One Small Step: Long Vision 2035 Action Plans, PMI New High, P2P Fintech, Edmund Phelps: Risk, Policy, Macro, Investment, a Special Weekend Edition

Intelligence and Insights on China's government actions, foreign policy, economy and the capital market

Spacecraft Chang’e-5 successfully unfurled the Chinese national flag on the Moon this week. China, second only to the US, has extolled earthly sovereignty in the celestial terrain in the history of humanity.

For more than four decades, China has assimilated, for its own good, the beholder of the human technological and economic zenith of the 21st century. The Moon landing is yet another small step in seeking closure.

More evidently in 2020, China is emboldened in its policymaking to seek alternative paths to the future. This week, ideas arose that China should embrace zero tariffs, zero subsidies, and zero barriers to entry in trade, that China should remain open to the US in trade and investments despite sanctions from the US, that China should become the world’s largest importer in the next 3-5 years, and that China will embark on green development, not as an altruistic act, but as a massive catalyst for its economy.

A well-trodden path for China to emulate, there is no more.

A system as such depends on innovation more than ever. Innovation is a risky act. Without risks, there’d be no landing on the Moon.

In a recent interview with us on China, Nobel laureate in Economics Prof. Edmund Phelps reflected brilliantly (we encourage you to watch this video at the end).

Prof. Edmund Phelps theorized a set of values, born in the Renaissance, have brought the golden era of the West over the past five centuries. It may be interesting to see if these values, which Prof. Phelps calls interchangeably the “love of the unknown”, will be exhibited in China over the coming decades.

Yes, it is the love of the unknown that has been the consistent magnet for human progress. The rise and fall of polities, ephemeral in the long span of civilizations, is fondly remembered as a derivative of the capacity to imagine the unknown.

Unknown ahead

1. Pentagon Blacklists Chipmaker SMIC and Oil Titan CNOOC

The Department of Defense blacklisted four Chinese companies, for reasons that they are either owned or controlled by the Chinese People’s Liberation Army. This means they’re now subject to restrictions, including a ban on Americans investing in them.

• Semiconductor Manufacturing International Corp.

• China National Offshore Oil Corp.

• China Construction Technology Co. Ltd.

• China International Engineering Consulting Corp.

SMIC is China’s leading chipmaker, which was informed to have been placed on the Entities List by the Department of Commerce earlier. The sanctions prevented US companies from selling specific equipment and software to the company. 50% of the equipment at SMIC are said to be reliant on US import.

CNOOC is the smallest of China’s “big three” oil producers. This DoD sanction may concern CNOOC’s engagements in offshore oil drilling in the South China Sea.

These DoD sanctions are based on a broad definition of control and ownership by the Chinese military. It may mean companies that directly or indirectly support China’s military modernization. This means an extensive net for China’s state-owned enterprises.

Assessments

Sanctions on individual Chinese companies can come and go with executive orders. So far, the sanctions strike Chinese companies on an individual basis with high precision. They hurt specific companies. These sanctions have not caused systemic shocks to either economy so far.

The sanctions also aim at various objectives:

Restrict China’s access to leading US technologies, as in SMIC and Huawei’s case;

Cut off Chinese state-led military-civil fusion developments from access to US funding, as in CNOOC’s case;

and disconnect Chinese tech companies’ access to data in the US, as in TikTok and WeChat’s case.

What’s possible ahead of January 20?

1) Trump administration can unilaterally raise tariffs on Chinese goods again. China has not fulfilled the purchase commitments according to the US-China phase 1 trade deal this year. On the one-year anniversary of signing the US-China phase 1 trade deal, Trump could impose higher punitive tariffs.

2) President Trump, with near certainty, will sign off on the Holding Foreign Companies Accountable Act, which has now passed both the House and the Senate before January 20. Once the US pursues capital market decoupling with China, particularly backed with unanimous congressional support, this decision will be extremely hard to reverse by the next administration.

3) TikTok sale should be pushed to a definitive resolution before January 20, either with an outright sale or leaving the US market. (interview on CNN)

2. The US Tightens Visas for Chinese Communist Party Members

Trump administration issued a new immigration policy tightening visa rules for the Chinese Communist Party members with immediate effect on December 2. Travel visas (B1/B2 visitor visas) for CPC members and their immediate families are reduced from up to 10 years multiple entry visas to 1-month single-entry visas.

This new visa policy is expected to impact up to 250 million Chinese by some estimates. China currently boasts over 90 million Communist Party members. From a practical perspective, this visa policy will affect most the prominent Communist Party elites in politics, business, and arts, more than the junior CPC members whose Party affiliations the US would not readily identify. The New York Times article, which first broke the story, reported that it is likely that party status is determined through the visa application and interview process.

3. US Bill That Triggers Delistings of Chinese Companies

The Holding Foreign Companies Accountable Act (the Act) was unanimously passed at the House of Representatives on December 3, following Bill’s passing in May in the Senate. President Trump is expected to sign the Act into law.

The Act requires listed companies to disclose any affiliations to foreign governments. It also mandates listed companies to disclose three consecutive years of audit records. Although the Act is not specifically tailored to confine Chinese companies, currently, 92% of the US’s listed entities who do not comply with such audit standards are companies from mainland China.

Possible options include that the US-listed Chinese companies may perform two parallel audits, with one auditor licensed in China and another auditor licensed in the US. However, the solutions are unclear at this point.

Policy

1. Action Plans to Achieve China’s Long Vision 2035

Liu Shijin (刘世锦) is one of the first senior officials to outline China's detailed execution strategies to achieve the Long Vision 2035, launched during the 5th Plenum of the 19th Party Congress in October. China’s new development will require a moderately high speed, coupled with higher-quality growth.

Quantitative targets implied in China’s Long Vision 2035

China’s GDP will need to double again between 2020 to 2035, which implies an average annual growth rate of 4.7% over the next 15 years, for the Long Vision 2035 to be achievable.

十九届五中全会提出,2035年人均国内生产总值要达到中等发达国家水平,要实现这样的增长速度,平均增速不能低于4.7%,或者是要达到6%甚至8%以上才能实现。

New Development Matrix under the New Development Theory

In addition to GDP targets, the development benchmarks should incorporate unemployment rate, average household income, CPI, total factor productivity, debt to GDP ratio, per capita GDP, carbon intensity, etc.

Currency Strength and Total Factor Productivity

Achieving an average 4.7% average annual growth rate over the next 15 years remains a difficult economic task. A most important variable will be the currency exchange rate. The exchange rate is also directly related to the quality of development. A strong currency can narrow the income gap than GDP growth, based on similar experiences from developed countries.

China, to reach such economic targets, should shift focus more towards the stability/strength of the currency and total factor productivity.

日本、德国等二战以后的发展经历表明,一段时期内人均收入差距的缩小,汇率升值的贡献要大于经济增速的贡献。

China’s “1+3+2” Strategy for the Long Vision 2035

“1” is to develop China’s metropolitan clusters, focusing on building regional economies of scale and factor input efficiencies.

“3” refers to repairing the three weaknesses in the current economy.

Low efficiency in some vital economic areas.

These areas are still embedded with government policy interventions and lack market competition. It is important to break the government intervention to enable sufficient market competition.

A small middle-income class in proportion to the total population. Over the next 15 years, China’s middle-income earners should double in size, from the current 400 million to 800 million.

A still weak basic science and research capacity. Basic science and research are the “choking” points of the Chinese industrial production. Enhancing the basic science and research capacity will foster an innovation-led economy.

“2” refers to two new economic impetus for the Chinese economic takeoff.

the digital economy

green development

Four Reforms required to achieve the Long Vision 2035

Rural land reform. Rural collective land designated for development(农村集体建设开发用地) should be allowed to enter the market. Use right of such land should be allowed to be transactional in the market.

Petroleum, natural gas, electricity, railway, telecommunications, and finance, and other basic industries, should lower the barriers to entry, and encourage competition.

Break the social welfare disparity between urban and rural residents. Connect the silos between the rural and urban social security systems, and enable migrant workers to obtain urban status and urban dwelling.

Deepen higher education and basic research reforms. Enable innovative cities, such as Hangzhou & Shenzhen, to break the current educational system's status quo in recruitments, project management, capital financing, IP protection, international exchange, etc.

On Opening up

China should be a leader in the next wave of globalization.

The “Three 0s” in the China Opening up:

China should strive for three “zero”s in global trade: zero tariffs, zero barriers to trade, zero subsidies.

他建议,打出“三个零”这张牌:零关税、零壁垒、零补贴,“这个推行很不容易,但是把这个牌打出来,就站上了国际博弈的制高点”。

(Liu Shijin is the deputy director of the economic committee of China’s CPPCC.)

2. Incremental Delay of Retirement Age Anticipated by Central Government

The Central Committee of the Communist Party of China expects to implement a policy plan on the progressive delay of the legal retirement age as part of the “14th Five-Year Plan for National Economic and Social Development and Long-Term Goals 2035”.

Policy Considerations: Life Expectancy vs Fertility Trap

The context surrounding the implementation of this policy is strongly related to the predictions of a declining Chinese population,, which, according to the National Bureau of Statistics, is being heavily affected by the “low fertility trap.”

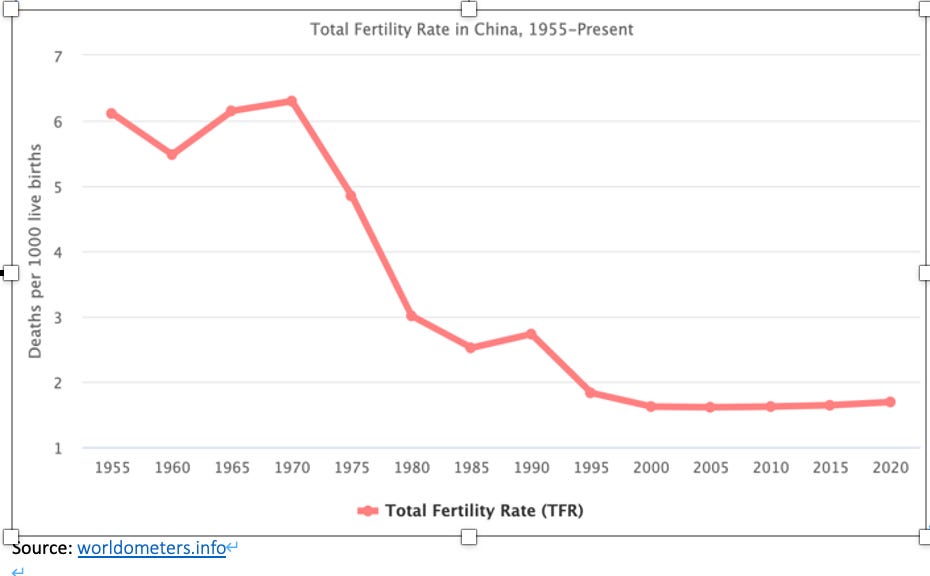

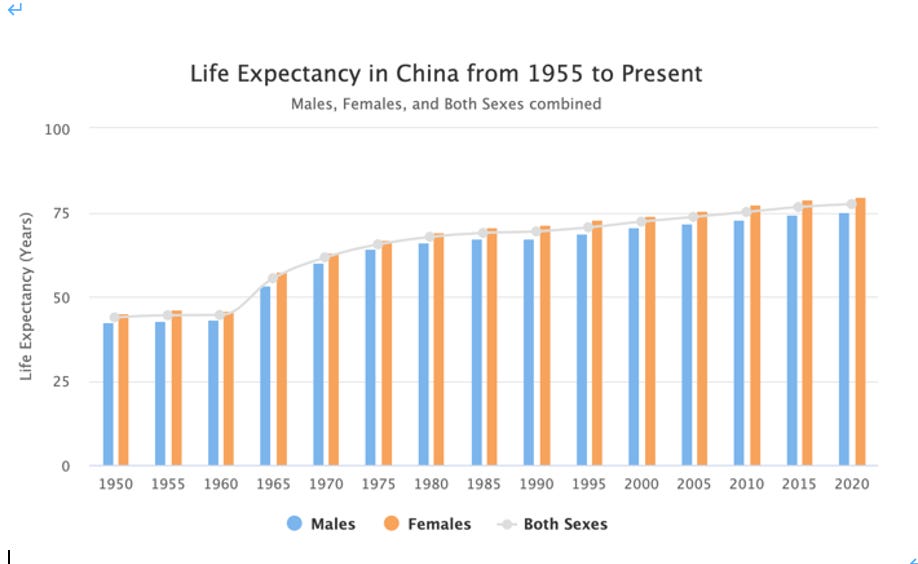

The minimum value of Total Fertility Rate (TFR) should be above 2.1 to meet the Replacement-Level Fertility (average number of children per woman needed for each generation to exactly replace itself without needing immigration). China’s fertility rate has fallen below this value for the last 20-25 years, signaling an aging population at an accelerated speed. (read more)

On the other demographic spectrum, life expectancy is increasing. In the 1950s, life expectancy was below 50 years of age for men and women in China. Life expectancies reach 75 and above for both gender groups. In 2019, people aged 65 and above in China reached 176 million, accounting for 23.0% of this age cohort globally. For more than four decades, the legal retirement age in China has been stipulated at 50 to 55 for women (depending on job function) and 60 for men. (read more)

Source: worldometers.info

Policy Implementation: Expectations and Design

Zheng Dongliang, then director of the Labor Science Research Institute of the Ministry of Human Resources and Social Security, predicted that the gradual delay of the legal retirement age could buffer the potential adverse effects of this “demographic time-bomb” on China’s domestic economy.

虽然劳动生产率逐步提高,但教育年限延长,劳动者的工作年限减少,社会总体劳动力资源在减少。因此,必须充分开发利用劳动力资源,而渐进式的延迟退休是一个途径。

According to Renmin University of China Professor Zheng Gongcheng, increasing the base retirement age to 65 by 2050 may be feasible in two stages. In the first stage, 2020-2035, the goal shall be to narrow the retirement age gap between men and women. The second stage, 2036-2050, shall be dedicated to raising the legal minimum retirement age.

The Central Committee has clarified that the policy design predicts a transition period to extend the retirement age. This will be done in incremental steps to ease the social shock. The implementation of this policy will also be a combination of unified regulations and voluntary choices by workers. Females, with real-life retirements hovering at 55, may take the lead in implementing the policy, says Su Hainan, a special researcher of the Chinese Labor Association.

This policy is ultimately a part of a more significant improvement and transformation of China’s social security system.

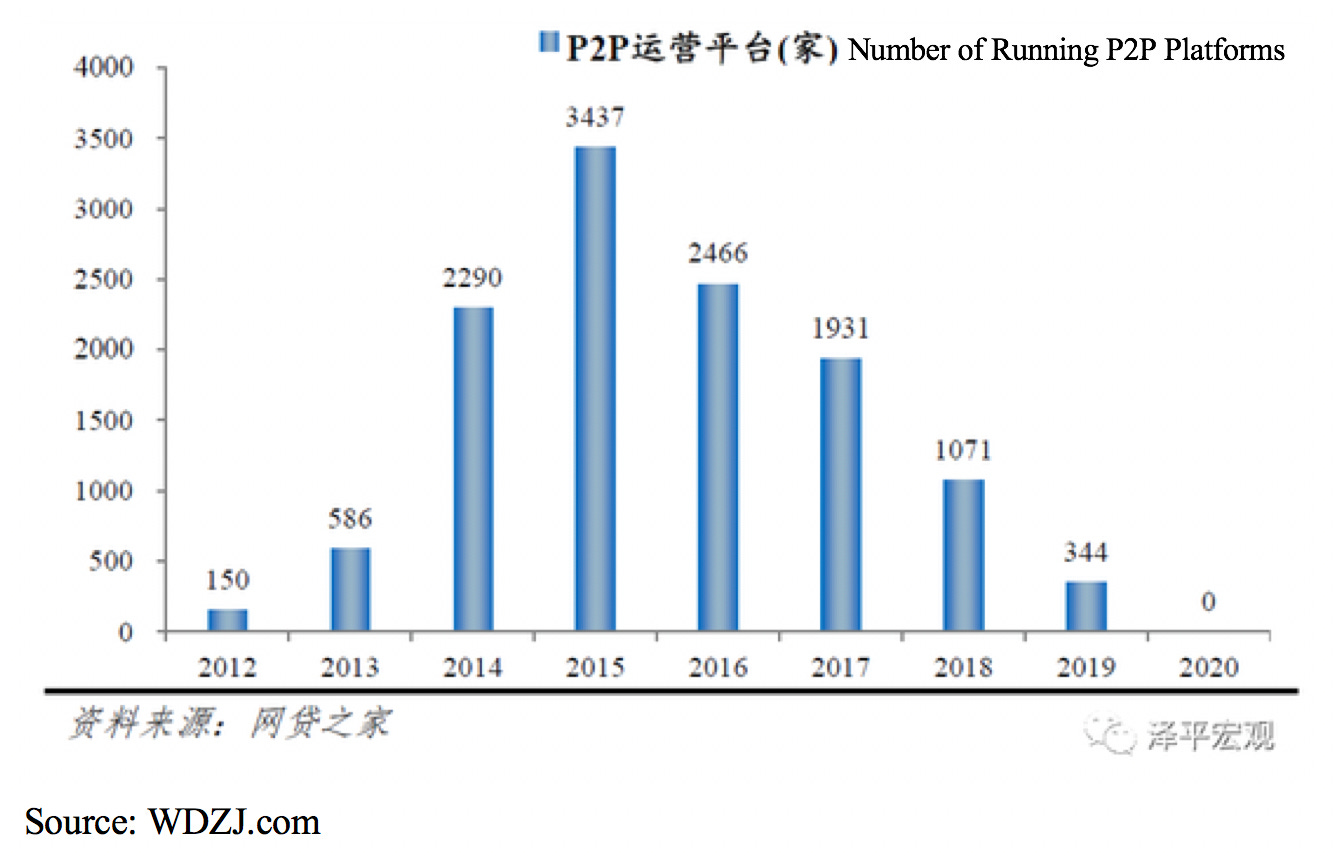

3. China’s P2P Platforms Fall to Nil

The number of Chinese peer-to-peer (P2P) lenders had fallen to zero by mid-November, after China’s ongoing efforts to crack down the P2P sector following a recent series of financial collapses at these companies.

History of P2P Lending in China

From 2012 to 2015, P2P lending arose as a market-based lending alternative to individuals and small businesses who otherwise would not have been able to seek financing from traditional banking institutions. P2P lending helped fill a gap in the rigid commercial banking system. P2P platforms surged in response to the vast market demand, marked by a historical peak of over 3,400 P2P platforms in 2015.

Devoid of proper regulations, P2P lending deviated from its role as the infomediary connecting borrowers and lenders. It became directly involved in pooling assets and providing loans, a traditional banking function. Moral hazards, Ponzi schemes, and loan failures that followed caused massive credit defaults, liquidity depletion, and owners’ flee. (read more in Chinese)

Since 2016, China has begun to impose strict supervision and control measures on P2P lending. The P2P industry suffered from financial deleveraging, lack of consumer confidence, and cash drain. The industry's scale has shrunk by $3.04 trillion (20 trillion yuan) from its historical peak. (read more in Chinese)

Outlook

With the rapid development of financial technology, China will need to handle the relationship between financial development, financial stability and security, said Liu He from the Financial Stability and Development Committee. China will

strengthen supervision and regulate the fintech industry;

improve a nationwide credit score system;

encourage fintech innovations, but

impose new regulations to protect investors. (read more in Chinese)

Macro

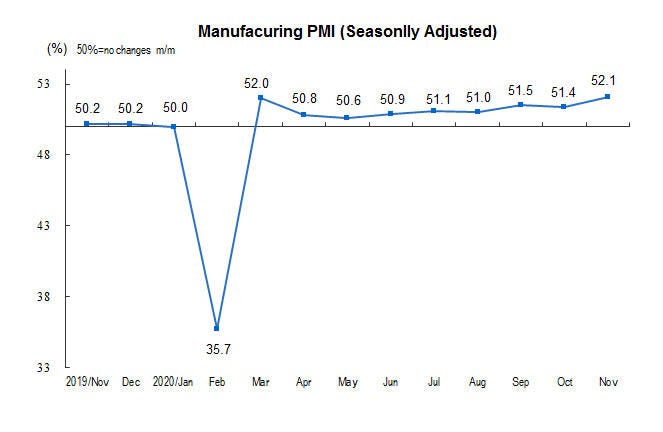

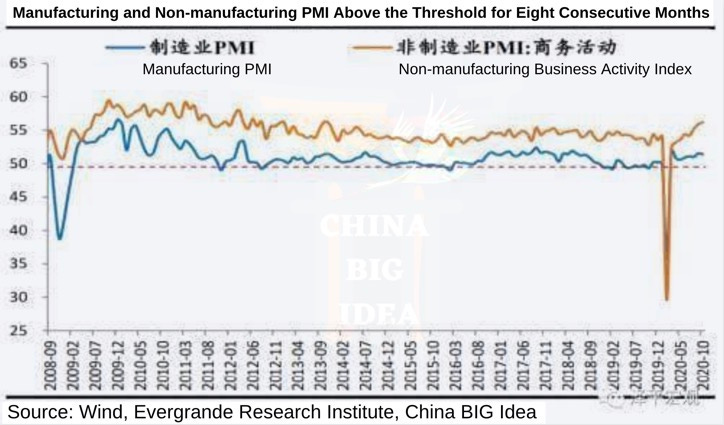

1. China’s November PMI Hit Highest Level in More Than Three Years

China's November Manufacturing Purchasing Managers Index (PMI) was 52.1%, hitting the highest record since October 2017. PMI predicts the prevailing direction of economic trends in the manufacturing and service sectors.

Supply and demand of manufactured goods both saw strong recoveries.

The production index and new orders index were 54.7% and 53.9% respectively, up 0.8% and 1.1% from the previous months.

The production index reached the highest level since May 2012.

Businesses started restocking inventories. Business confidence continued to improve. (read more in Chinese)

Imports and exports have steadily recovered.

New export orders index and import index were 51.5% and 50.9% respectively, up 0.5% and 0.1%.

Prices of raw materials and output have risen.

Main raw material purchase price index and producer price index were 62.6% and 56.5% respectively, up 3.8% and 3.3%. Upstream production elements saw significant price appreciation.

Consumer inflation could make a comeback in the presence of rising producer price indexes and rising demand. (read more in Chinese)

Prospects of manufacturers of all sizes have improved.

The PMI of large, medium and small enterprises were 53.0%, 52.0%, and 50.1% respectively, up 0.4%, 1.4% and 0.7%. Large corporations recover the strongest. Small enterprises remain teetering on the recovery line.

Organic business growth picked up.

Investment in export capacity and manufacturing sectors, mostly led by private enterprises, are leading indicators to the economic cycle. PMI’s recovery indicates further organic economic recovery. (read more in Chinese)

Recoveries were uneven across industries.

The PMI in traditional industries remained low and the momentum stayed weak.

Currency fluctuations affected competitiveness of export businesses.

Due to the recent strength of the RMB, 1.7% more of export companies reported declining profits or falling export orders.

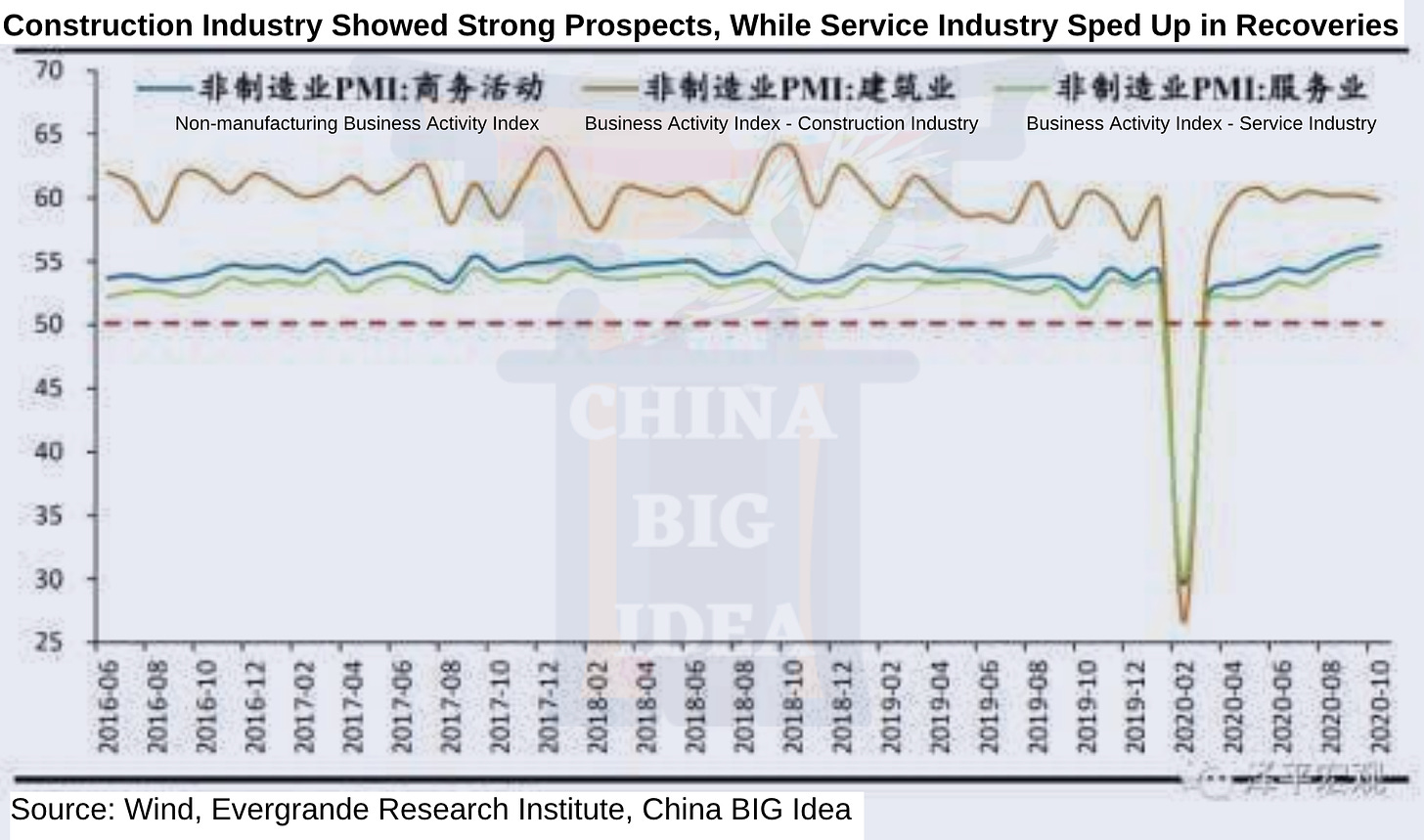

Non-manufacturing purchasing managers index (PMI) recovered faster.

non-manufacturing business activity index recovered faster than manufacturing PMI.

Restaurant industry returned to positive revenue growth YoY in October 2020.

Tourism, retail and services-related industries have experienced a healthy boost due to the stimulus over the October Golden Week holiday.

Business activities in railway transportation, airlines, hotels, culture, sports and entertainment all recorded over 59% in October.

Construction business activities continue to lead the non-PMI recovery, registering 59.8% in October. The sector has seen continuous expansion of infrastructure development, which is well expected.

2. Shenzhen Property Speculation Draws Criticism. Real Estate Named Grey Rhino

In a recent wave of real estate speculations, Shenzhen’s $3million new apartments welcome 5 times the bidders than capacity.

Han Zheng’s Stern Warning against Use of Real Estate as Economic Stimulus

Han Zheng, Standing Committee member and Vice Premier, held a symposium at the Ministry of Housing and Urban-Rural Development on December 3, focused on the importance of real estate market stability. It is the first time the real estate market has been named the grey rhino in the Chinese economy, symbolizing large potential systemic risks.

Han stated that the State Council has been implementing regulations and controls to stabilize land prices, real estate prices, real estate growth expectations, and adjust policies to different localities.

“Houses are for living in, not for speculations” must be strictly enforced. (read more)

“要牢牢坚持房子是用来住的、不是用来炒的定位,不把房地产作为短期刺激经济的手段,时刻绷紧房地产市场调控这根弦,从实际出发不断完善政策工具箱,推动房地产市场平稳健康发展。”

2. The inflated inelastic demand

All apartments labeled with a per-unit price of over $3million in a high-end community in Shenzhen was sold in 2 days.

China currently practices a dual-track real estate pricing mechanism in many major cities. The new apartments are under price control set by the government in most major cities. The secondary market is priced based on supply and demand.

The new apartments referred to above in Shenzhen are offered at 25% below the secondary market pricing, triggering an excessive speculative demand for new apartments.

Reselling a $3million new apartment in the secondary market will result in an immediate return of $760,000.

Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission (CBIRC), labels the real estate market as the biggest Grey Rhino - a predictable high-risk market.

Shenzhen leads the country in the property market this year. In November, Shenzhen's second-hand housing price index rose 1.65% month-on-month, up 18.69% year-on-year, far higher than other hot cities.

The household leverage ratio (household debt /income) has exceeded 60% nationally and is catching up with developed countries. In 2008, household leverage was less than 20%. It's tripled in a little over 10 years.

The ratio of housing price to average household income exceeds 35 times in Shenzhen, 20 times in Sanya, Beijing, Shanghai, and Xiamen, and 15 times in Guangzhou, Fuzhou, Hangzhou Nanjing, Dongguan, and Suzhou, while the international norm is between 3-6. (read more)

Rumors of the property tax levy in Shenzhen in 2021

A Shenzhen real estate Tax Pilot Plan was rumored that from January 1, 2021, property taxes will be piloted in Shenzhen and Shenzhen-Shantou Cooperation Zone (深汕合作区).

According to the plan's details, an apartment with less than 60 square meters per capita is exempt from property taxes. Each additional property will be progressively taxed at 1.5%, 2.5%, and 4.5% of the assessed market value.

Sources with the Shenzhen Housing and Construction Bureau denied the report and said the bureau's official information would prevail.

Nevertheless, in 2018, China has already included property tax legislation in the legislative plan of the current National People's Congress. It is expected that the deadline for property tax introduction will be in 2022.

Public & Private Investment

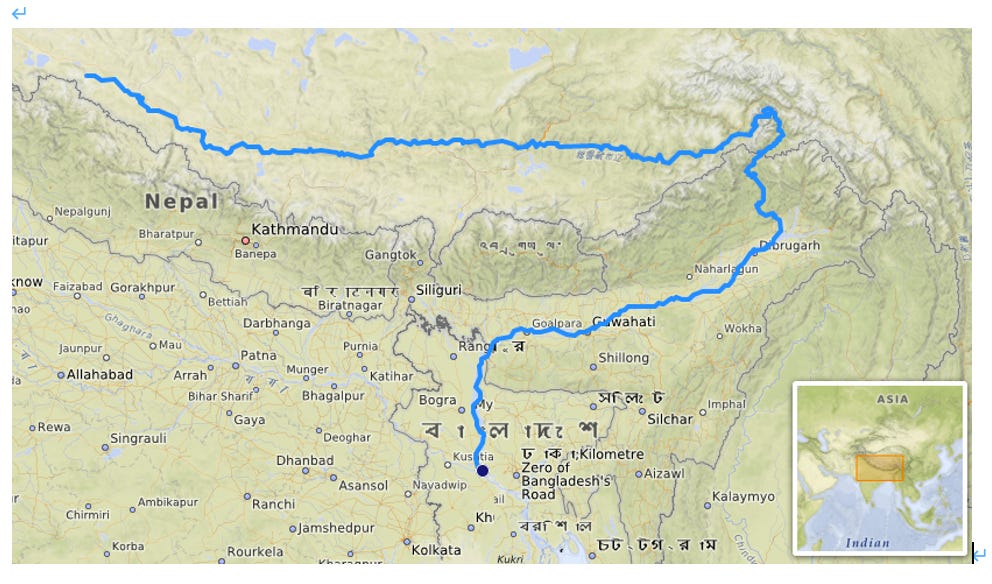

1. Hydroelectric Power Station at the Yarlung Tsangpo River (雅鲁藏布江)

Execution of hydroelectric development at lower reaches of the Yarlung Tsangpo River’ was named as a key infrastructure development project in China’s Long Vision 2035 and 14th Five Year Plan.

Project Significance

The clear language “execution” was used in the 14th Five-year Plan in reference to the Yarlung Ysangpo hydroelectric project. Such a clear and stern expression on the delivery of a project in China’s central party document is unprecedented. Yan Zhiyong (CEO from China Electric Power Construction Corporation) commented on 26th November during the 40-year anniversary conference of China Hydroelectric Engineering Organisation. (read more)

党中央关于制定‘十四五’规划和2035年远景目标的建议中明确提出‘实施雅鲁藏布江下游水电开发’。这在中央文件中是史无前例的,写得很清楚,是‘实施’。

The project is significant in 5 aspects according to Yan Zhiyong

The project is significant in providing alternative sources of energy to support China’s environmental goals. China plans to reach the peak of CO2 emission in 2030 and achieve carbon neutrality by 2060.

为我国“二氧化碳排放力争于2030年前达到峰值,努力争取2060年前实现碳中和”发挥绝对巨大的作用

It is a national security project. This includes both water resource security and homeland security.

It will improve social welfare, especially in the west Tibetan region. The project is forecast to generate an estimated 20 billion RMB income annually.

It is a cornerstone national energy project. This project will be the equivalent of three Three Gorges Dam in power generation capacity. Downstream of the Yarlung Tsangpo River can potentially generate 60 million kilowatts of hydroelectric power. The Three Gorges’ capacity is only at 20 million kilowatts of hydroelectric power.

It is a multinational cooperative project. With the development of the hydroelectric power station at the Yarlung Tsangpo River, power grid and road connection will be enhanced as a result. This can provide further opportunities for energy and infrastructure cooperation with South Asia.

Within the Chinese border, Yarlung Tsangpo River spans 2057 kilometers. The lower reaches account for 24% of the total length.

The path of Yarlung Tsangpo River

It flows along southern Tibet to break through the Himalayas in great gorges and into Arunachal Pradesh (India). It flows southwest through the Assam Valley as Brahmaputra and south through Bangladesh as Jamuna. In the vast Ganges Delta, it merges with the Padma, the popular name of the river Ganges in Bangladesh, and finally, after merging with Padma, it becomes the Meghna and from here, it flows as Meghna river before merging into the Bay of Bengal. (read more)

2. Ant Cash Now (蚂蚁借呗) and Ant Credit Pay (花呗) 20 billion RMB ABS Issuance Approved

Ant Group's ABS issuance has been approved despite its suspended IPO. According to the Shanghai Stock Exchange, Ant's two asset-backed securities (ABS) issuance, Ant Cash Now and Ant Credit Pay, were approved for a combined capital size of $3.04 billion (20 billion RMB). Three more ABS with a total size of $3.95 billion (26 billion RMB) are also in the pipeline.

蚂蚁获批的两只ABS分别是:中信证券花呗一至十期授信付款资产支持专项计划、国泰君安借呗第4-12期消费贷款资产支持专项计划,规模均为100亿元。

Interim Measures for Network of Microfinance Business Management (draft),《网络小额贷款业务管理暂行办法(征求意见稿)》) rules the maximum leverage for small loan companies can be up to 5 times of net asset, which means that the previous model of unlimited leverage is over. Ant’s two micro-financing companies will be subject to these new rules.

According to the annual data of China Asset Securitization Network (CNABS), over the past three years, Ant Credit Pay and Ant Cash Now-related products have accounted for more than 70% of the total consumer credit ABS market. In 2020 alone, the total amount of financing (including approved and accepted) related to Ant Cash Now and Ant Credit Pay has reached $14 billion (92 billion RMB).