Government Work Report & 2022 Targets, 2021 Economic Performance, Real Estate Debt, Taiwan Visits, AIIB Suspension, Data-Computing Roadmap, Special Weekend Edition of 06 March

Intelligence and Insights on China's government actions, foreign policy, economy, and the capital markets.

Below are the highlights of the week. Full articles are accessible with a full subscription.

Please click here for a subscription to the complete weekend edition. This briefing booklet comes after days of work. We very much appreciate your support.

Beyond the Quarrels:

This weekend’s edition is dedicated to the innocent suffering from the Russo-Ukrainian conflicts.

The rapidly deteriorating humanitarian situation leaves us all in disbelief and dismay, we have no commentary this weekend, instead would like to dedicate this edition to all victims of the tragic conflicts and their courageous friends, families, and relatives. The grave humanitarian concerns demand that we refrain from all political commentary for the time being other than joining the people of the world in a united voice calling for the immediate cessation of hostilities. With China’s “Two Sessions” underway, we will continue bringing you the latest actions and perspectives from China in our daily publications.

Summary of Articles:

Economy

Chinese PMI Recorded 50.2%, Indicting Flat Expansion

Key Economic Matrix for 2021 Performed above Expectations

China’s GDP Per Capita Near High-income Country Status in 2021

China Banks on National Data Roadmap to Lead Major Growth in Digital Economy and its West

Government in Action

Government Work Report Unveils Targets for 2022

Government’s Key Economic Advisor Justin Yifu Lin on China’s Financial Reform

Technology

Chip Sanctions on Russia Open Up Opportunities for Chinese Chip-makers

Capital Market

EV Leader Nio Applies for Secondary IPO in Hong Kong

Real Estate Debt Repayment Hit over $10 Billion for 2 Months in a Row

International Relation

New Chinese Ambassador Extends Olive Branch To Australia

U.S. delegation Arrives in Taiwan. China Rebukes.

Former US Secretary of State Pompeo Visits Taiwan

China Sees Itself as the Mediator of “Russia-Ukraine” Peace

AIIB Suspends Russia and Belarus Lending

Please connect with us on social media, thanks to our digital editors: Ebube Oguaju-Dike and Ifeanyi Eke.

Twitter: @chinabigidea1

Linkedin: www.linkedin.com/showcase/chinabigidea

Also, be sure to join our brand-new discussion groups.6

Facebook: China Big Idea

LinkedIn: https://www.linkedin.com/groups/9069127/

Economy

1. Chinese PMI Recorded 50.2%, Indicting Flat Expansion

Chinese PMI in February reached 50.2%, slightly above the growth/recession line of 50%, indicating no major growth activities but in line with the Chinese government’s overarching goal of economic stability.

Based on the size of companies,

the large and medium-sized companies recorded strong PMIs at 51.8% and 51.4%, respectively, up 0.2% and 0.9% compared to January.

Small-sized companies recorded 45.1%, down 0.9% from January, indicating continued pressure and contraction of manufacturing activities by the country’s small-sized companies.

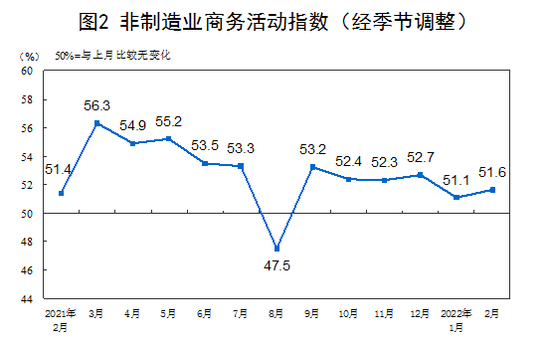

Non-manufacturing PMIs

Non-manufacturing PMIs reached 51.6%, higher than the manufacturing counterpart.

The construction activities index reached 57.6%, up 2.2% from January, most likely attributable to the government's massive infrastructure development initiatives.

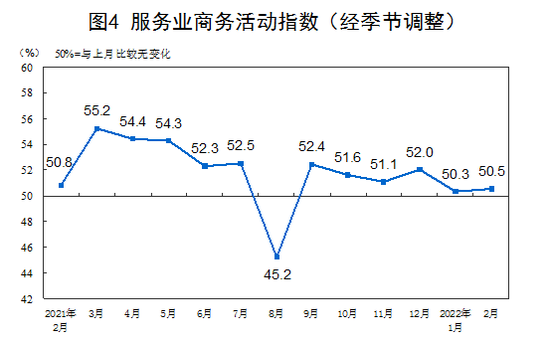

Services business activities index

The services index reached 50.5%. The strong support comes from the rapid recovery of transportation, airlines, postal services, TV, satellite and telecom services, financial services, and sports and entertainment services.

The laggards in the services business activities index continue to be retail and capital market services.

2. Key Economic Matrix for 2021 Performed above Expectations

The key economic matrix in 2021 shows performance above expectations. A list of parameters was released as a part of the annual Government Work Report.

GDP: In 2021, China’s GDP grew 8.1%, far exceeding the government’s growth target of 6% set in March 2021.

Food production grew 2% in 2021. The total yield stayed above the key threshold of 1.3 trillion tons of annual production.

CPI rose 0.9% YoY in 2021, way below the government’s target of 3%. (A flat inflation is indicative of weak consumption. It is not necessarily positive for the economy.)

Urban unemployment was 5.1% for 2021, lower than the government’s target of 5.5%.

The fiscal deficit came in at 3.1%, lower than the target of 3.2%.

2022 government targets

The current expectation places the economic growth target for 2022 at circa 5.5%, indicating a long-term trend of slower growth.

CPI will target around 3%. The urban unemployment target will stay around 5.5%. Energy efficiency (energy usage per unit of GDP) will reduce by 3% in 2022.

3. China’s GDP Per Capita Near High-income Country Status in 2021

China’s 2021 GDP Per Capita reached $12,400, nearly reaching the low bound of the high-income country status, currently set at $12,700 by the World Bank.

In 2021, disposable income per capita reached RMB 35,128, growing by 8.1%, keeping pace with the rise of GDP per capita.

Of which,

Rural residents’ disposable income grew by 9.7%, and urban residents’ disposable income grew by 7.1%, narrowing the income gap between urban and rural regions.

Ning Jizhe, head of the National Bureau of Statistics, stressed that China is not a high-income country yet. Compared to the West's advanced economies, there is still a large gap to fill.

4. China Banks on National Data Roadmap to Lead Major Growth in Digital Economy and its West

The vision for digital infrastructure growth in China is newly crystallized in one plan - East-West Data-Computing Roadmap (the Data Computing Roadmap, “东数西算”).

Since the East-West data-computing framework was formally launched on February 17, 10 national data centers have been formally planned and announced.

The Data Computing Roadmap was to optimally allocate China’s data and data computing capabilities across the regions. The less demanding data computing capabilities, including back-office functions, offline analytics, data storage, and backup, will be sent to China’s Western data computing centers. The more demanding data computing work, including AI, video conference, etc., will remain in the Eastern data computing centers.

The question of electricity

A major consideration of China’s East-West Data-Computing Roadmap is to capitalize on the renewable energy capacity in China’s West.

China’s solar energy industry welcomed explosive growth in 2021. The actual utilization of solar energy capacity was only 326 Billion kWh. Despite the growth of 25% YoY, solar energy only accounted for 3.9% of the total electricity output in the country in 2021. Given the current capacity, renewable energy supply is not enough to empower the massive data computing centers’ demand in China’s West. Fossil fuel energy is still required.

The question of computing power

By 2021, Alibaba’s Ali Cloud had established partnerships with 26 ministries and 31 provinces and regions in China. Alibaba is the world’s 4th largest cloud services provider, with 4 million customers, including IBM and Ford Motors in the US.

The US joins China in the investigation of Ali Cloud

The Biden administration is investigating Alibaba on national security grounds. The investigation includes Ali Cloud and “whether the Chinese government will be able to obtain US customer’s data.” In a worst-case scenario, the Biden administration may pursue a ban of using Ali Cloud services by US citizens.

Meanwhile, the Chinese government cannot rely solely on the local governments and SOEs to match Alibaba's national data computing power.

Alibaba is currently under government investigations from both the US and China.

China’s digital economy over the 14th Five-Year Plan

By 2025, China aims to enhance the value-added from the digital economy from the current 7.4% to 10%. This will imply that the digital economy will grow twice as fast as the national GDP.

Comparison of the China-US data computing power

In the 2021 AI Index Report published by Stanford University, the number of AI research papers published by Chinese authors surpassed the US in 2017. Chinese-authored articles accounted for 18% of the global total, ranked no. 1 globally. The next is the US, with 12.3%. However, in terms of academic paper citations, the US accounted for 40.1% of the global total, much higher than China.

Between 2015 and 2020, the global AI market grew at an annual rate of 26.2%. The growth rate in China over this period was 44.5%.

Government in Action

1. Government Work Report Unveils Targets for 2022

Chinese premier Li Keqiang delivered his annual Government Work Report, in which he confirmed China’s economic performance and achievements for 2021 and laid out China’s economic tasks for 2022. (read in Chinese)

China’s 2022 annual GDP target is set for 5.5%.

Proactive fiscal policy will be expanded. The fiscal deficit target for 2022 is 2.8%, down from the 3.2% target in 2022. The fiscal budget is expected to expand by RMB 2 Trillion in 2022. The increased expenditure will primarily address employment stability consumption expansion and support the real economy.

The central government will transfer payment of around 10 Trillion RMB to the local governments’ fiscal budget, increasing 18% from 2021. This is the largest rise in fiscal payment transfer from the central government to the local governments over many years.

The Report continued to call on government-level austerity measures. The government should reduce its own expenditures, new infrastructure buildings, corruption, and wasteful behaviors.

Monetary policy continues to support the growth of the real economy in managing both the total monetary liquidity and the structure of the liquidity.

Target the speed of growth of liquidity (M2), the credit market (total social financing), and the economy (nominal GDP) at principally the same rate.

The government’s tax rebate and tax reduction will be expanded to SME companies, manufacturing, and sole proprietors.

The number of college graduates will reach 10 million in 2022. Employment support will focus on youth employment and flexible employment (self-employment).

Unwaveringly deepen China’s reform and international cooperation.

Continue to expand China’s domestic market and consumption.

Expand Government’s key infrastructure investments.

The report also touched on the major targets in trade, FDI, new urbanization, regional development coordination, and other economic areas. We will focus on these in the next newsletter.

2. Government’s Key Economic Advisor Justin Yifu Lin on China’s Financial Reform

China’s financial market has not fully adopted a market-based operating mechanism.

Government key economic policy advisor Justin Yifu Lin emphasized that China’s financial market reform centers on two issues: the financial structural reform and the financial instruments’ price reform.

The current Chinese financial system is centered on big commercial banks and the stock market. There is an insufficient supply of local and medium-small-sized commercial banks.

When China started the financial reform at the early stage of the Reform and Opening-up, the financial system intended to provide lower-cost financing to the large and struggling SOEs at the time. When China’s stock markets were first conceived, its primary goal was to help the SOEs raise capital. Therefore, the Chinese financial system remains run by large banks and large state-owned companies.

Financial structural reform:

The current Chinese financial structure is more inclined to service large companies. In China, a large number of micro-small-medium-sized companies have huge unfulfilled financial demands. Encouraging setting up medium-small banks will bring a more optimal structure to satisfy the financing needs of the smaller companies.

Financial price reform

Due to the nature of China's dual-track financial reform, China’s savings rate and the lending rate had both been artificially deflated. Currently, China has adopted a full market-based lending rate regime. However, China’s savings rate is still not market-based (set by the government). The rate gap between China’s lending and savings rates can be as high as 3%, whereas, in a fully liberalized interest rate market, the lending and savings rates gap is much narrower, oftentimes around 1%.

The key subject of the financial price reform is implementing a market-based savings rate regime.

These are likely the policies that will be further implemented in China's current wave of financial market reform, as the country aims to address corporate borrowing needs, particularly SMEs.

Keep reading with a 7-day free trial

Subscribe to China BIG Idea to keep reading this post and get 7 days of free access to the full post archives.