Innovation: State, Science and Wealth: 5-year Plans, Chip Shortage, DCEP, Health Insurance & Pension Reform, Space Exploration, Goldman, a Special Weekend Edition

Intelligence and Insights on China's government actions, foreign policy, economy and the capital market

In 1492, Christopher Columbus, through the Spanish Court, was able to raise a handsome sum to discover “a new route to East Asia.” In one of humanity’s most pivotal experiments to discover its own ignorance, creditors of the exploration were bountifully rewarded.

Innovation requires more than science. Innovation sits at the zenith of politics, science, and financial prowess. In looking at history’s progress, it is hard to identify whether power breeds innovation or innovation breeds power. Perhaps it is better to think that innovation is power.

To build an innovation-led economy, China needs to develop a more transparent, more resilient, and more vibrant financial market to fuel its bid for innovation. Credit defaults are more than a financial risk; it impedes innovation.

When State-owned Enterprise defaults continue to rattle the financial market, the old debt-led financing model must yield to new forms of financing to support the new economy.

China is superb in applied science. This week, the second large-scale sovereign digital currency pilot testing commenced in Suzhou. For the first time, the DCEP can be tendered online via JD.com. However, basic research continues to be the “choke point” of Chinese innovation. The Chinese automobile industry has recovered to its full production capacity, only now able to operate at a reduced capacity due to the shortage of automobile chips heavily reliant on imports.

In the 6 Central provinces' newly released 14th Five-Year Plans, the ambitions include building a fiberoptic valley, China’s automobile capital, biotech centers, and digital supply chains for the modern economy.

Innovation is disruptive. It, by its very nature, must disrupt the old to pave the way for the new. We bring you this week’s “old and new” in China’s drive for an innovative future.

Revelation: incentives for innovation

1, Commercial and Pension Insurance Welcome Blue Ocean Opportunities

A State Council meeting hosted by Premier Li Keqiang affirmed that China will expedite commercial insurance and pension insurance schemes' fast development.

China’s Burgeoning Commercial Insurance Market

China’s medical insurance scheme covers 1.38 billion people. It is the world’s most extensive medical insurance system.

The burgeoning commercial insurance industry has been fast developing over the past few years. However, commercial insurance payouts represent only 2% of China’s total medical expenses.

Alternative forms of fintech-based community health-sharing schemes have become popular, led by China’s leading fintech players.

Demographic Shift

China’s aged population may reach 460-480million at the demographic peak, representing over 30% of the total population. This brings the necessity to develop a robust commercial pension insurance system to provide medical care, elder care, and retirement lifestyle support.

Non-life Insurance Market Prospects

As of October 2020, utilization of insurance funds reached 22.6Trillion RMB ($3.4T) in China, marking a compound annual growth rate of 16.7% over the past 10 years.

截至今年10月末,我国保险资金运用余额已达到 22.6 万亿元,过去10年间复合增长率达16.7%,在服务实体经济、完善金融市场中发挥了重要作用。(read more)

(Source: EY)

(Source: EY)

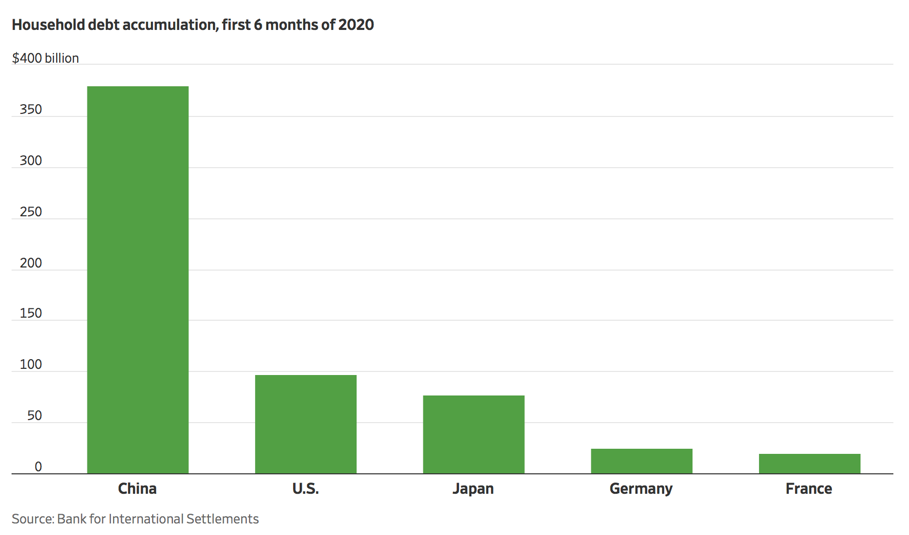

2, Household Debt Surges in China post COVID-19

China’s household debt surged by about $379.62 billion in the first half of 2020, according to news from the Wall Street Journal and data from the Bank for International Settlements. Chinese household debt accumulation in the H1 of 2020 was nearly four times that of the U.S.

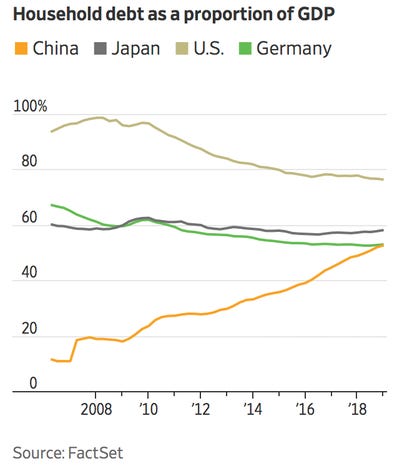

Chinese household debt as a share of GP stands at 59.1%, higher than most developed economics and up by 3.9% in the first six months of the year.

Real-estate Investment Drives Household Debt

PBOC, concerned about property market bubbles and rampant credit growth, has been prudent with monetary easing in 2020. In 2015, interest rate cuts led to home-buying frenzy and soaring household debt to unprecedented levels. (read more)

However, rising speculative demand continues to drive the property boom and rising household leverages.

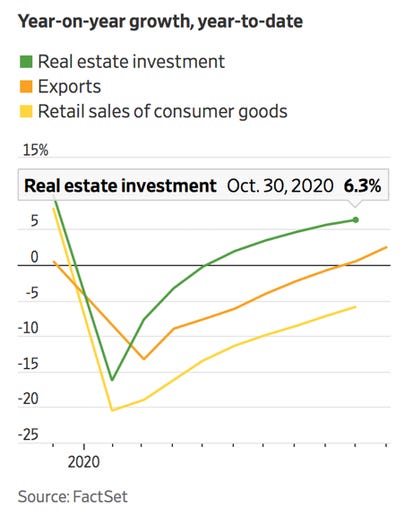

As a result, the rapid expansion of real-estate investment has contributed greatly to China’s economic recovery post-COVID, stronger than recoveries in exports and retail sales.

In 2017, data from China Household Finance Survey reported about 21% of vacant homes in urban China. Rental yields are below 2% in major cities, lower than returns from government bonds. The pandemic has caused many to invest in a second or third home for fear of inflation. (read more)

In the meantime, the number of listings for second-hand homes have soared this year. (read more in Chinese)

Chinese regulators have initiated a series of controls on the real estate market, including “the three red lines” to reduce debt raising capacity for real estate developers. Still, immediate and sharp curtails can cause potentially severe economic shocks.

3, Automotive Disruption due to Chip Shortage

The global chip supply shortage has caused an unintended supply chain disruption in China’s automotive industry.

Since the beginning of December, mid-to-high-end manufacturers, including Volkswagen, are facing possible production risks in China. If the chip supply is not restored, 4 million vehicles a year could be affected. (read more)

Automobiles have become increasingly dependent on chips - many of them made in Europe - for everything from computer management of engines for better fuel economy to driver-assistance features such as emergency braking.

German auto suppliers Continental, Bosch and Volkswagen, the world’s largest carmaker, warned about the shortage of semiconductor components.

“Although semiconductor manufacturers have already responded to the unexpected demand with capacity expansions, the required additional volumes will only be available in six to nine months,” Continental said on Friday. “Therefore, the potential delivery bottlenecks may last into 2021.” (read more)

Dutch automotive chip supplier NXP Semiconductors has told customers that it must raise prices on all products because it is facing a “significant increase” in materials costs and a “severe shortage” of chips, according to Reuters.

Volkswagen Group (China)

Volkswagen China claimed chip supply has indeed been affected, particularly amid the return to full production capacity in China. AI Finance News reported that some Volkswagen productions in North and South China were suspended due to chip shortage for a day or two and are now operating with lower production capacity.

China’s Automotive Chip Supply Chain

The chip industry for automobiles is a full-blown vertical supply chain and relies on top semiconductor manufacturers such as Bosch or Continental to produce the chipsets. Both companies have stated that the ongoing pandemic has affected the supply of chips for specific electronic components.

At the beginning of the year, chip suppliers reduced their production capacity due to pessimistic predictions on the auto market. With the full recovery of production capacity in China, Continental says that existing chips are only sufficient to maintain supply for 6 to 9 months.

Leading auto chip manufacturer NXP has decided to increase product prices (may start from 5% increase) with a one-year NCNR (no cancellation or return) agreement.

Japanese semiconductor manufacturer Renesas Electronics also sent a price increase notice to customers, stating the company is facing inventory and cost pressure and product transportation risks.

Implications of an Imported Industry

Most of the chips for China’s automobile industry need to be imported. The entire automobile supply chain is affected by the decrease in overseas chip supplies. A domestic substitution does not appear realistic in the short-term. At present, 80% of automobile chipsets are made outside of China.

China accounts for 30% of the global automobile market, but 4.5% of the world’s automobile chipset supplies. This current shortage echos the need for China to build a more self-reliant chip supply chain.

Building a Self-Sufficient Chip Chain

Pioneers

BYD was the first Chinese auto manufacturer to launch its own chip venture, BYD semiconductors in 2004. BYD has been self-producing chips for more than 10 years. It sells its excess capacity to industry peers currently. BYD is also in partnership with Huawei, a driving force in the automotive chip supply breakthrough. This, however, entails a long time span.

Domestic Policy

In August, the State Council issued the “Policies to Promote High-Quality Development of the Integrated Circuit Industry and Software Industry in the New Era.”

More than 120 domestic vehicle and electronic component companies established the China Automotive Chip Industry Innovation Strategic Alliance in November. This Alliance will focus on crucial automobile chip innovations in the future.

Moon Shot: Innovators and market

4, China’s Moon Landing

With Chang’e-5 mission, China has successfully retrieved lunar samples, over four decades after the US and the former Soviet Union.

As early as 2022, China hopes to operate a permanent space station called Tiangong (heavenly palace) and send astronauts to the moon, as part of what he calls the country’s “space dream.” (read more)

History of China’s “Moon Dream”

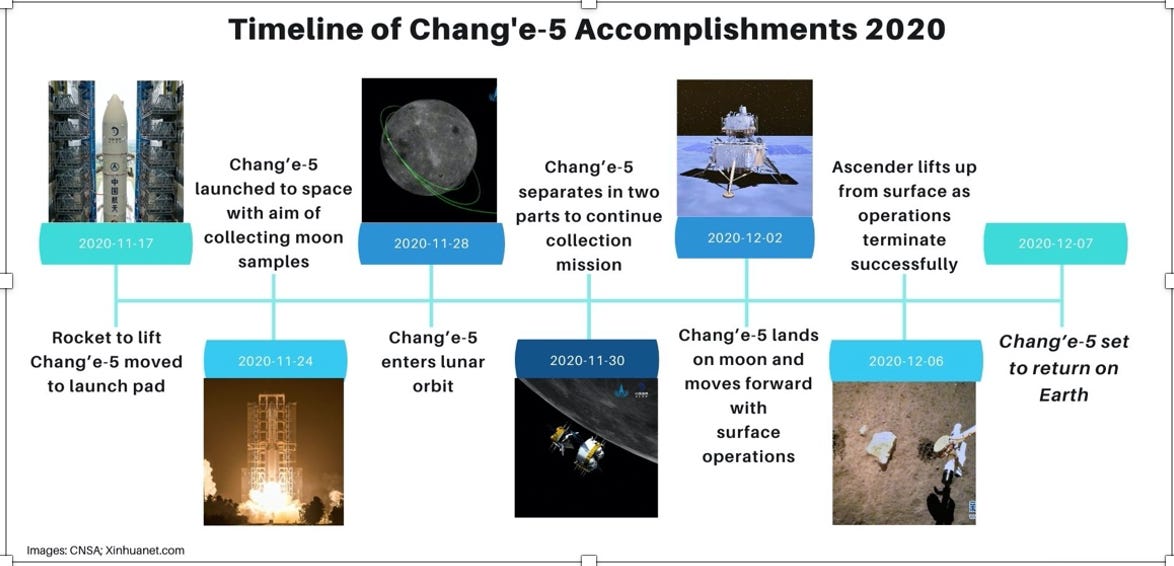

According to Zhang Kejian, head of the China National Space Administration (CNSA), the initial aim was to launch a crewed lunar mission by 2029. But a setback in 2017, when the rocket Long March-5 Y2 failed to launch, forced the delay of plans for Chang’e-5. In the meantime, the Chang'e-4 landed on the far side of the Moon in 2019. Finally, the first accomplishments of Chang’e-5, visible in late 2020, underline China’s outstanding advancement in its space program.

Engineering accomplishments

CNSA has reported the official accomplishment of Chang’e-5. The rocket was launched to space to collect moon samples. Before the end of the month, CNSA has also confirmed its entrance into the lunar orbit and separation in two parts. This was a vital stage of the mission as it meant that the orbiter re-entry capsule combination would have continued traveling in lunar orbit with an average altitude of around 200 kilometers above the moon while the lander-ascender combination prepared to land on the lunar surface. Landed on the moon on December 2nd, 2020, the lander-ascender part has moved forward with the collection mission, terminating surface operations only four days later. As of December 7th, 2020, Chang’e-5 is set to return to Earth. (read more)

Mission Schedule:

(2020-11-24) Chang’e-5 launched to space to collect moon samples

(2020-11-28) Chang’e-5 entered lunar orbit

(2020-11-30) Chang’e-5 separated into two parts to continue the collection mission.

(2020-12-02) Chang’e-5 landed and moved forward with surface operations.

(2020-12-06) Ascender lifted from the surface.

(2020-12-07) Chang’e-5 sets to return to Earth before the end of the year

CNSA’s 17 Development Goals

China’s space program states 17 long-term targets. (read more)

No Poverty. Satellite internet can help map poverty, enable money transfers to remote locations, and provide early warnings about the risks of food and water shortages affecting China’s rural population.

Zero Hunger. Satellites can help respond to natural disasters and other emergencies in rural areas, help predict agricultural output, gather data on soil condition and humidity for precision irrigation and farming. Experimenting with agriculture in space can help develop sustainable means applicable on Earth.

Good Health and Well-being. Satellites can identify ecological and environmental factors that contribute to the spread of diseases and enable telemedicine. Microgravity can also allow experiments for cancer and osteoporosis research.

Quality Education. Distance-learning, internet connectivity, and development of digital education in rural areas

Gender Equality. Space sector to create equal opportunities for men and women.

Clean Water and Sanitation. Water purification experiments in space can also add to the research on clean drinking water. Accurate meteorological forecasting can also help prevent water-related disasters.

Affordable and Clean Technology. Experiments in space can test new solar cell technologies to find efficient renewables.

Decent Work and Economic Growth. In 2017, the global space economy totaled US$ 383.5 billion and employed over 900,000 people.

Industry, Innovation, and Infrastructure. Space tech as a part of scientific exploration.

Reduced Inequalities.

Sustainable Cities and Communities. Space tech supports smart city planning, especially in rapid urbanization, leading to more resilient cities.

Responsible Consumption and Production. Satellites can help screen natural resources on Earth and can help governments understand their environmental footprint.

Climate Action. Satellites can identify climate changes and provide useful observations on climate over the years.

Life Below Water. Satellites can help monitor marine pollution and ocean acidification.

Life on Land. Space tech can track changes in the health, deforestation, biodiversity and assess damages caused by fires on the ecosystem.

Peace, Justice, and Strong Institutions. Implement the legal framework on sustainable management, and institutionalize the importance of space tech.

Partnerships for the Goals. Sustain international cooperation in space.

The US vs. China Space Statistics

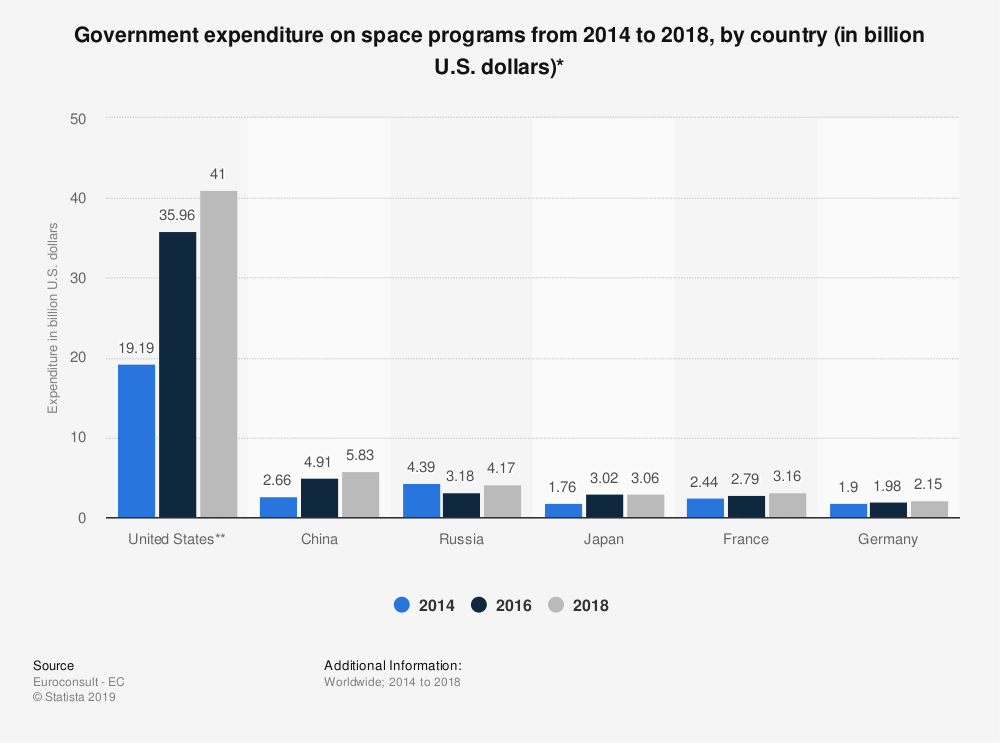

The Chinese government is among the world’s top investors in space programs. Between 2013 and 2018, China’s number of satellite launches grew from 15 (1 failed) to 39 (1 failed), whereas that of the US increased from 19 to 31. As of 2018, the total expenditure of NASA amounts to US$ 19.5 billion, while it sums up to US$ 11billion for CSNA. This means China has spent about 7 times more than India in its space program so far, claims Times of India. (read more)

Overall, the US-China space competition is growing, but it is also very likely that the cooperation between NASA and CSNA might be considered in the future to achieve common goals.

5, Hainan Island Plans to Double GDP by 2025

Hainan published an ambitious plan, which includes doubling its GDP by 2025, along with a list of priorities corresponding to China’s 14th Five-Year Plan and Long Vision 2035. (read more)

Double GDP by 2025.

Under the "14th Five-Year Plan", Hainan's GDP and GDP per capita aim to double by 2025, implying an average annual return over 14%. By 2025, per capita GDP will enter the high-income cohort in China, currently placed below the national average.

Rural-Urban Income Gap

70% of annual fiscal revenue is allocated to support services infrastructure development. The province has established 102 schools and 49 hospitals so far.

60% of Hainan residents are in rural areas;

80% of land in Hainan is designated rural land. Rural-urban integration is the key task for the free trade port.

每年将财政收入70%以上投入民生领域,引进102所学校和49所医院,覆盖全民的社会保障体系基本建成。但是也要清醒地看到,我省80%的土地在农村,60%以上的户籍人口在农村,农业农村发展不充分,城乡区域发展和收入分配差距较大。

Hainan Free Trade Port

The construction of China’s largest free trade port will turn Hainan into the gateway and the center of China’s opening up towards ASEAN and the RCEP region.

Fixed capital investment grew 8.4% in the first three quarters of 2020.

Nearly $100 Billion have been invested in the free trade port development in the past two years, across 1,331 projects.

两年来累计集中开工项目1331个,总投资6077亿元,实现自贸港建设顺利开局。今年前三季度全省固定资产投资同比增长8.4%,增速排名全国第五。

Smart Hainan

The entire province will be integrated into one single coordinated market.

Key industries will encompass tourism, the modern services industry, and high tech industries. The critical factor of development will be centered on human capital.

海南要以发展旅游业、现代服务业、高新技术产业为主导,强调通过人的全面发展。

Risk Prevention

Hainan has implemented policies to limit retail real estate purchases to curb property speculation.

Smuggling activities will be prevented by establishing three layers of border controls.

6, Suzhou Becomes Second City to Test Large Scale Digital RMB

Digital red envelopes containing the digital RMB were distributed via lottery in Suzhou(苏州), the second city following Shenzhen, officially on 5th Dec. 100,000 red envelopes were allotted containing 200 digital RMB each, in the total amount of 20 million RMB ( c $3Million). All red envelopes have been distributed in time for Suzhou's "Double 12" shopping festival.

JD becomes the first online payment partner for China’s digital RMB in the pilot program. All the other vendors accepting the digital RMB so far are physical retail outlets.

Jd Digits has previously reached strategic cooperation with the Digital Currency Research Institute of the People's Bank of China to promote the online and offline digital RMB wallet application.

Vision: Innovation and future

7, Second “Pearl Harbor” Could Happen in Space: Brookings

Army Gen Mark Milley held a virtual talk with the Brookings Institutions and shared his opinion on the rise of China, “today, the pacing threat is the rising People’s Liberation Army.”

Key messages: (read more)

The U.S. military is “extraordinarily capable” and powerful in all domains of warfare. Still, it is important to recognize that the gap between the U.S. and potential adversaries, including China and Russia, has narrowed over the last 10, 15, 20 years.

Space as a domain is critical since a country might seek a first move or advantage to blind the States by attacking satellites. The next Pearl Harbor could happen in space, just like many people have written.

The Chinese capitalized on a burgeoning economy to invest in military capabilities, thus closing the gap with the U.S.

The first aspect of the National Defense Strategy is the return of great power competition. (read more)

8, Goldman Sachs Takes 100% Control of China Securities Venture

Goldman Sachs has signed a definitive agreement and initiated the regulatory process to acquire all of the outstanding shares (49%) in Goldman Sachs Gao Hua from its local partner, Beijing Gao Hua Securities. It would be the first Wall Street bank with 100% ownership of its securities joint venture in China.

A memo signed by Goldman Chief Executive David Solomon said the move signaled a “significant commitment to and investment in China,” citing “ongoing reforms in China’s capital markets, continued robust economic growth, and the expanding needs of increasingly sophisticated clients.”

Foreign asset management firms have been able to apply for full ownership in China only as of April this year, as a result of the US-China phase 1 trade deal. Goldman was the first to establish a joint venture in 2004. UBS, Morgan Stanley and J.P. Morgan have all made recent moves to pursue wholly-owned asset management entities in China, especially given that profits in investment banking alone are expected to climb to US$47 billion by 2026.

9, JD Health IPO

JD Health went public on the Hong Kong Stock Exchange on 8th Dec. Bank of America Securities, Haitong Securities, and UBS are the co-underwriters of the IPO. China Renaissance acted as the exclusive financial advisor for the transaction. Before the IPO, JD had lured investment institutions such as Hillhouse Capital, Tiger Fund, GIC Special Investment, and BlackRock as cornerstone investors.

As of the close of trading on 8th Dec, Shares of JD Health rose 55.85%, boasting a market capitalization of $44.38 billion (HK $344billion). On JD Health's debut, the market cap of JD Group reached 1 trillion RMB ($150 billion) at noon.

Alihealth, the e-health subsidiary of Alibaba, rose 3.91% on the day and shares a comparable market capitalization of $41.49 billion (HK $321.6 billion).

It is disclosed that 40% of the funds JD Health raised will be used for business expansion, and 30% will be used for R&D.

JD Health Business & Structure

At the beginning of 2020, JD Group redefined the company as a "technology and services enterprise based on supply chain management" With JD Health’s IPO, the HKSE had its first internet health service company with annual revenue of more than $10 billion.

In the first three quarters of 2020, JD Health recorded total revenue of $2.02 billion (13.2 billion RMB). JD Health's net profit from 2017 to the first half of 2020 was $32 million (209 million RMB), $38 million (248 million RMB), $52.65 million (344 million RMB), and $56.79 million (371 million RMB) respectively, and its profitability continues to improve.

Platform sales of pharmaceutical and health products are the main source of income. From 2017 to 2019, and in the first half of 2020, this segment accounted for 88.4%, 88.8%, 87.0%, and 87.6% of total sales respectively. Merchandise revenue is expected to continue as a vital revenue growth point.

As of September 30, JD Health had 80 million annual active users, nearly double the 43.9 million at the end of 2017.

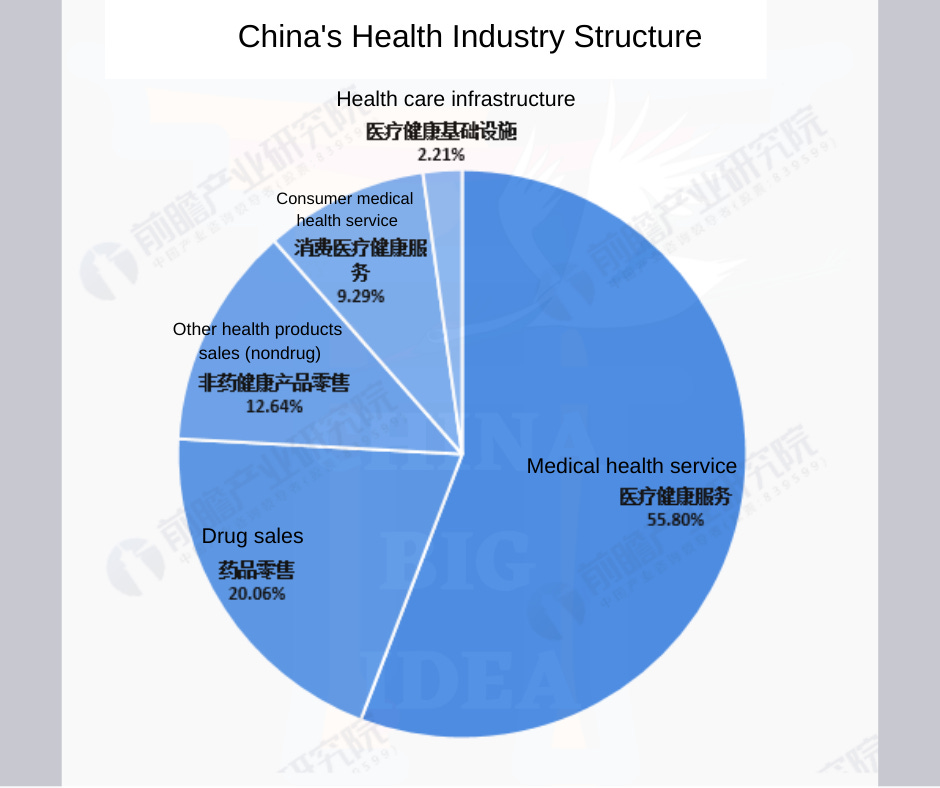

China’s Health Industry Will Triple in 10 Years

China's health industry's market size was $1.24 billion (8.131 billion RMB) in 2019. It is expected to Triple to $3.33 billion (21.773 billion RMB) by 2030, with a compound annual growth rate of 9.4%.

By 2030, the national health expenditure is expected to reach $2.60 trillion (17 trillion RMB). It is also estimated that the domestic health and healthcare industry's market size will reach $3.37 trillion (22 trillion RMB) by 2030.

E-health and Medical e-commerce

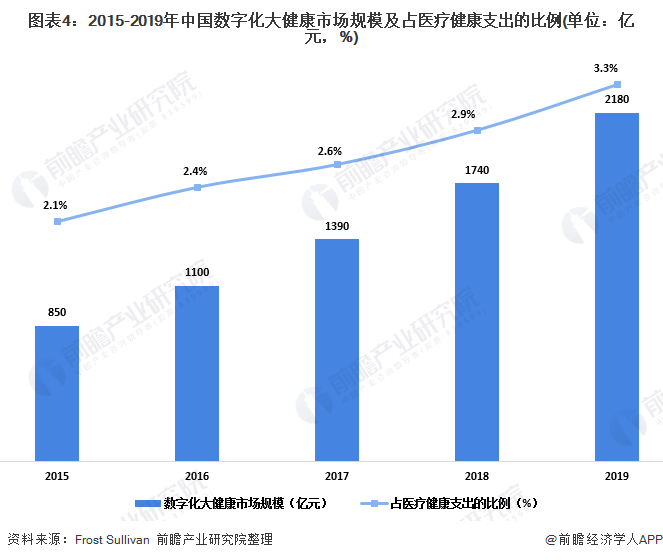

China's medical and health industry is still in the primary stage of digitization. Only 2.1% of drugs in China were sold through online pharmacies in 2019.

It is expected that the digital proportion of China's health and healthcare market will increase to 25.9% by 2030, up from 3.7% currently.