583,000 Orders Per Second! What Can This Year’s 11.11 Sales Tell You?

Unlike traditional Double 11 sales, this year, China’s Double 11 shopping season started on November 1 through November 11. Half way through 11.11, sales volumes have broken historic records. However, it is unclear how the day’s sales revenue compares to that of 2019, due to the calculation of this year’s double 11 sales from November 1-11. The belief is that this year, while volumes continue to hit records, price may be suppressed in order to drive volume.

Real time records this year ( by 1am on November 11)

The peak volume on Tmall, Alibaba's e-commerce platform, hit 583,000 per second, 1,457 times the volume comparing to the first Double 11 in 2009. Resource costs per 10,000 transactions fell by 80% compared to 4 years ago.

Since the start of the shopping spree on November 1, sales hit 372.3 billion yuan ($56.3 billion) by 12:30am on November 11, about 1.4 times of the sales recorded on Double 11 2019.

Unlike previous years, Tmall did not display real-time transaction data.

250,000 brands and 5 million merchants participated in this year’s Double 11, including more than 2 million offline merchants. The number of items on discount totaled 14 million, 1.4 times that of last year.

Other e-commerce platforms:

Suning Tesco reported a 72% increase in online orders in the first hour.

In 9 minutes, total transactions exceeded 200 billion RMB on JD.com.

In 7 seconds, Huawei Mate40 series exceeded 100 million RMB ($15.4M) in sales on JD.com.

In 50 minutes, Xiaomi announced total sales of over 2 billion RMB.

Longer shopping season

This year’s shopping season spans over two periods, the first is from November 1 to 3, and the second on November 11. It is understood that

this is to accommodate an estimated 800 million shoppers for the Season, compared to 500 million shoppers in 2019.

this offers the flexibility to further stimulate consumption following COVID-19.

this also relieves the pressure on merchandising supply chain and logistics. (read more in Chinese)

Consumption trends

Shanghai, Zhejiang, Beijing, Jiangsu and Guangdong saw highest growths in tourism-related services sales (旅游(产品)目的地成交额). (read more in Chinese)

Beijing ranks the highest on per capita consumption today. (read more in Chinese)

According to Tmall data, from 0:00 am on November 1st to 0:35 am on November 11th, 342 brands have achieved over 100 million RMB in total transactions. Among which, 13 brands have exceeded 1 billion RMB, including consumer electronics brands Apple, Huawei, Midea and Haier.

Top 5 sales categories: (read more in Chinese)

Electronics: Haier, Midea, Siemens, Gree and Xiaomi.

Beauty: Estee Lauder, Lancome, L 'Oreal, Empress, Olay.

Mobile phones: Apple, Xiaomi, Huawei, Honor, Vivo.

Home appliances: Midea, Dyson, Coworth, Supor, Joyoung.

Digital: Apple, Lenovo, Huawei, Xiaomi, Asus.

III. International Relations

China Aims at Sealing the RCEP by Year End

Deputy Minister of Commerce, Qian Keming, confirmed that China aims to complete the RCEP signing by year end.

Assistant Minister of Commerce Li confirmed further that all negotiations leading to the signing of the RCEP have been completed. All legal review of the draft agreement is also complete. The current plan is to complete the RCEP signing in the upcoming RCEP/East Asia Leadership Conference.

The Regional Comprehensive Economic Partnership was initiated as a regional free trade agreement by the 10 ASEAN countries in 2012. 6 other regional economies, Australia, India, China, Japan, ROK, New Zealand, also received invitations to join the RCEP.

Timing for the Signing

The hope is that the RCEP will be formally signed at the 4th RCEP Leadership Summit on November 15.

第四次RCEP领导人会议定于15日举行。阮国勇表示,RCEP谈判工作已经完成,有望于15日正式签署。

China’s relationship with ASEAN

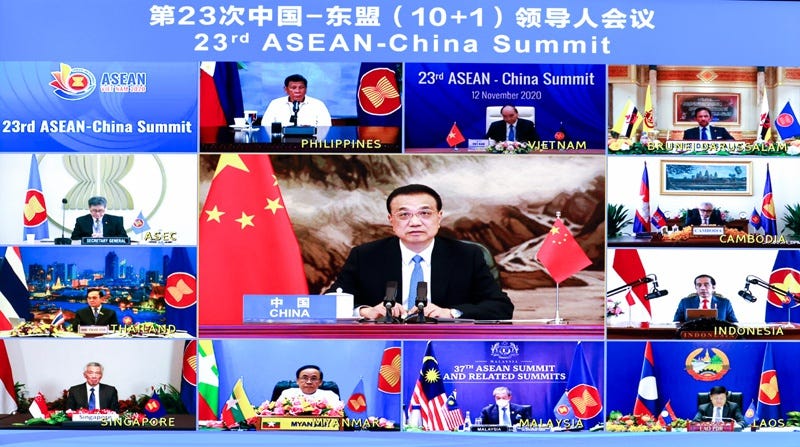

Chinese Premier Li Keqiang’s key messages at the 23rd ASEAN-China Summit.

China-ASEAN trade and investment continue to rise in 2020. ASEAN has already surpassed the EU to become China’s largest trading partner in 2020.

China sees ASEAN as the regional diplomatic priority, and supports the key role ASEAN holds in the region.

中国始终视东盟为周边外交优先方向,坚定支持东盟共同体建设,坚定支持东盟加强在区域合作中的中心地位。

Yao Yang on China’s Economy and Geopolitics

Yao Yang, a renowned Chinese policy scholar and dean of Peking University’s National School of Development, has outlined a number of policy priorities for China in the coming 5 years.

“Double Circulation” is not new to China.

The "double circulation" economic model began to emerge since China acceded in the World Trade Organization in 2001. From 2001 to 2008, the international economic cycle took off. China’s exports increased five-fold with an average annual growth rate of 29%, while foreign exchange reserves also surged.

Following the 2008 Global Financial Crisis, China has gone through significant structural changes in its economy. Net exports contributed less to overall GDP, even negligible in some years, whereas consumption took up a larger proportion in GDP.

Medium- and Long-term Trends of China's Economic Development (full speech)

Key technology self-reliance will be the top priority.

On the goal of 70% self-sufficiency in chip production outlined in Made in China 2025, China will likely achieve chip production self-sufficiency in 40nm chips, which will equate to about 80% of the total chip demand in China.

From this point of view, China’s 70% goal in chip independence, as laid out in Made in China 2025, is obtainable, but its obtainment is unbalanced. It does not address China’s high-end chip insufficiency.

Urbanization over the 14th FYP

China’s official urbanization rate of 60% includes the migrant population who work in the cities without a proper city residency status. If migrant population are excluded from urbanization statistics, China’s urbanization rate would be less than 45%.

Rural labor force accounts for only 28% of China’s labor force.

China’s goal is to reach 75%-80% urbanization rate by 2035. In order to reach this goal, urbanization rate should grow at 1.3% per annum during the 14th FYP. This will far exceed the average urbanization growth rate around 1% over the past 40 years.

Based on statistical evidence, urbanization is far from saturation, and the speed of urbanization required in order to reach China’s socialist modernity by 2035 remains challenging.

Regional development rebalance over the 14th FYP

Wuhan, XI’an, Xian’yang, Chengdu and Chongqing will be the growth drivers of Western economic development.

during the 2018-2019 era, deleverage has “harmed” the western region more than the coastal region, which exacerbated the regional development gap.

Rebalancing the regional development during the 14th FYP will be a key task.

Belt and Road Initiative (BRI) should be Institutionalized with a physical organizational presence.

BRI should perform the counterpart role of the “OECD” for the developing countries or South-South cooperation.

“While many countries in Europe have been active partners in China’s BRI, why not follow the trend and establish the headquarter of the BRI in Europe? BRI will be an open multilateral organization. A European headquarter will give China more power in defending its global open architectural agenda.”

“Many worry that this will be an overtly high profile move. Today, China must realize that it is no longer feasible for China to go back to “hide your brightness and bide your time.” (read more in Chinese)

其实欧洲很多人是赞成中国这样做的,我们为什么不顺应这个潮流,甚至就将“一带一路”的总部放在欧洲呢?这样我们面对的国际形势不就更主动吗?而且,我们要把它做成一个开放的组织。 有人可能会担心这样太张扬和大张旗鼓,可能会让我们与其他国家的关系更紧张。但是,就像我最近在很多演讲中提到的:我们必须清醒地意识到也必须承认,中国发展到了今天,再坚持“韬光养晦”已经行不通、藏不住了。

U.S. Marines Training in Taiwan for the 1st time

On November 9, U.S. Marines officially arrived at the invitation of Taiwan’s military and will provide training for the Taiwanese military in assault and infiltration missions. This is the first U.S. Marines training in Taiwan since 1979. (read more)

The training was hosted at the Tsoying Naval Base in Kaohsiung. The Navy Command said that “this is a routine Taiwan-U.S. military exchange and cooperation training,” aiming at maintaining regional peace and stability. The training would improve the combat capabilities of the troops. (read more)

This was the first public acknowledgment of U.S. Marines training in Taiwan, though the U.S. sent small units of elite troops to Taiwan for joint training on an annual basis without any public announcement. (read more)

The U.S. approved several arms sales to Taiwan in the past two months, which has already provoked China. The training might further deteriorate the relations between the two countries.

A US$600 million arms sales including MQ-9B Reaper drones, anti-ship missiles, and associated equipment and program support. (read more)

More than US$13 billion sales including F-16 fighter jets, M1A2T Abrams tanks, Stinger anti-aircraft missiles and MK-48 Mod6. (read more)

On October 13, the sales of three advanced weapons systems to Taiwan, including the Lockheed Martin-made High Mobility Artillery Rocket System, a truck-mounted rocket launcher; the Boeing-made precision strike missile Standoff Land Attack Missile-Expanded Response, and external sensor pods for Taiwan’s F-16 jets. (read more)

On October 22, more than $1Billion sales of advanced weaponry for Taiwan. (read more)

On October 26, US$2.4 billion more potential arm sales including 100 Boeing-made Harpoon Coastal Defense Systems. The Harpoon Coastal Defense Systems comprise 400 RGM-84L-4 Harpoon Block II Surface Launched Missiles to service as coastal defense cruise missiles. (read more)

However, it is expected that a possible Biden presidency will usher in “a balanced strategy” to handle the tension along the Taiwan Straits, and would not provoke China by crossing a red line. (read more)

There is no official comment from Beijing on the Marines training at this moment.