How Ukraine Tension Draws Russia and China Closer: Real Estate, FDI, Iron Speculation, Olympic Tech, France-China Third Market, Special Weekend Edition of Feb. 20

Intelligence and Insights on China's government actions, foreign policy, economy, and the capital markets.

Below are the highlights of the week. Full articles are accessible with a full subscription.

Please click here for a subscription to the complete weekend edition. This briefing booklet comes after days of work. We very much appreciate your support.

Shirley’s Op-Ed on SCMP (15 Feb.):

China and Russia have consolidated a common Eurasian ambition by setting aside their historical differences. The shared message of Chinese President Xi Jinping and Russian President Vladimir Putin on the opening day of the Beijing Winter Olympics was to bolster alternatives to western liberal democracy, dedollarise bilateral trade and dismantle the US dominance of the global security architecture.

A union of sorts preserves the power and interests of both nations in the face of the eastern advance of Nato and western-led security partnerships known as the Quad (involving Australia, India, Japan and the US) and Aukus (which includes Australia, the UK and the US).

Throughout history, there were several points of differences and distrust between the two countries. In October 1969, the Soviet Union loaded a missile with hundreds of tonnes of nuclear material aimed at China. Chairman Mao Zedong headed to Wuhan. Senior military staff lived in a bunker.

This was the closest communist China came to a nuclear peril. The then US president Richard Nixon intervened and helped save China from falling as a major nuclear casualty at the height of the Cold War by its own ally. The West preserved its victory. China earned its right to security and prosperity. The rest is history.

But history also provides further evidence of a complicated Eurasian alliance. The Amur River forms the border between Russia's far east and north-eastern China. In 1858, imperial Russia annexed from the Chinese Qing court territory larger than Ukraine and more than 600 times the size of Hong Kong. A century later, the British returned Hong Kong to China. The Amur region remains in Russian control.

China may no longer appreciate American assistance from decades ago, but to think that it now sees Russia as a confidant is illusory. The ceded Chinese territory remains a dormant fault line, whose significance can be no smaller than Taiwan or the South China Sea islands, should tensions erupt. Nonetheless, any eruption between the two countries over the issue remains unlikely for now; their strategic alliance is a bigger gain for China.

The two countries have signed significant energy deals estimated at $137 billion, at a time when Moscow needs economic leverage.

Germany, heavily reliant on Russian liquefied natural gas supplies, may have to give up the Nord Stream gas pipeline project in the event Russia invades Ukraine. The US, meanwhile, has said it could remove Russia from the international dollar clearance system called Swift. To minimise this threat, Moscow would like to see its trade and the currency with which it trades decoupled from the West.

By expanding China-Russia trade by $60bn to $200bn in 2022, China plans to divert much of its missed purchase commitments obliged under the US-China Phase One Trade Deal to Russia.

With energy prices reaching multi-year highs, locking in purchase agreements runs the risk of paying a premium. Additionally, the oil trade will be settled in euros. Although dedollarisation fits China's national strategy, why was the trade not settled in the RMB? As the world's largest energy importer, China desires a bigger role for the RMB as a global trade currency.

On the weekend news programme Meet the Press, US National Security Adviser Jake Sullivan recently said that China will end up owning a part of the cost of Russia's invasion of Ukraine.

If Moscow does not send troops into Ukraine, both China and Russia will be better off. But if it does, the highest economic costs would still be borne by the West, where inflation has risen sharply in recent months. Another sudden surge in inflation would exacerbate the current US administration's political unpopularity, disrupt the Federal Reserve's plan with rate tightening and, if mismanaged, induce a financial meltdown.

China must also bear in mind that Russia is also smartly drawing on its relationship with India. Nearly one quarter of Russia's arms sales went to India between 2016 and 2020. Russia's defence partnership with India puts China in a precarious position – a replay of what Nixon and the then US secretary of state Henry Kissinger envisioned during the Cold War by encircling the former USSR with China. It is in Russia's interest to not see China's rise as the sole leader in Eastern Eurasia. Until China becomes one, complementarity trumps conflict of interest between the two neighbours.

It also makes sense that China and Russia have unified in objecting to Nato's eastern advance. The Shanghai Co-operation Organisation, a regional security pact centred on China and Russia, stands at the security frontier as Nato's junior counterpart to the East. This pact aims to evolve further into a free trade zone.

Beyond hard power, China and Russia have articulated a common ethos on democracy, development, security and the impending world order. Both see a "new centre of economic growth and political influence" in which stability and prosperity are inseparable, and democracy is expendable.

Both countries also harbour dreams of national rejuvenation. These two ambitious powers are looking out for each other. The meeting between their leaders at the start of the Beijing Olympics may well turn out to have reshaped Eurasian geopolitics.

original title: Why Ukraine is bringing Russia and China closer

Summary of Articles:

Economy

Chinese Real Estate Industry Spreads Financial Woes to Banking, Government, and the International Markets

Households Added $851 Billion to Savings in January

China’s Inflation Remains Tame through January

Government in Action

Chinese Regulators Crack Down on Iron Ore Speculation

China Lays out Plans to Merge Pesticide Companies into Global Brands

Zhengjiang Released Major Incentives to Encourage Entrepreneurship and Invest in Human Capital

Capital Market

Global investment Bellwethers Predict 2022 a Year to Pivot to Chinese Stocks

Chinese Companies Resume NYSE Listings

China Attracted 11.6% More FDI in January

Technology

Smart Technologies During the Beijing 2022 Winter Olympics

International Relation

Biden Administration Eases Tariffs on Solar Equipment

France and China Sign $1.7 Billion Projects in Third Markets

China’s Difficult Position on Ukraine: Urging a Multilateral Diplomatic Approach

Please connect with us on social media, thanks to our digital editors: Ebube Oguaju-Dike and Ifeanyi Eke.

Twitter: @chinabigidea1

Linkedin: www.linkedin.com/showcase/chinabigidea

Also, be sure to join our brand-new discussion groups.6

Facebook: China Big Idea

LinkedIn: https://www.linkedin.com/groups/9069127/

Economy

1, Chinese Real Estate Industry Spreads Financial Woes to Banking, Government, and the International Markets

The real estate value chain contributed 25% of China’s GDP growth in 2021. As the industry irreversibly cools in 2022, not only do real estate-related supply chains see bleak revenue forecasts, China’s development model is going through a transition to deleverage from lending. Local governments shift from land sales for fiscal revenue to attracting FDIs in technology.

Vanke says “golden age” of the Chinese property market is over.

Vanke is the third-largest home seller by revenue in China. During an internal staff meeting in January, Yu Liang, the group chairman, said that “we are on our last legs, which means there are no other options.” He also pronounced the golden age, “when home prices only went up, and developers made billions,” had come to an end. To emphasize the need for survival and set an example, Yu led the cost-cutting measures at Vanke by booking cheap flight tickets and hotels.

According to the China Real Estate Information Corporation, a data compiler, the collective revenue of the top 100 Chinese developers in January fell by 41% from last year. Moody’s, the international rating agency, expected Chinese home sales to fall by 5-10% in 2022.

The local government responded to the property market slowdown by courting foreign investment.

The real estate sector and associated value chain, which represented around 25% of Chinese GDP in 2021, is a major source of revenue for local governments through land sales and building projects. Already high in debt, local governments are set to face even bigger challenges to their financing as the real estate sector is projected to cool.

In response, various Chinese local governments have started competing for limited foreign capital to fund technological capabilities and infrastructure projects. According to the SCMP, the targets for local governments on fixed-asset investment growth “generally ranged between 6 to 10 percent for the year.”

Shanghai announced that it had signed 53 foreign investment projects exceeding US$ 5.44 billion, including a US$ 30 million investment from German optics company Carl Zeiss. The company supplies ASML with lenses in the newest semiconductor photo-lithography machines. Shenzhen, the southern technology capital, offered up to US$ 15.7 million perks for any foreign project worth US$ 50 million, except for projects in the real estate or finance sectors.

Chinese real estate developers exit London’s New Financial City, leaving stalled projects and shattered bondholders.

“China’s debt-saddled private developers face growing risks of a liquidity crunch, with home buyers and bondholders’ shattered confidence raising the specter of broader financial contagion,” according to Bloomberg Intelligence senior analyst Patrick Wong.

According to Real Capital Analytics Inc., the number of real estate transactions by Chinese investors in London has declined by 88% over the past 5 years. Land acquisitions by Chinese developers in London went down from 731 Million euros to 113,000 Euros over the same period. Most of the Chinese real estate development interests have been swarming into the Canary Wharf area, leaving projects unfinished with the exit of Chinese developers.

In London’s Royal Albert Dock, almost two dozen buildings conceived of as a new Chinese Canary Wharf stand mostly empty and in the hands of lenders who have finally pulled the plug. About 10 miles to the west, some construction workers angry at not being paid have downed tools on Guangzhou R&F Properties Co.’s flagship development in Nine Elms. And in Paternoster Square, in the heart of the City. ( read more)

2, Households Added $851 Billion to Savings in January

Chinese households added 5.41 trillion RMB to their savings in January, exceeding the same figure last year by about 4 trillion and “much higher than the average level,” according to data from the Chinese central bank. Non-financial business deposits fell by 1.4 trillion yuan in comparison, explained by year-end bonus increases.

As income is either saved or consumed, increased savings indicate China’s lackluster consumption growth. Zhong Zhengsheng, the chief economist at Ping-An Securities, cited “continuing pandemic outbreaks and the sluggish housing market” as major reasons for the decline in consumption.

Analysts also pointed out that even under normal circumstances, Chinese households have one of the highest savings rates in the world. Boosting consumption through both re-balancing from businesses to households and encouraging households to spend what they already have will be a major challenge for policy-makers.

Gold consumption booms during Spring Festival

According to the China Gold Association, gold consumption during the recent week-long Spring Festival period has increased by 13% YoY. Total consumption of gold in 2021 totaled 1,121 tonnes, up 36.5% over that in 2020 and 11.8% over that of 2019. Gold ornaments and bars were among the best-selling products.

Even though purchasing gold counts towards consumption, it is largely investment-driven. Gold has long been seen as a store of value, so consumption of gold should be interpreted as another form of savings by households. This interpretation is consistent with the rise in savings.

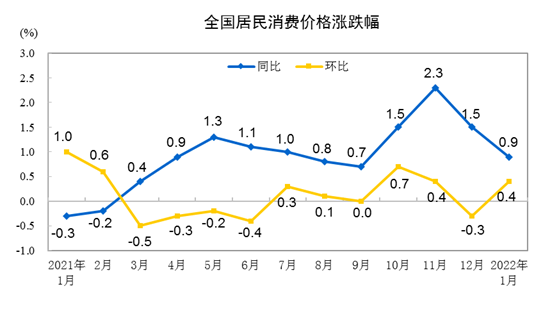

3, China’s Inflation Remains Tame through January

China’s CPI rose 0.9% in January YoY, indicating a continuous lackluster consumption recovery. Food inflation declined by 3.8%, and non-food inflation rose 2% YoY.

Services inflation rose 1.7%, far higher than inflation in goods at 0.4%.

Urban inflation rose slightly higher than rural inflation, indicating a bigger demand for services in the urban areas.

On a month-over-month basis, CPI rose from the December level by 0.4%. It may be attributable to a loose monetary policy and the consumption period ahead of the Chinese New Year. However, the monthly rise was much milder than the same period last year (up 1%).

(Blue line: CPI YoY; Yellow line: CPI MoM)

Source: NBS

Big movers in CPI:

Meat prices went down by 25.6%. Pork prices were 41.6% lower than a year ago.

Consumption in services, transportation, and communications rose 5.2%; education, culture, and entertainment rose by 2.9%; and residential cost of dwelling went up by 1.4%.

Affected by energy prices, prices of gas, diesel, and LNG rose by 2.2%, 2.4%, and 1.5%, respectively.

Airline tickets, vehicle rental, and long-distance bus tickets rose 12.4%, 9.8%, and 5.2%, respectively.

Housekeeping, baby care, and hairdresser prices rose between 2.6% and 9.1%.

PPI continues to hover around 10%

PPI in January rose 9.1% YoY, declining by 1.2% from last month. The rise in PPI is largely attributable to manufacturing material costs (up by 11.8%).

Implications

With a high PPI and a very mild CPI, most of the price pressure has not been passed down to the consumers. It remains deeply entrenched in the middle-lower end of the manufacturing supply chain that now bears cost inflation.

Government in Action

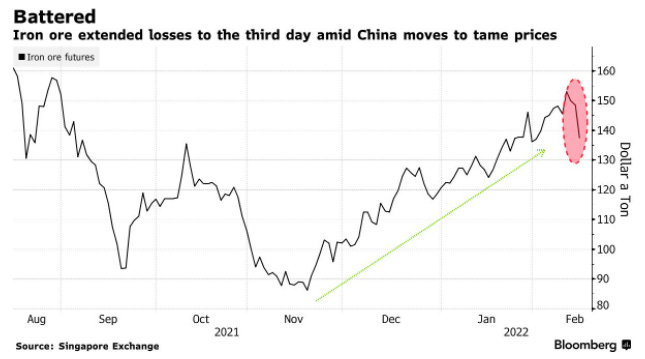

1, Chinese Regulators Crack Down on Iron Ore Speculation

In response to the heightened speculation in the iron ore market, Chinese regulators have made it explicit to businesses to stop spreading misinformation, engaging in malicious speculations, hoarding, and other irresponsible behaviors. As a result, domestic iron ore prices fell from a high of RMB 850/ton last week to below RMB 700/ton. The international market also fell following the announcement, with prices on the Singapore exchange falling by 8%.

The government’s two major targets are speculators in the domestic market, such as brokerage and proprietary trading firms, and global iron ore suppliers. The announcement prompted a response from the latter group, with Mike Henry, the CEO of BHP, pointing to supply and demand in determining iron ore prices. He highlighted that healthy demand coupled with supply constraints would support pricing.

However, some experts oppose that the recent rise is purely driven by market fundamentals. Hongying Wang, Head of Research at the Institution of Financial Derivatives of China, pointed to both the illogical basis for the supply-demand view (steel manufacturers stock through winter but not after the new year) and the speculative nature of local exchanges (with more options and less physical contracts).

It is unclear what measures the government has in mind to control the iron ore prices. The announcement alone has already had some desired effects, and the international market response is positive. The obvious next step would be for the government to have closed-door meetings with State-Owned Enterprises in steel manufacturing, trading firms, and brokerages to drill down the policy and be on the same page. There are rumors that these meetings will be held on February 17th.

Much of the pricing power of iron ore suppliers comes from the market structure, with few suppliers competing in oligopoly and many steel manufacturers scattered and uncoordinated. With ongoing consolidation among manufacturers and the government taking additional steps, if China can have more pricing power in the value chain, that would boost the domestic economic agenda.

Keep reading with a 7-day free trial

Subscribe to China BIG Idea to keep reading this post and get 7 days of free access to the full post archives.