Shoring Up Electricity Supply; Media Bans; Trip.com Monopoly Allegations; Blockbuster Controversy;Yang-Sullivan Meeting in Zurich; Joint Chip Project; Unicorns.

Intelligence and Insights on China's government actions, foreign policy, economy, and the capital markets.

Temporary marketization, acting against ‘defamation’, and shoring up supply chains

Chinese authorities have rolled out policy prescriptions to deal with the country’s electricity crunch, and are sending unambiguous signals that there is no light at the end of the tunnel for established private media players.

We’ve got a rundown of the latest face-to-face meeting between Washington and Beijing.

It may seem a paradox, but China is looking for external partners to shore up internal manufacturing capacities.

Read about these and other topics in the pages ahead that help capture the fluidity of developments in China and the essence of where the country is headed in the current era.

Please sign up for the China BIG Idea quarterly call

Always, we invite you to connect with us on social media and say thank you to our digital editors: Ebube Oguaju-Dike and Ifeanyi Eke.

Twitter: @chinabigidea1

Linkedin: www.linkedin.com/showcase/chinabigidea

Also, be sure to join our brand new discussion groups.

Facebook: China Big Idea

LinkedIn: https://www.linkedin.com/groups/9069127/

Government in Action

Electricity Adjusts to Market Pricing to Alleviate Power Outage

The National Development and Reform Commission (NDRC) announced yesterday the pricing policy for the nation’s electricity supply, which has fueled the long-speculated electricity price hike to alleviate the power shortage engulfing the country currently.

The NDRC’s announcement clarified that:

In principle, all fossil fuel-generated electricity will enter the market, subject to market pricing mechanism. The price should be set within the NDRC’s “base price + a capped range”.

The price fluctuation shall fall within the following range of the base pricing: market-based pricing should not float upwards or downwards more than 20%.

Electricity pricing for power-intensive sectors is not bound by the 20% fluctuation range stipulated above.

Small and medium-sized companies shall be given conditional subsidized electricity pricing.

Maintain electricity pricing stability for residential, agricultural and non-profit (including schools, charity organizations, and community service centers) sectors.

有序放开全部燃煤发电电量上网电价。燃煤发电电量原则上全部进入电力市场,通过市场交易在“基准价+上下浮动”范围内形成上网电价。

扩大市场交易电价上下浮动范围。将燃煤发电市场交易价格浮动范围由现行的上浮不超过10%、下浮原则上不超过15%,扩大为上下浮动原则上均不超过20%,高耗能企业市场交易电价不受上浮20%限制。

The NDRC further clarified just a few hours before publication that this is not intended to increase the residential electricity prices.

China’s electricity usage allocation

Residential electricity usage takes up about 15% of China’s total power usage.

China adopts a dual-track electricity pricing mechanism. Electricity cost per unit is higher for the industrial sector to subsidize residential usage.

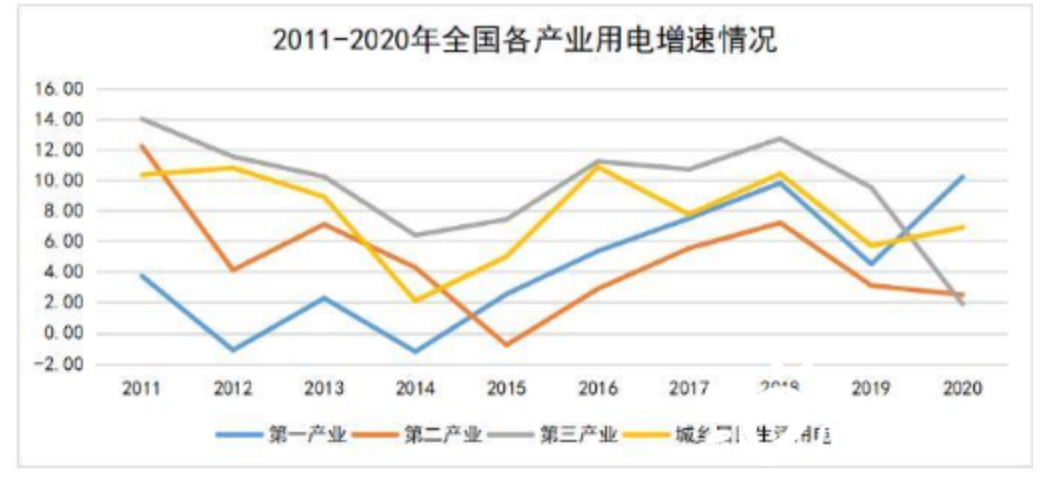

The biggest rise in electricity usage between 2019-2020 was in the agricultural and, to a lesser extent, residential sectors. The growth speed of the tertiary industry significantly dropped in 2019-2020.

(image course: NDRC)

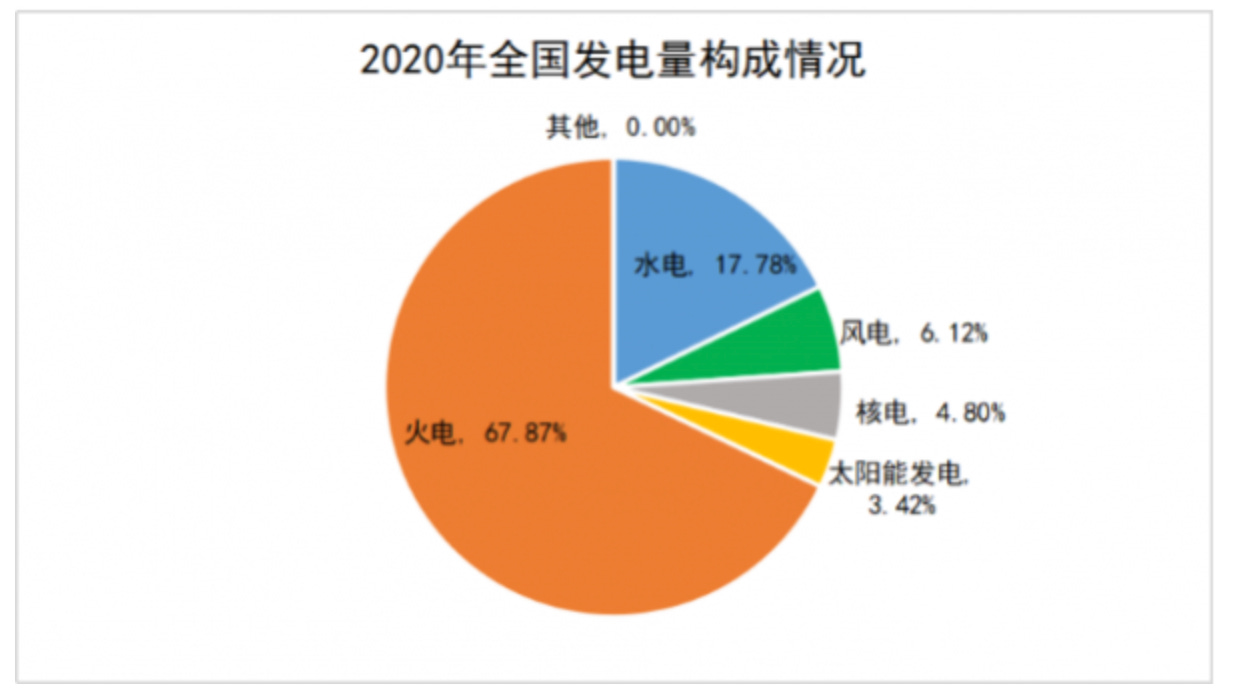

Fossil fuel still contribute 2/3 of China’s electricity supply. Renewable energy sources make up about 1/3 of China’s electricity market currently, according to the NDRC data.

(image course: NDRC)

China’s carbon neutral conundrum

Based on the domestic economic survey, with the introduction of over 2,200 power companies into the national carbon trading system, the purchase of carbon credits from the national carbon exchange — albeit at about 1/10 of the EU carbon pricing mechanism — imposes additional costs on power companies as a disincentive for coal-fired power production.

Keep reading with a 7-day free trial

Subscribe to China BIG Idea to keep reading this post and get 7 days of free access to the full post archives.