More of the Old or Much of the New: Economy, Regulation, Biden Cabinet Nominees. A Special Weekend Edition

Intelligence and Insights on China's government actions, foreign policy, economy and the capital market

Letter from the Editor

“Landscape with Rainbow” (1859) by the African American artist Robert Duncanson hid the deep wounds of a country set for imminent Civil War.

The week saw China achieve beyond-expectation economic growth, continue its stability-seeking monetary policy and antitrust enactment. In this weekend edition, we turn our attention to the bilateral US-China relations in the new Biden era.

If the inaugural painting Landscape with Rainbow for the new 46th US President is imbued with profound optimism, the immediate executive actions and the cabinet nominations do little to revert the strategic impairments left by the last administration.

The latest testimony from the Senate floor: Secretary of State nominee Antony Blinken endorsed the last administration’s gravest “genocide” discourse --- a serious allegation in international law but only hastily brought up in the last few days of the Trump administration. Tariffs against Chinese goods appear to linger -- a signature policy of the Trump administration. A concerted critical approach towards China is still prominently featured in the cabinet nominees’ words and thoughts. Chinese Embassy in the US has just confirmed that China has not proposed a Xi-Biden summit.

Despite the worrying signs, a reset of the relationship is still in the hopes.

Climate Emergency tops the list. John Kerry, the most seasoned diplomat in the cabinet lineup, is nominated for the historically significant position of Special Envoy for Climate Change, an issue both the Chinese and US leaders now regard as an existential threat, and the latter has made it copiously clear that cooperation with China is indispensable.

Tariffs against China also expose the deep divide within Biden’s cabinet picks, Vice-President Kamala Harris, the Wall Street-friendly Janet Yellen, and to a lesser extent, the national security advisor nominee Jake Sullivan, all consistently expressed reservations about the trade war and its devastating effect on American jobs, production, and reputation.

Eventually, the Biden Administration’s diplomatic program depends on the American people’s support, as much as on the good faith of its “Western allies,” especially when the European allies moved alone to culminate a bilateral Comprehensive Agreement on Investment (CAI) with China 3 weeks ago without waiting on the US.

We conclude our note with an invitation to enjoy this paywall-free special weekend edition on China’s most recent economic news and views from the “White House” on the future US-China relations.

Economy

China’s Economy Expanded by 2.3% in 2020

China’s 2020 economy grew by 2.3% YoY in 2020. This is higher than China’s own earlier estimate of 2% GDP growth for 2020.

The size of the Chinese economy topped $15.4 trillion (RMB 100 trillion) for the first time. Per capita income surpassed $11,000.

Given the GDP estimate in current Dollars, China’s GDP in 2020 may have reached around 75% of the US’s.

Ning Jizhe, director of NBS, said China's economic strength, scientific and technological strength, and comprehensive national power had reached a new high. (read more in Chinese)

“国内生产总值已经突破了100万亿元大关,这意味着我国经济实力、科技实力、综合国力又跃上一个新的大台阶。对于全面建成小康社会,开启全面建设社会主义现代化国家新征程,都具有十分重要的标志性意义。”

By industries

The total value added from primary, secondary, and tertiary industries increased by 3.0%, 2.6%, and 2.1%, respectively.

The value added from the tertiary industry accounted for 54.5% of the country’s GDP, up 0.2% year on year.

Still, the tertiary industry showed a lagging recovery. China's total retail sales of consumer goods fell 3.9% YoY in 2020, the first negative growth since 1969. On the positive side, the third and fourth quarters saw positive growths of 0.9% and 4.6% respectively.

Final Consumption in GDP Reached Highest Level

Final consumption accounted for 54.3% of China's 2020 GDP, reaching a historic high.

“消费仍然是经济稳定运行的压舱石。”

Compared with developed countries whose final consumption accounted for 70% to 80% of their total GDP, there is a large room for China's consumption growth. (read more in Chinese)

Resident Income Grew at the Same Pace as the Economy

The per capita disposable income was $4,959 (RMB 32,189), a nominal increase of 4.7% YoY, and a real increase of 2.1% YoY, which was generally at the same pace as the growth of the economy.

The per capita disposable income of urban households was 2.56 times that of rural households. Urban-rural per capita income ratio narrowed, but only very slightly.

Investment Played a Key Role in Economic Recovery

The investment in fixed assets grew by 2.9% YoY. The investment in infrastructure was up by 0.9% and that in real estate development by 7.0%.

The investment in primary, secondary, and tertiary industries grew by 19.5%, 3.6%, and 1.0%, respectively.

The investment in high-tech industries grew by 10.6%.

The investment in the public sectors grew by 11.9%. Among them, investment in health and education grew by 29.9% and 12.3%, respectively.

“总的看,2020年,消费发挥了基础性作用,投资发挥了关键性作用。全年的固定资产投资、三次产业投资、社会领域投资、基础设施投资都实现了正增长。”

Trade Registered Positive Growth

In 2020, the value of two-way trade in goods increased by 1.9% YoY, reaching a historic high. Exports went up by 4.0%, and imports went down by 0.7%. The trade surplus was $571.2 billion (RMB 3,709.6 billion).

China’s Economic Track Record since 2000

Here is a set of historical growth figures:

In 2000, China’s GDP totaled $1.21 trillion (RMB 10.03 trillion).

In 2012, China’s GDP exceeded $7.7 trillion (RMB 50 trillion).

In 2020, China’s GDP topped $15.4 trillion (RMB 100 trillion)

Within 20 years, China’s economic volume has expanded 10 times from RMB 10T to RMB 100T.

China’s economic weighting globally

China currently represents about 17% of the global nominal GDP.

According to the World Bank, China is solidly in the upper bound of the middle-income category on a per-capita basis. The upper bound of the Middle-Income country status is currently placed at $12,000 GDP p.c.

China has achieved its Vision 2020 target of doubling GDP and per capita income by 2020 from 2010. China aims to double its GDP and GDP per capita again between 2020 and 2035.

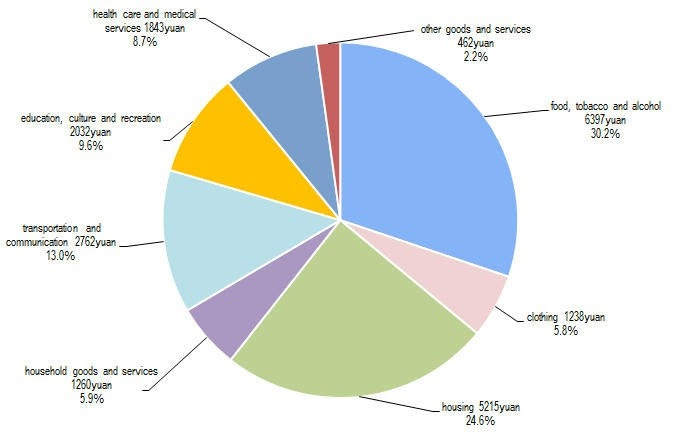

A Close Scrutiny at China’s Consumption

In 2020, China's per capita consumption expenditure was $3,270 (RMB 21,210), a nominal decrease of 1.6% YoY, and a real decrease of 4.0% YoY.

What sectors of consumption have dropped?

Education, culture, and entertainment consumption dropped the most in 2020 by 19.1%.

Accommodation and restaurant expenditure dropped by 13.1% YoY.

Leasing activities and business services dropped by 5.3% YoY.

Wholesale and retail sales dropped by 1.3% YoY.

What sectors of consumption have risen?

Food, tobacco, and alcohol consumption expenditure rose the most by 5.1%, mostly attributable to food inflation.

Information transmission, software, and information technology services rose by 16.9% YoY.

Financial services rose by 7.0% YoY.

Themes of Growth in 2020

Growth in innovative sectors outpaces conventional industries.

The strategically innovative services sector(战略性新兴服务业) grew by 8.6% YoY, 7% higher than its conventional peers, in 2020.

Revenue from the industrial robotic, new energy vehicle, and IC industries grew over 15% in 2020.

Centrally-controlled State-owned Companies(SOEs) saw a V-shaped recovery in 2020.

The biggest national SOEs saw an average profit rise of 2.1% in 2020.

Profit generated per employee at China’s centrally-controlled SOEs hit $22,000 in 2020. (read more)

China continued to attract Foreign Direct Investment in 2020

China attracted RMB 1Trillion of non-financial Foreign direct investment in 2020, rising by 6.2% in 2020.

The total size, growth rate, and global weighting of China’s foreign direct investment hit new highs in 2020 due to its early economic recovery and derisked market environment.

引资总量、增长幅度、全球占比“三提升”

Hainan free-trade port, the signing of the Regional Comprehensive Economic Partnership (RCEP), and the China-EU Comprehensive Agreement on Investment (CAI) will provide a further strong impetus for the inflow of investments in 2021.

Government in Action

Antitrust Regulation on Third-Party Payment Launched

The Central Bank released the “Non-Bank Payment Processing Institutions Regulations (Draft)" 《非银行支付机构条例(征求意见稿)》on January 20th. This marks the first regulatory effort by the Central Bank to establish a legal framework to regulate the third-party payment processing industry, including Ant Group and other legal fintech players.

This framework addresses the massive innovations in the sector and the lagging-behind regulatory landscape. (read more)

All current third-party payment processing licenses will be reviewed under the new Rule to determine renewal eligibility. This can cause a potential reshuffle of the industry. Ant Group’s licenses may face the pressure to comply with the rules with additional licensing requirements.

All innovative business models, including “credit-based consumer microfinance” products, will face new regulations.

It establishes a clear “red line” for the third-party payment processing industry to prepare for a clear guideline for antitrust violations in the industry.

在此次《条例》中,支付行业最为关注的便是明确支付市场支配地位“红线”,为支付行业反垄断提供了明确的标准。

1. Matrix that triggers Antitrust warnings

If a company meets one of the three criteria, PBOC will initiate regulatory discussions and antitrust investigations.

Early Warning

if one third-party payment processing company takes up over 1/3 of the entire third-party payment processing market.

two third-party payment processing providers take up 1/2 of the third-party payment processing market.

three third-party payment processing providers take up 3/5 of the total market.

Antitrust actions

PBOC may consult the State Council’s Anti-Monopoly Law Enforcement Agency to trigger antitrust warnings and investigations if:

A non-bank payment institution's market share in the national e-payment market reaches 1/2.

The total market share of the two non-bank payment institutions in the market reaches 2/3.

The total market share of the three non-bank payment institutions in the market reaches 3/4.

(一)一个非银行支付机构在全国电子支付市场的市场份额达到二分之一;

(二)两个非银行支付机构在全国电子支付市场的市场份额合计达到三分之二;

(三)三个非银行支付机构在全国电子支付市场的市场份额合计达到四分之三。

2. Regulations on Shareholders

PBOC will clarify the real shareholders sifting through all legal entities and identify their capital sources in the third-party payment processing market.

A shareholder shall not hold more than 10% equity in two or more non-bank payment companies.

The same controlling shareholder shall not control two or more non-bank payment institutions.

The controlling shareholders of non-bank payment companies shall not evade supervision through SPVs or ownership in other people’s names.

Shares held by controlling shareholders in non-bank payment institutions shall not be transferred within the first 3 years.

3. Separate regulations of deposit business and payment business

The Central Bank reclassifies the business lines involved in the third-party payment industry into 2 separate categories under "deposit business" and "payment processing business" to enable separate regulations based on the different natures of these businesses.

Implications

All these regulations hit at the heart of Ant Group’s business. Ant’s Alipay and Tencent’s WeChat Pay currently dominate 90% of China’s third-party payment processing market.

Both companies, according to the new “red line,” will need to reduce their market shares. This means China may open up the market by issuing more third-party payment processing licenses to new start-ups in the industry to dilute Ant and Tencent’s market shares. Bytedance stands to benefit from this new competition.

Stability Tops Monetary Policy Priority in 2021

“Stability” tops the monetary policy priority for 2021, says Chen Yulu, deputy Central Bank Governor. (read more)

Central Bank Monetary Policy Target

The monetary Policy target in 2021 aims to match the pace of expansion of money supply and public finance with the nominal GDP growth rate. Central Bank will moderately expand the money supply to support sustainable economic recovery in 2021. If the above policy target holds, China’s broad money supply should be expected to expand at about 8-9% in 2021, given the GDP growth projection at 8.5% for 2021.

2021年是“十四五”开局之年,人民银行会坚持“稳”字当头,不急转弯,根据疫情防控和经济社会发展的阶段性特征,灵活把握货币政策的力度、节奏和重点,保持货币供应量和社会融资规模增速同名义经济增速基本匹配,以适度货币增长支持经济持续恢复和高质量发展。

1. Lending rate will continue to adopt market-based pricing mechanisms in 2021.

As of 2020, over 80% of China’s commercial lending rates were based on market-priced LPR rates. While China still hasn’t fully denounced a “dual-track” interest rate regime, nearly all lending rates are benchmarked on market-priced rates. Market-based interest rate regime marks a critical step in the Chinese interest rate liberation process.

2. China continues to curb excessive real estate borrowing.

Real estate loans grew at a slower pace than the growth rate of total lending in 2020. New real estate loans as a percentage of total new loans hit 28% in 2020, compared to 49% in 2016.

The stability of the real estate market centers on three parameters: stability of the land value, the stability of the housing value, and stability of real estate price expectations.

去年房地产贷款增速8年来首次低于各项贷款增速,新增房地产贷款占各项贷款比重从2016年的44.8%下降到去年的28%。”人民银行金融市场司司长邹澜表示,近年来,人民银行坚持房子是用来住的、不是用来炒的定位,紧紧围绕稳地价、稳房价、稳预期的目标全面落实房地产长效机制,加强房地产金融管理。

3. RMB exchange rate is expected to fluctuate within a stable range in 2021.

RMB appreciated by 6.9% against the USD and appreciated by 4% against the basket of currencies in 2020.

Although the appreciation put pressure on exports, the overall economic impact of exchange rate appreciation balanced itself out in 2020.

Currency is expected to remain stable and fluctuate based on supply and demand in 2021 within a range.

US-China

This weekend, we take a focused view of Biden’s top nominations and their China positions.

Antony Blinken – Secretary of State Nominee

Blinken has been a long-time confidant of Biden and was a key foreign policy advisor in Biden’s presidential campaign.

Blinken served as the Democratic staff director for the Senate Foreign Relations Committee under Biden in 2002-2008, and national security advisor to the then-vice-president Biden in 2009-2013. He is also the co-founder of WestExec Advisors.

Blinken’s multilateralism approach: The New York Times described Blinken as a “defender of global alliances.” His piece, titled “Trump is ceding global leadership to China,” called for a reinvigoration of American stewardship of the international order by advancing liberal values and progressive norms. (full piece)

Blinken on tariffs: Blinken has been critical of Trump’s tariffs previously. However, he has not ruled out tariffs, saying that they may be used if “backed by a strategy and a plan.” (read more) He also notes that the WTO can play an important role in facilitating trade practices.

Blinken on Hong Kong: Blinken wrote that “ the Biden-Harris administration will stand with the people of Hong Kong and against Beijing's crackdown on democracy.” He has previously called for sanctions against Chinese banks and officials for breaking the One Country Two Systems principles.

Blinken on Taiwan: According to Douglas Paal, a scholar at the Carnegie Endowment for International Peace and former representative to the American Institute of Taiwan, Blinken will value Taiwan’s positive role in world affairs and support Taiwan’s democracy. If appointed, he will likely build on Pompeo’s recent moves to lift restrictions on US communications with Taiwanese officials.

Biden’s Nomination: Janet Yellen, Treasury Secretary

President Biden nominated Janet Yellen as the U.S. treasury secretary. If confirmed, Janet Yellen would be the first woman ever to lead the US Treasury. (read more)

Janet Yellen served as the 15th Fed Chair and Chair of the Council of Economic Advisers under President Clinton. (read more)

Yellen’s Policy Inclinations

Yellen supports a loose monetary and a tight fiscal policy. (read more)

Yellen said the U.S. debt situation is “unsustainable.” She has proposed to increase taxes and reduce retirement expenditures. (read more)

When Yellen took office as the chairman of the Fed, QE was ended. In 2015, the U.S. began to raise interest rates by 0.25% points – its first increase since 2006.(read more)

Yellen supports the implementation of increased carbon taxes. (read more)

She is a founding member of the Climate leadership Council, an international policy institute with a stated mission to tax carbon to reduce greenhouse gas emissions. (read more)

She has also proposed an initial carbon tax of US$40 per metric ton with a progressive annual increase. If implemented in 2021, it could cut the US CO2 emissions by half by 2035. (read more)

Yellen believes that the US-China trade war slows global recovery.

Although Yellen’s stance on China remains unclear, she supports open trade and the current global trade system. (read more)

U.S. China trade war will affect Asian economies. (read more)

Competition between the U.S. and China in AI, 5G, and other technology will be quite difficult to deal with and will have very significant consequences for the global economy. (read more)

If the two superpowers are unable to find common ground, the pace of technological advancement could slow and complicate the launch of new commercial applications. (read more)

Biden Nomination: Katherine Tai – US trade representative

Biden nominated Katherine Tai to lead the Office of the US Trade Representative (USTR). As a highly experienced trade lawyer who is also fluent in Mandarin, her appointment is viewed overwhelmingly favorably across the political spectrum in the US and among key trade and business groups in Washington. Upon her appointment, she will become a key figure in managing economic ties with China and the future direction of US-China trade talks.

Key experiences (read more)

2014 onwards: Chief trade counsel on the House Ways and Means Committee – Played a significant role in the House’s negotiations with Trump regarding the US-Mexico-Canada Agreement.

2011-2014: Chief counsel for China trade enforcement at USTR – Responsible for litigating Washington’s disputes against China at the World Trade Organisation

Addressing China “forcefully and strategically.”

Tai has extensive experience in dealing with China’s unfair trade practices. In a speech made in August 2020 at the Centre for American Progress, Tai argued that tariffs and sanctions are “defensive,” while the Trump administration lacked offensive measures. The US industry would compete and be victorious over the Chinese (read more). Biden has mentioned that he will not move quickly to lift sanctions against China, and Tai will be expected to seek bipartisan backing for more “offensive” trade maneuvers against China.

An American “worker-centric trade policy.”

President-elect Biden has emphasized that his trade policy strategy will focus on the interests of American workers. In a speech at the National Foreign Trade Council, Tai reiterated this emphasis, stating that “U.S. trade policy must benefit regular Americans, communities, and workers. And that starts with recognizing that people are not just consumers. They are also workers and wage earners”. (full speech)

Resolving trade disputes through the WTO

While the Trump administration was frustrated with the WTO and favored tariffs to pressure China, Tai has previously used multilateral approaches to achieve trade aims. As chief counsel for China trade enforcement at the USTR, she won WTO disputes against China in partnership with allies in Europe. She is expected to continue to pursue America’s trade policy goals through trade organizations and with support from allies. (read more)

Tougher labor and environmental standards

Tai is widely recognized for pushing tough labor and environmental standards in the US-Mexico-Canada trade pact. Labor standards were a sticking point in the EU negotiations with China, and Tai’s insistence on tough standards will be a source of pressure for the Chinese.

John Kerry – Special Presidential Envoy for Climate

Biden has elected former Secretary of State John Kerry to the role of the climate tsar. This is a new cabinet-level position that reflects the incoming administration's commitment towards climate action, both domestically and internationally.

Kerry’s main task

While the exact scope of his role and authority remains vague, his main task will be to establish the United States as a key player in tackling climate change. Rather than encouraging a legal agreement, which was achieved in 2016 with the Paris Agreement, he will have to persuade Americans and other nations to aggressively cut carbon emissions. Paul Bodnar, managing director at the Rocky Mountain Institute, remarked that “his job is to basically execute a pivot from 30 years of negotiations to a decade of aggressive action”. (read more)

Getting China on board

In an interview before the election, Kerry stated that China is bringing large amounts of coal-fired power online and is engaging in competition in the Arctic for rare minerals – he responded by saying, “that’s going to kill us. That’s going to kill the efforts to deal with climate”. While he thinks the US should stand firm when it disagrees with Beijing, geopolitical competition is of secondary importance to the climate threat (read more). He asserts that China needs to be brought to the negotiating table and help lead climate-friendly development efforts. He further stated that “China is going to be, like it or not, one of the most important relationships that we work on over these next 10, 15, 20 years or longer”. (full interview)

Significance of climate in the US-China relationship

According to Thomas Wright, Kerry believes that the US should elevate the climate to the top priority and be willing to make concessions on China's issues. This, however, is a minority view, and most, including Biden, believe that cooperation on climate should be compartmentalized from the rest of the US-China relationship. (read more) This may compromise the unity of the approach taken by the incoming administration.

Aside from the role of climate in the US’s overall China strategy, Kerry will have to address the competitive aspect of climate change. There will be strong competition with China for a technological edge in green innovation and green finance. A report written for the European Council on Foreign Relations shows how “the competitive dimension in climate diplomacy will become more dominant” between the EU and China. This competitiveness is likely to manifest in US-China climate relations as well. (full report)

Jake Sullivan – National Security Advisor

After previously having served in a similar role for VP Biden, Jake Sullivan will serve as a national security advisor in the Biden administration. He previously served as the deputy chief of staff at the State Department while Hillary Clinton was Secretary of State. He will play a highly significant role in shaping American national security and foreign policy.

Bridging the gap between rhetoric and action

While on the campaign trail with Biden, Sullivan, in his capacity as a senior advisor, said that Trump was consumed by “tough talk hardly substantiated by action.” (read more). He argued in an essay for Foreign Affairs that while the strategic competition was a viable approach, the concept was useless unless the US specified how it would out-compete China.

Closer cooperation with allies and engagement with international institutions

Sullivan has argued for a foreign policy that is more focused on supporting US allies. Sullivan said that “it is time for the United States to truly pull together the like-minded democracies of the world to develop a clear set of priorities” on issues such as China and climate change. (read more) He has urged for a strategy of using alliances to pressure China by presenting a united front of democratic interests.

On trade

He suggests that while unilateral tariffs pursued by the Trump administration have backfired. The pursuit of tariffs multilaterally will create the greatest chance of success. (read more)

Competitive Cooperation with China

As mentioned above, an essay in Foreign Affairs states that the US strategy towards China cannot be a Cold War redux. Instead, the US will have to accept that China has a stronger role in the Indo-Pacific, while China will have to accept some US role in the region. (full article)

Kurt Campbell – Indo-Pacific Coordinator

Kurt Campbell, a former assistant secretary of state for East Asian and Pacific Affairs under Obama, has been nominated for a new position created by the Biden administration in the National Security Council to tackle Asia policies. He is widely known for his role in Obama’s “Pivot to Asia” strategy, which promoted greater investment and policy engagement with Asia (read more). This strategy was replaced by Trump’s Indo-Pacific Strategy, detailed in a recently declassified document (full document).

Restoring a balance of power with China

Campbell released an essay on the Foreign Affairs website last week titled “How America Can Shore Up Asian Order: A Strategy for Restoring Balance and Legitimacy” (full article). He warned of an increasingly powerful China destabilizing the “delicate balance” of the Indo-Pacific, but the region has been left in flux because of US ambivalence. He called for more proactive engagement with allies in the region to “deter Chinese adventurism” and restore US legitimacy as the leader of regional policy.

Campbell argues that Beijing can and should be a part of the new regional order. Another article he wrote in 2019 with Jake Sullivan states that “despite the many divides between the two countries, each will need to be prepared to live with the other as a major power.” (full article) They argue that rather than being anti-China, Washington should establish “clear-eyed coexistence” and establish favorable terms by advancing the appeal of American values on their own terms, rather than to score points in a competition.

Changing security strategy

On the security front, Campbell suggests that the US military should turn to relatively low-cost and asymmetric capabilities to “complicate Chinese calculations and force Beijing to re-evaluate whether risky provocations would succeed.” He also recommends Washington disperse American forces across the region to reduce risk. (read more)

Strong interest in Taiwan

Campbell remarked in December that a degree of “productive and quiet dialogue” between Beijing and Taipei “is in everyone’s best strategic interests,” and “the ultimate responsibility of the US is to maintain the credibility and the commitment to preserve peace and stability across the Taiwan Strait.” (read more) He also asserted that the US is pro-Taiwan as well as not anti-China.

Linda Thomas-Greenfield – U.S. Ambassador to the UN

Linda Thomas-Greenfield began her career in the foreign service in 1982. In her 35-year tenure, she served as the director-general of the Foreign Service, held an ambassadorship in Liberia, and postings in Geneva, Pakistan, Kenya, Gambia, Nigeria, and Jamaica. (read more)

Thomas-Greenfield was the assistant secretary for the Bureau of African Affairs under the Obama-Biden administration. (read more)

To rebuild the State Department. (read more)

The State Department was “too narrowly focused on terrorism and too wrapped up in magical thinking about the U.S.’s supposed power to transform regions and societies.”

The State Department “paid too little attention to a rapidly changing international landscape in which geopolitical competition with a rising China and a resurgent Russia was accelerating and other huge global challenges.”

The U.S. diplomacy has to accept the country’s diminished, but still pivotal, role in global affairs.

It is necessary to organize wisely for geopolitical competition with China.

The wreckage at the State Department runs deep. Career diplomats have been systematically sidelined.

The aim should be to reinvent the power and purpose of U.S. diplomacy for a new era.

Capital Market

Chinese Investment in the US Undeterred in 2020

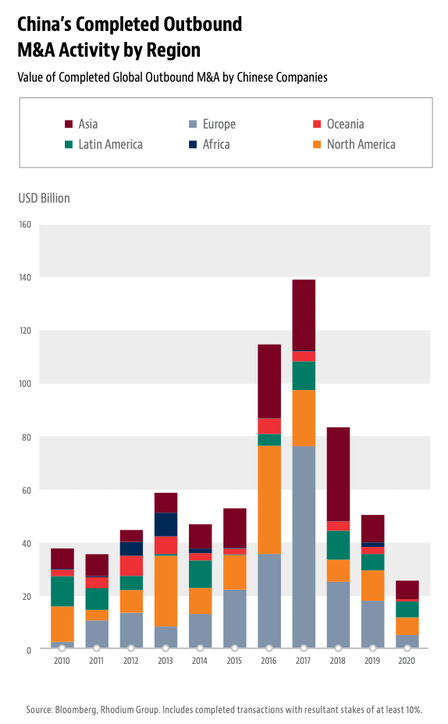

According to research by global law firm Baker McKenzie and Rhodium Groups, Chinese outbound M&A fell 45% globally in 2020, to a total of US$29 billion, making it the lowest total since the last financial crisis in 2008. Acquisitions in Asia fell by just over 30%.

Despite U.S.-China tensions, however, Chinese outward FDI into North America climbed by more than 30% to US$7.7 billion. This was the first year in five years that investment in North America outstripped that in Europe. Investment in the U.S. and Canada was concentrated in entertainment, health and biotech, and natural resources. California was by far the largest hub for Chinese investment in North America.