State Council in Action, Deep look in Q2 Economic Recovery, ChiNext Board Takeoff, Ant's $200B IPO, Central Bank Decision (July 20)

Intelligence and Insights on China's government action, macro policy, economy, and the capital market.

A deep-dive look into China’s government in action, ministerial reshuffle, China’s macro economy beyond 3.2% GDP growth for Q2, including weaknesses in consumption and employment. China’s capital market reform and ChiNext board take off. Ant Group (former Ant Financial)’s $200 Billion IPO and its implications.

Government in Action:

1. Premier Li Keqiang at State Council Executive Meeting(July 15)

“部署深入推进大众创业万众创新,重点支持高校毕业生等群体就业创业。”

A reemphasis of the 2014 Likonomic policy of “mass innovation, mass entrepreneurship”. Premier Li intends to use self-employment and entrepreneurship to alleviate the unemployment spike exacerbated by COVID-19, with 8.34 million college graduates entering the jobs market, and 20 million (perhaps even more) unemployed migrant workers in focus.

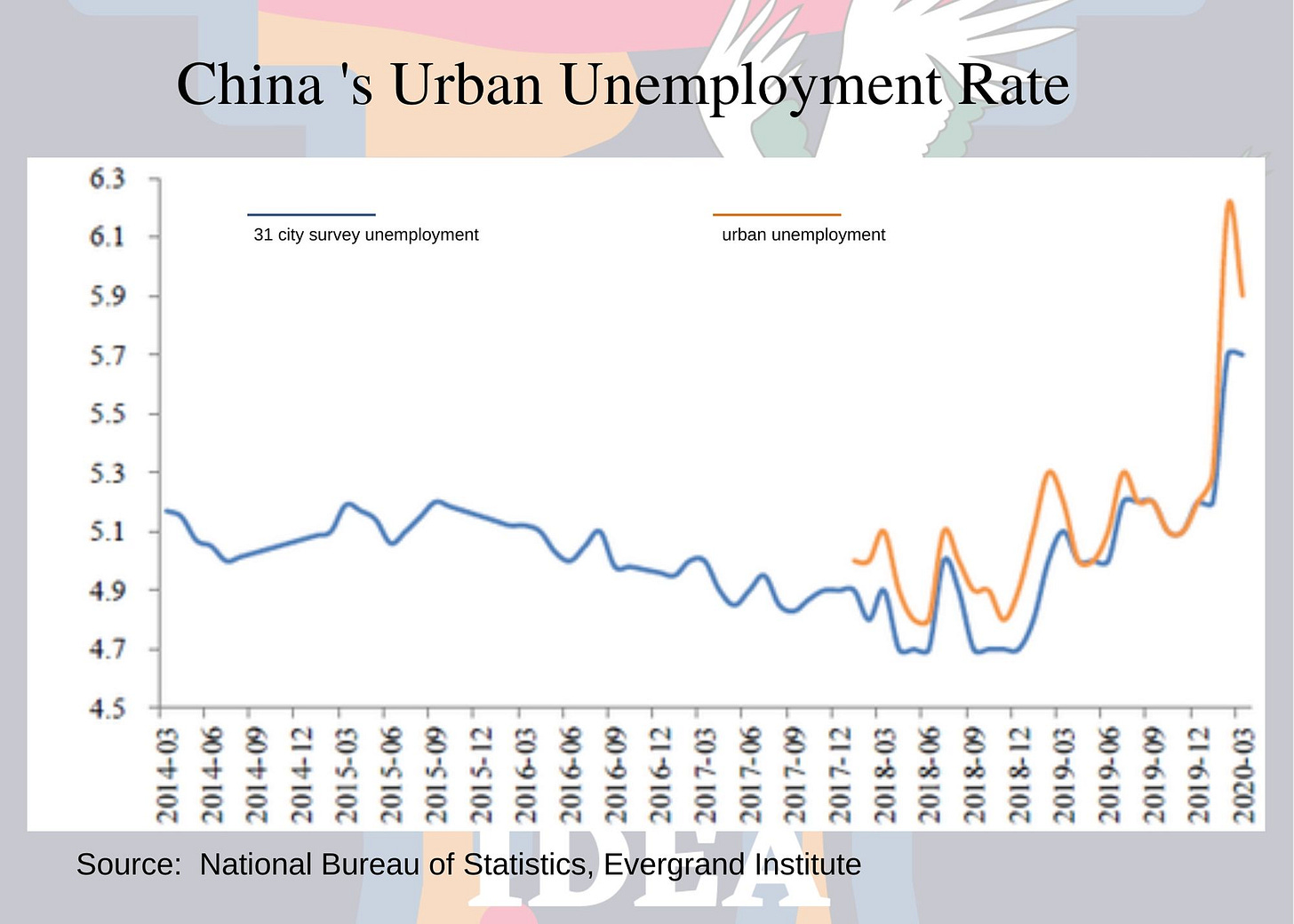

There is no unified unemployment statistics for the Chinese economy. China’s National Bureau of statistics published the urban unemployment ratio. The ratio spiked post COVID-19 in February, but stayed relatively unchanged through May, average around 6% urban unemployment.

The portion that the Premier particularly focused on was unemployment for the migrant population. At the end of 2019, there were close to 200 million migrant workers in China. Accordingly to statistics released by the National Bureau of Statistics, as of May, 90% of migrant population have returned to the cities, indicating a roughly 20 million more unemployed on a baseline estimate.

Ministry of Education has recently adjusted the categories of employment to include writers, freelancer bloggers, competitive online gamers, and online shop owners. This policy will improve statistics on college graduate employment rate, but does not enhance the livelihoods of many college graduates. (read more)

Conclusion:

Chinese economy needs to grow at 4.4% minimum in order to sustain stable employment. Employment has been on top of China’s national agenda in both the policy of “ six stabilities” before COVID-19, and the policy of “six guarantees” post Covid-19.

“会议强调,要优化债券资金投向,严禁用于置换存量债务,决不允许搞形象工程、面子工程.。”

By July 15, 1.9 Trillion RMB in social local government special purpose bonds have been placed in the hands of local government. Premier stressed that new debt shall not be used to swap old debt. It shall not be used to build “image projects” and “prestige projects.” “Some of the city dwellings are demolished before they qualify for demolition. Local governments care about aesthetics, but never consider where money comes from”, remarked Li.

Based on statistics released for Q2 by sector, real estate investment increased 1.9% in Q2, reflecting a 9.6% growth from Q1, 2020. Undeniably, local governments have resorted to land sales and real estate development projects post COVID19 to source tax revenue to finance government budget deficit. This warning by the Premier revealed there is danger that local governments might fall back to the old model of real estate-fueled economic growth.

Key Government Appointments

DengJie Tang, Deputy Chairman of the National Development and Reform Commission (NDRC),mechanical engineering major, former Shanghai deputy mayor, former Fujian Governor, both regions where Mr. Xi presided over.

China Macro Economy

Consumption remains weak, underneath China’s V-shaped economic recovery.

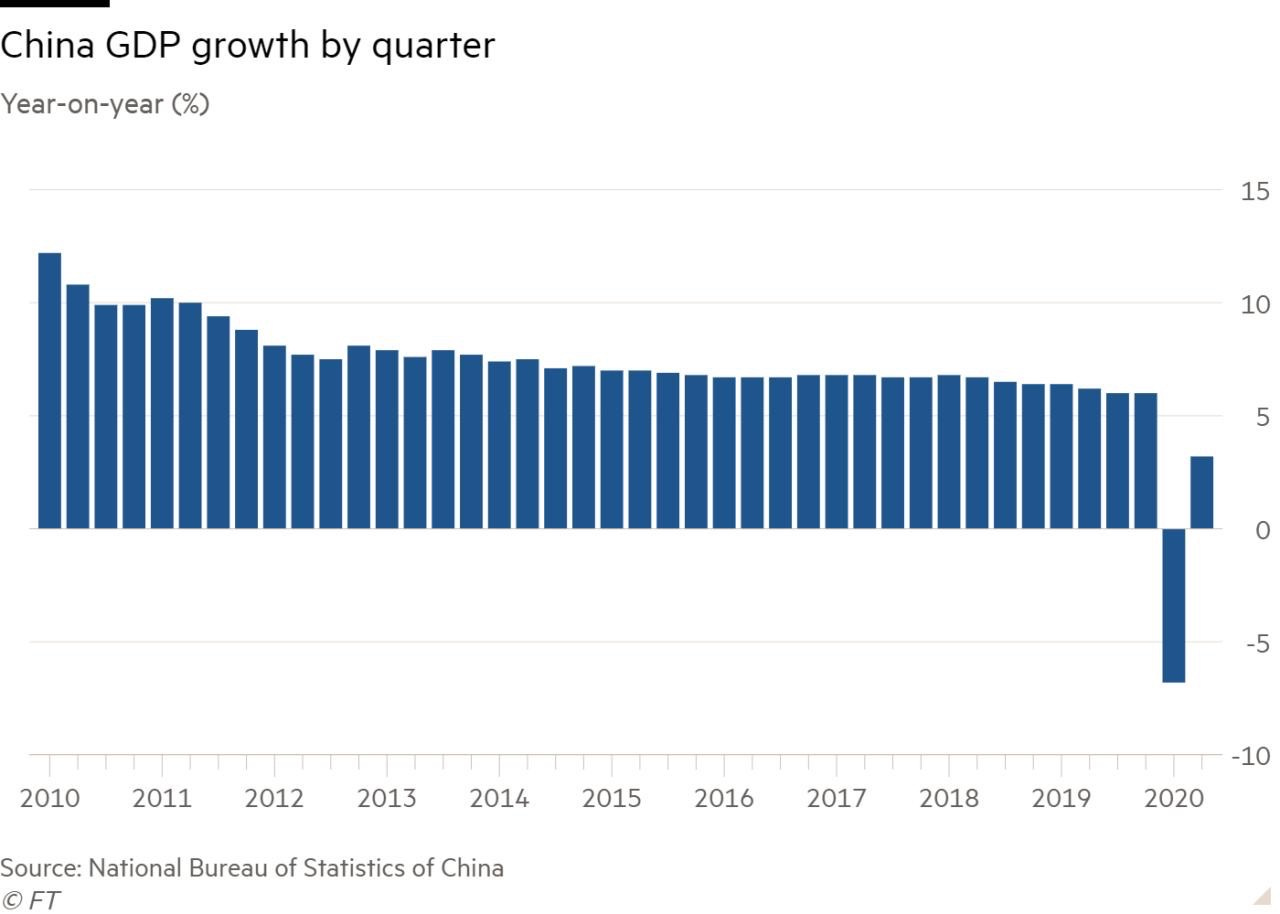

China registered a perfect V-shaped recovery through Q2. The economy saw a 6.8% contraction in Q1, and 3.2% growth in Q2.

We pierce through the statistics to look at the economic fundamentals.

Its recovery is led by conventional trade and fixed asset investments. Both imports and exports expanded YoY in Q2. Fixed asset investments, though 3.1% down in Q2, was a 13% recovery from Q1’s. Real estate investment expanded 1.9% YoY. Consumption, 55% of China’s GDP by composition, and a near 80% of GDP growth contributor as of 2019, continued to contact near 4% in Q2. This is not such good news. Unless consumption picks up, economic recovery will remain investment intensive, government policy-led, and vulnerable to demand weakness. (read more)

Once the Chinese economy recovered, it would indicate that the worst of the economic shock from COVID19 is over. It would be unlikely that the economy contracts again in this economic cycle.

Learning from this round of China’s economic recovery, the rest of the world, in tackling an aggregate demand shock, need to resort to a strong degree of government infrastructure and fiscal stimulus. Keynesianism is alive in this global environment. Governments who have the capacity for large scale infrastructure and fiscal stimuli will recover faster and stronger.

China has left one-year, and five-year rate unchanged today. (read more)

China has resorted to rate cuts, particularly in savings rates, and credit expansion through open market operations, to counter this wave of economic crisis. But comparing to the Fed, China’s central bank has established some clear redlines.

郭树清:”中国不会搞大水漫灌、赤字货币化和负利率。” Lu Jiazui Forum

China will not resort to monetization of fiscal deficits, a policy the US has become accustomed to through the 2008 financial crisis and this wave of economic crisis.

China will not resort to negative interest rate, whereas major developed economies around the world are in a zero or negative rate environment with nearly no prudent monetary policy room left for maneuver, should situation worsens.

Emergency monetary policy measures will continue to normalize in China, but remain on a marginally expansionary basis in the coming months.

Capital Markets

China launched the pilot program of registration-based initial public offering (IPO) system this April, marking a major capital market reform policy. During the four meetings held last week by the listing committee, 14 companies were accepted, steadily boosting the size of ChiNext. So far, a sum of 426 companies have been accepted by the ChiNext reform and pilot registration-based system, of which 296 companies have applied for IPO. This week, maintaining the speed, there will be another 12 companies targeting at the IPOs in ChiNext.

IPO

Ant Financial IPO (read more)

Alibaba’s Ant Group (formerly Ant Financial) seeks dual listings in both Shanghai and Hong Kong Stock Exchanges, aiming to accelerate its offerings to customers in China and abroad.

“Ant” size

During the 12-month period ended March 31, 2020, the number of global annual active users served by Ant Group and its local partners has reached 1.3 billion. It outsizes WeChat Pay in China with a 53% domestic market share.

“Ant” valuation

Bankers are now valuing the company at more than US$200 billion, giving the fintech compay a larger capitalisation than China Construction Bank, and slightly less than Bank of America. The valuation is almost at parity with PayPal.

The nature of “Ant”

Ant Group stresses it is a technology company, not a financial company. It even removed "Financial" from its name. I suspect the reasons are possibly two:

A financial company faces much more regulatory scrutiny than a technology company. Softbank still struggles with the fact that "Ant" was removed from Alibaba due to regulatory restrictions.

Technology companies have a much higher valuation potential than the world of finance. Goldman Sachs is today valued at $87 billion. It is natural that investors would prefer to be in tech, than finance.

The reality is debatable. Ant Group has introduced the new era of global finance, run on technology infrastructure.

I still believe finance is the end, and technology, the means.