Technology: the Manifestation of Human progress that transpires in every Culture. Government Proposals, Huawei, FDI, Monetary Policy 2021, a special Weekly Edition

Intelligence and Insights on China's government actions, foreign policy, economy and the capital markets.

Mathematician, philosopher, politician Marquis of Condorcet affirmed in his final work Esquisse d'un tableau historique des progrès de l'esprit humain that incremental advancement of techniques lead to the progress of mankind. Like an ever-ascending staircase, the pursuit of innovation is endless, so is the perfectibility of human spirits.

A Letter from the Editor

Topping every local congressional agenda this week, leading to the annual twin congressional sessions, is the innovation of innovation policies themselves.

The expressions of digitization, innovation, and the Fourth Industrial Revolution transpire in every Chinese city’s future vision, every corporate playbook, and every strategic communiqué. It’s all propaganda and all state-led. One might conveniently discard its significance.

Shanghai, Beijing, and Guangdong proclaimed their drive for fintech, digital economy, innovative banking, innovative capital markets, and innovation-based manufacturing at their annual congressional sessions.

The development challenges China faces are multifaceted. No single revolutionary technology can be the silver-bullet solution to all these challenges: the sovereign digital currency cannot magically establish RMB’s central position in the global currency system; the high-speed rail infrastructure alone cannot transport the Greater Bay Area into the world’s next Silicon Valley.

The technology of today was born of problems of yesterday. It breeds the technologies of tomorrow.

For now, we see a society casting a bold pursuit of scientific advancements at an unnerving speed.

When the revolution of technology actually happens inside scientific laboratories, we commend the human drive for innovation itself. This same spirit created and propelled the modern Renaissance. When every era is eventually buried in history’s remains, this spirit will last and carry humanity on.

Please feel free to share. If you are not a full subscriber yet, please subscribe and join us for a full year of in-depth research and insights on China.

Please feel free to use either of below holiday links. We can only grow with your support. Thank you.

Government in Action

1. Shanghai Plans Critical City Transformation at Annual Congressional Session.

“5 new satellite cities” and “ 5 poles to the economy” are written into the City’s Government work report, as the annual congressional session takes place.

5 new satellite cities

Shanghai has designated Jiading, Qingpu, Songjiang, Fengxian, and Nanhui (嘉定、青浦、松江、奉贤、南汇) as the “5 Satellite Cities”. The 5 satellite cities will focus on building coordinated and independent industrial supply chains to strengthen, particularly in strategic and frontier industries.

The core strengths of the 5 satellite cities have been in traditional manufacturing, as a component of the greater Yangtze River Delta region. The new focus will center on high-end manufacturing and digital transformation.

5 poles to the economy

Shanghai is now defined as an innovative economy, service economy, open economy, headquarter economy, and platform economy.

上海经济是典型的创新型经济、服务型经济、开放型经济、总部型经济、流量型经济.

Deliver digital transformation

The digital economy accounted for over 50% of Shanghai’s GDP in 2020. The number is slightly lower than Beijing’s, but is a significant infrastructure to the city’s future development.

2019年数字经济对经济增长的贡献率为67.7%,是驱动我国经济增长的核心关键力量。而数字经济在上海占主导地位,GDP占比已超过50%,大量高新企业和新基建相关企业为上海数字经济发展提供了支持和保障。

Develop technology banking infrastructure

The integration of finance and technology will inevitably be Shanghai’s core strength. The city will lead in efforts to develop technology banking services specifically tailored for the financing needs of high-tech companies.

Technology banking refers to banks that specifically deliver financial services to high-tech companies. The expertise required will involve IP-based lending services and a different set of parameters in understanding collaterals and creditworthiness.

Technology banking services will make lending to tech firms for its development expedient.

所谓科技银行,通常是指专为高科技企业提供融资服务的银行机构,其优势在于,针对科技贷款,在资信条件和客户规模评估方面,条件并不苛刻,因而高技术企业能够便捷地获得科技贷款。

We will bring you key congressional outcomes from other major cities in the subsequent issues.

2. Congressional Sessions: Guangdong Province

This is the second review of the regional annual congressional sessions. The first review was on Shanghai’s annual congressional sessions. Please refer to yesterday’s briefing.

Key priorities for 2021:The Guangdong-HK-Macau Greater Bay Area (GBA) and Shenzhen pilot city of Socialism with Chinese Characteristics

Develop the “Rail Greater Bay Area”. (轨道上的大湾区)

Guangzhou, Zhuhai, Foshan, Dongguan, Zhongshan, Jiangmen, and Zhaoqing 7 cities (广州、珠海、佛山、 东莞、 中山、江门、肇庆) will be connected via inter-city high-speed rail links.

The high-speed rail will cover 636 kilometers, built over 13 projects, with over $5.8 billion.

13个项目总里程636公里,总投资3783亿元。

The transportation targets for GBA:

Among major cities: within 1 hour

Among major cities and satellite and inner regions: within 2 hours

GBA with neighboring provincial capitals: within 3 hours.

The action plan for Guangzhou:

Guangzhou will excel on

building innovative commodities exchanges ( possibly the carbon exchange), and

incubating a GBA international commercial bank to support Guangzhou as the hub of China’s trade status.

《中共广东省委全面深化改革委员会关于印发广州市推动“四个出新出彩”行动方案的通知》明确,建设现代服务业强市,加快广州创新型期货交易所和粤港澳大湾区国际商业银行落地

Shenzhen and Guangzhou's strategic partnerships will bring world-leading advanced industrial clusters and world transportation hubs.

This will start to form the core of the Chinese “Silicon Valley.”

The plan also includes the “Canton Exports to the World” strategy. ( 粤贸全球)

Macro

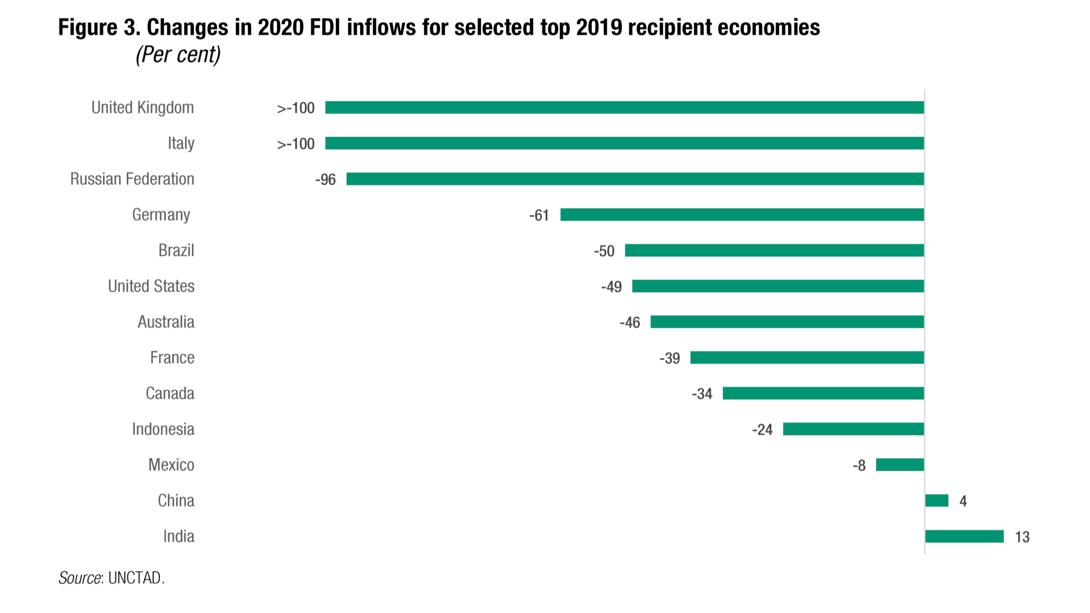

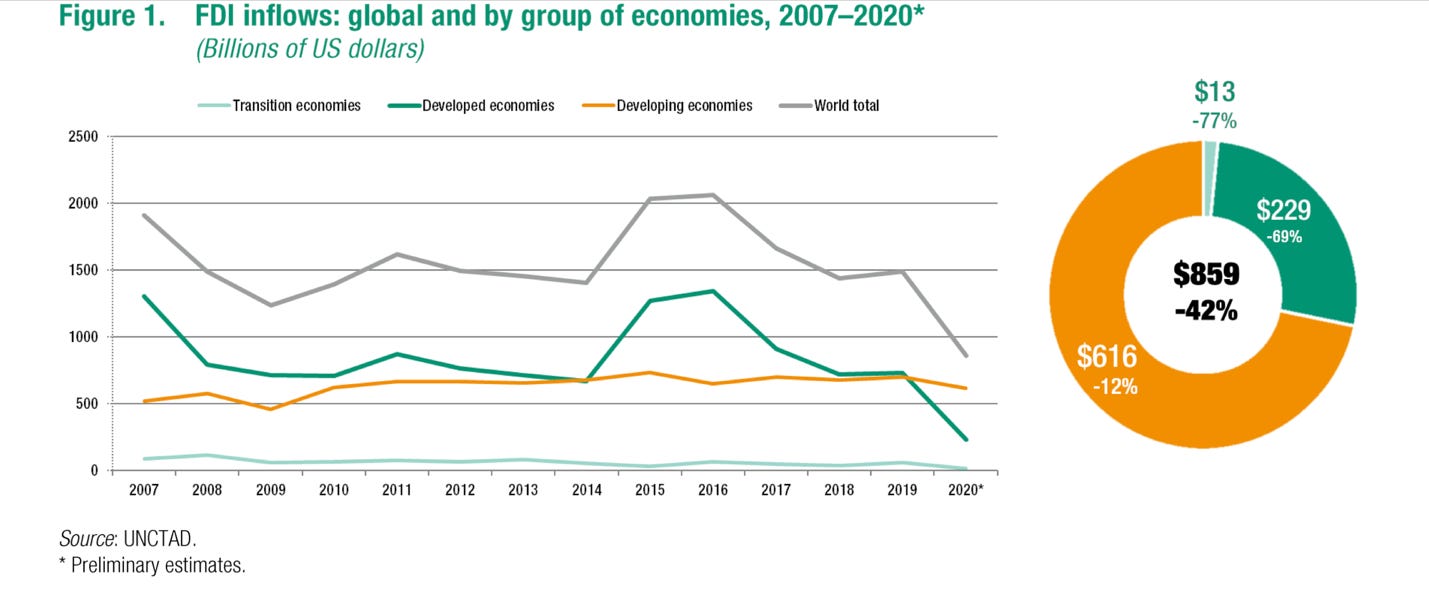

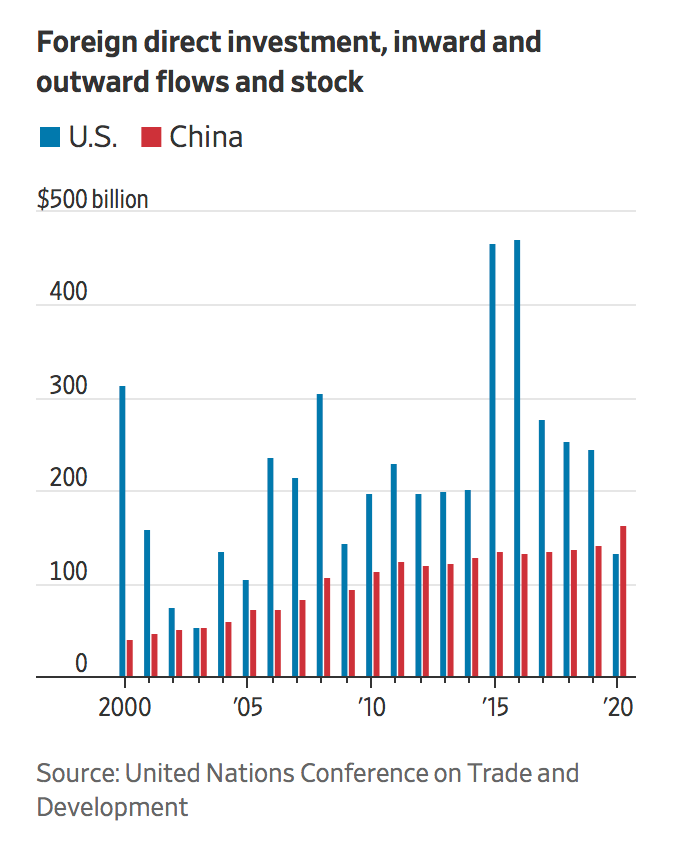

China Surpasses the US as Largest Recipient of FDI in 2020

China topped the global ranking in one more economic benchmark in 2020. It attracted $163 billion in inflows last year, compared to $134 billion by the US, according to the UNCTAD report. This represented a small increase of 4% in its inflows.

India also saw a positive increase in FDI inflows under the pandemic.

Globally, FDI plunged 42% to $859 billion in 2020.

Investment in the US fell 49%. Still, the total stock of foreign direct investments in the US remains much larger than that in China. (read more)

Allocation of the Disbursement of Foreign Investment

Data from the Ministry of Commerce shows China’s actual disbursement of foreign investment reached nearly $154.72 billion (RMB 999.98 billion) in 2020, up 6.2% YoY.

The service sector used foreign investment of over $119 billion (RMB 776 billion) in 2020, accounting for over 77% of its actual disbursement of foreign investment and growing by 13.9% YoY.

Foreign investment attracted by the high-tech industries grew by 11.4% YoY.

China continues to rely on FDIs under the New Development Theory.

Foreign-invested companies will play a critical role in China’s pursuit of the new development pattern. Although these enterprises account for 2% of the total number of enterprises in China, they provide one-tenth of the jobs in urban areas and one-sixth in tax revenue.

3. China’s M2 Money Supply & Monetary Policy 2021

Governor Yi Gang of the Peoples Bank of China (PBOC) seeks continuation of the PBOC’s current policy position. He stated that “China will try and maintain a normal monetary policy for as long as possible and keep the yield curve upwards sloping.”

China’s debt to output ratio currently stands at 280% at the end of 2020, up 20% in 2019. The PBOC believes this will stabilize in 2021.

PBOC adviser Ma Jun argued that China should permanently abandon GDP targets from this year and instead prioritize stabilizing employment and controlling inflation as the major goals of macroeconomic policy”. The argument was based on the fact that setting an official GDP target may incentivize the local government to borrow money to boost their economy, add to the financial risks, or inflate their statistics. However, this is practically not possible for 2021 as cities have already started to publicize 2021 GDP benchmarks.

Due to the macro leverage ratio climbing rapidly, asset inflation began forming in both the stock and property markets. Yet, it is important policy shifts shouldn’t happen too fast to avert hazards such as project suspensions and rise in bad loans continue. (Recent examples of this would be R&F properties).

The 2021 monetary policy guideline

The guideline is to match the growth speed of M2 and public finance to the growth speed of GDP.

Therefore, the growth of the M2 money supply should be kept at 9% in 2021 to manage inflation effectively.

The correlation between M2 and Asset inflation

It is worth noting that the increase in M2 provides a lot of liquidity to the market, which led to a rise in both overseas and domestic technology stocks and boosting returns in the secondary market and sentiment in the primary market. Tech likely continues to generate excess returns as well as policy friendly sectors and the online economy.

Technology

1. Biden Administration’s Policies on Huawei Unclear

The Biden administration has yet issued clear signals on its policies towards the Chinese telecom giant.

At the White House press briefing today, the White House expressed it will continue to defend American technologies not to be used for the Chinese military build-up.

US Semi Industry Group urges correction to Huawei August Sanctions.

SEMI, the US semiconductor industry group, urged the Commerce Secretary-designate to quickly correct an August rule that expanded U.S. authority over foreign company sales to China’s Huawei, which unintentionally affected some foreign-made semiconductor production and test equipment.

It also asked the Biden administration to promptly reduce the backlog of license applications to supply Chinese telecom companies.

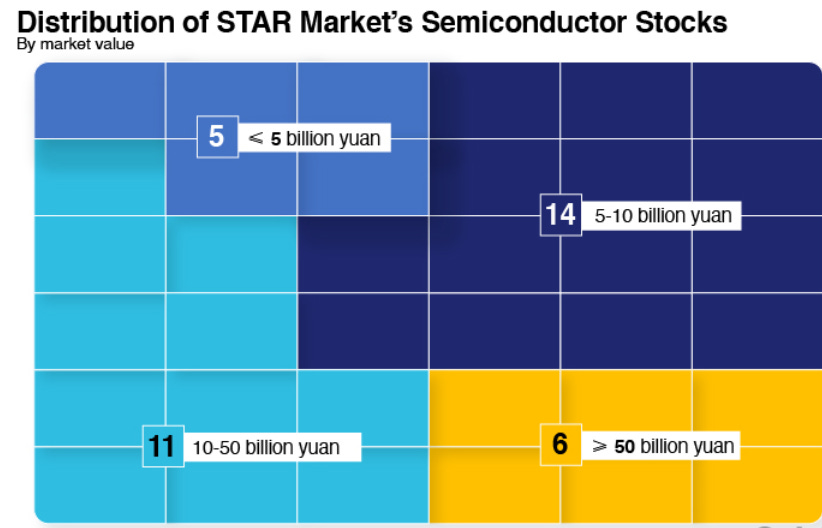

2. China’s Semiconductor Development

The semiconductor industry in China saw $22 billion (140 billion Rmb) invested in 2020, more than four times that of 2019. The number of major investment deals has also soured to 413, nearly double the 211 deals seen in 2019.

The STAR market, which has acted as a catalyst for innovation, adopts a NASDAQ-style listing requirement than the more traditional Chinese intensive review process. By enabling IPOs without the profitability requirements, it allows chip startups the capital required to advance their development faster in cutting edge fields.

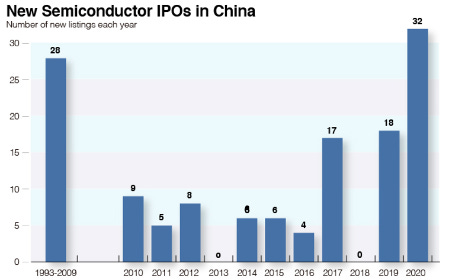

There were no semiconductor IPOs in China in 2018. After the STAR market launch in July 2019, this number jumped to 18 and 32 in 2020. The Semiconductor International Manufacturing Corp (SMIC) raised over 46 billion Rmb and now trades at over double the IPO price, reflecting a pattern of strong gains seen across the semiconductor industry.

3. Huawei Announced First Overseas Factory in France

Huawei announced on December 17, it would invest €200 million in building a mobile phone network equipment factory in the east of France. Its products will be directed towards the European market despite French efforts to phase out Huawei‘s 5G gear. While the French government has yet to articulate a clear position on the company, authorities announced in July 2020 they won't allow firms to renew licensing of Huawei’s 5G products once they expire. (source)

Europe is increasingly becoming a 5G battleground. France’s largest mobile operator, Orange, opted to partner with Nokia and Ericsson for 5G development. Other French providers, including Bouygues Telecom and SFR, already rely on Huawei, though they have not finalized 5G partnerships. (source)

In comparison to France, other European governments and businesses have developed a more lenient Huawei strategy. For example, Huawei won 5G contracts with providers in Hungary and Spain. Germany, the Netherlands, and Portugal, among others, allow Huawei to bid for their 5G development, noting that all participating firms would be subject to EU and national regulations. (source)

Debate remains on how to reconcile the benefits and shortcomings of doing business with Huawei and better coordinate cybersecurity approaches. The EU and the UK appear to have adopted the notion that they can mitigate risk by promoting market diversity to avoid dependence on any one vendor. (source)

4. Huawei Turns to Smart Vehicles

Last November, Huawei merged its smart vehicle and consumer businesses as a first step towards the creation of an EV segment. The Chinese smartphone producer has been harmed by US sanctions and has not revived its smartphone business ever since. To prevent the company from dying out stymied by the scarcity of semiconductors, the management of Huawei has eyed the opportunity to enter the EV business, which is currently booming in China.

Huawei’s participation in the rise of the smart vehicles industry can bring innovation and accelerate the development of new fully autonomous driving technologies. Huawei still has the means to enter this industry and gain a dominant position—although the competition will be fierce as other tech giants are eager to participate in the development of this growing industry.

Indeed, Huawei’s competitors are in a better position as companies like Alibaba and Tencent can leverage their strengths in deep learning and AI—which Huawei currently lacks.

“The smart vehicle business is Huawei’s new business […]. We have sufficient strategic patience to invest in the sector, and there is no profitability requirement in the short term.”

- Huawei Spokesman

Huawei believes that the world of mobility is undergoing significant changes, and the Chinese smartphone manufacturer thus wishes to “bring the digital world to every car.” Indeed, the company’s technology directly comes from its ICT business, representing its competitive advantage in the smart vehicle industry. For instance, in 2019, Huawei announced that it would use its 5G technology to develop state-of-the-art radars and laser radars for smart vehicles.

Consequences of Huawei’s Entry

Thanks to its balance sheet, Huawei will sustain the substantial expenses stemming from R&D and government-issued testing licenses. The smartphone manufacturer will therefore be able to achieve cost-efficient ways to reach large-scale adoption of fully self-driving vehicles. Furthermore, Huawei will spearhead the process of cost reduction in equipment prices.

5. Apple Shifts More Supply Chains out of China

Apple is speeding up removing production out of China and pursuing diversification in Southeast Asia and South Asia. iPad production will allegedly begin in Vietnam by mid-2021, and iPhone production in India will be stepped up, including the latest iPhone 12 series as soon as March 2021 (source).

Apple is also increasing production capacity for its smart speakers, earphones, and computers in Southeast Asia to diversify the supply chain. Smart speakers had been produced in Vietnam since their introduction last year. Furthermore, some of Apple’s computer production will be relocated to Malaysia and Vietnam, although its bulk remains in China (source).

Suppliers have rushed to meet Apple’s desire for more diverse production bases.

Already in 2018, China’s Goertek – AirPods assembler – asked its suppliers to assess the feasibility of moving production to Vietnam (source). In 2019 Apple asked several suppliers to calculate the costs of moving 15% to 30% of their production outside of China (source).

Last year, key supplier Foxconn invested $270 million to set up a subsidiary in Vietnam to expand its production capacity there (source).

Luxshare Precision Industry – new iPhone assembler and supplier – is ramping up production in Vietnam (source).

Apple’s restructuring of its supply chain is only one example of global tech giants reducing their production dependence on China. Although China maintains the world’s most sophisticated supply chain, tensions between Washington and Beijing, the rise of labor costs, and the coronavirus-induced disruption of supply chains have exposed the risks of depending too heavily on one location for production.

Moreover, the Trump administration has launched a campaign to restructure supply chains, urging suppliers to flee China (source). The new Biden administration does not seem to be willing to immediately reverse the former administration's policy (source), meaning that technological decoupling is likely to continue in 2021.

Economy

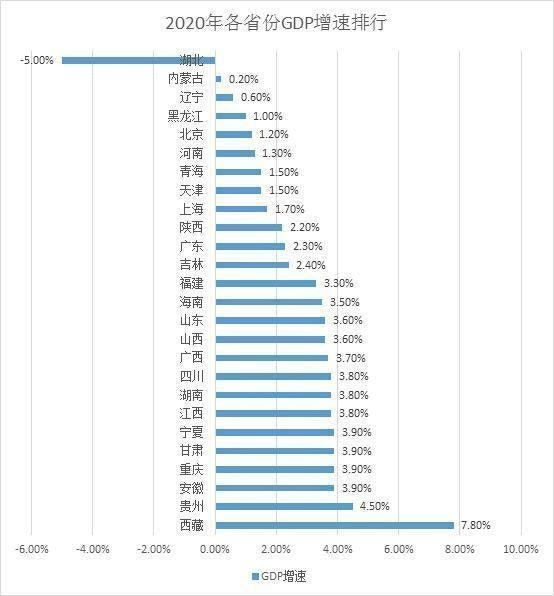

30 of 31 Mainland Provinces Registered Positive Economic Growth in 2020

All mainland provinces, except Hubei Province (-5.00%)-the epicenter of the coronavirus outbreak, achieved positive economic growth in 2020. (read more in Chinese)

Five provinces that have not released full-year 2020 data - Hebei Province, Jiangsu Province, Henan Province, and Xinjiang Autonomous Region- achieved positive economic growth already by Q3 2020.

Hubei’s GDP reached about $618 billion (RMB 4 trillion) last year and recovered to more than 95% of that in 2019.

Geographic Breakdown

More than half of the provinces grew faster than the national rate at 2.3%.

· 6 western provinces grew the strongest in 2020 – Tibet (7.80%), Guizhou (4.50%), Gansu (3.90%), Ningxia (3.90%), Chongqing (3.90%), Sichuan (3.80%);

· 4 South Central provinces – Anhui (3.90%), Hunan (3.80%), Guangxi (3.70%), Hainan (3.50%);

· 2 eastern provinces – Jiangxi (3.80%), Shandong (3.60%);

· 1 northern province – Shanxi (3.60%); and

· 1 southeastern province – Fujian (3.30%). (read more in Chinese)

Chart: eastmoney.com

Western China’s stellar catch-up

Tibet Autonomous Region grew at a striking 7.8%.

Guizhou Province, the runner up, grew by 4.5%, ranking among the fastest-growing provinces for 10 consecutive years.

The Big Three Regional Economies.

Guangdong Province became the first province to surpass the $1.7 trillion (RMB 11 trillion) benchmark and topped China’s regional GDP performance for the 32nd consecutive year.

Jiangsu Province came in second and ranked first in per capita GDP.

Shandong Province, the third-largest in economy scale, grew by 3.6% YoY, faster than Guangdong and Jiangsu.

Noticeably, all these big economic provinces are coastal regions.

Economic targets set for 2021

East China provinces, including Guangdong, Shanghai, Beijing, and Tianjin, set their growth targets at 6.5%.

Central provinces, having seen rapid growths in recent years, have set higher growth targets of more than 7%, while Shanxi set an 8% target.

Hubei sets its economic growth rate at over 10% in 2021, given the low base of 2020. “As we expect favorable policies from the central government, Hubei will see great development in 2021," said Ye Qing, Deputy Director of Hubei Provincial Bureau of Statistics. (read more in Chinese)

Hainan anticipates a “no less than 10%” growth rate in 2021, as it implements China’s largest free trade port development. (read more in Chinese)

7 New Cities Achieve RMB 1 Trillion GDP Milestone

As of January 26, 23 cities have entered the RMB 1 trillion($154 billion) GDP club.

7 new cities were freshly minted to the Trillion RMB Club in 2020. Fuzhou (福州), Quanzhou (泉州), Nantong (南通), Hefei (合肥), Xi’an(西安), Jinan (济南), and Fuzhou (福州). 3 of the 7 cities are in Fujian province.

The remaining 16 cities are Shanghai, Beijing, Guangzhou(广州), Shenzhen (深圳), Tianjin (天津), Suzhou (苏州), Chongqing (重庆), Chengdu (成都), Wuhan (武汉), Hangzhou (杭州), Nanjing (南京), Qingdao (青岛), Wuxi (无锡), Changsha (长沙), Ningbo (宁波), Zhengzhou (郑州), and Foshan (佛山).

International Relations

Biden Administration Commerce Secretary Designate: Gina Raimondo

Biden’s pick for Commerce Secretary Gina Raimondo appeared before the Senate confirmation hearing on Tuesday. Governor Raimondo, with a background in the financial industry, has been the governor of Rhode Island since 2014. If confirmed, she will be responsible for promoting economic growth domestically and overseas and inherit a department that has imposed numerous restrictions against China.

“Aggressive” steps to combat “unfair” trade practices

Governor Raimondo, at her confirmation hearing, stated that China has “clearly behaved in ways that are anti-competitive” and has hurt American workers and businesses. She specifically mentioned the dumping of cheap steel and aluminum to compete. She asserted that “whether it is the entities list, or tariffs, or countervailing duties, I intend to use all these tools to the fullest extent possible to level the playing field for the American worker” (read more).

Shunned on Huawei and China telecom carriers

Senator Ted Cruz, who is well-known for his anti-China stance, asked Raimondo to assure that she would not remove Huawei from the Entity List (the list of blacklisted companies). She did not offer a direct answer but instead stated that she would consult with relevant stakeholders to “make an assessment as to what’s best for American national and economic security (read more).

This remark led to an outcry from Senator Ben Sasse, who said that “tough talk on China is empty if you let Huawei out of the box.” However, Governer Raimondo repeatedly emphasized that she is committed to safeguarding threats posed by Chinese telecommunications equipment, such as preventing the establishment of a back door into the US network. (read more)

China’s response to Raimondo’s hearing

At a Foreign Ministry press conference on Wednesday, Zhao Lijian stated in response to a question about Raimondo’s remarks at the Senate hearing, that the US administration has “blatantly engaged in unilateral, protectionist, and bullying practices” and that “China will continue taking necessary measures to safeguard our companies’ lawful rights and interests” (read more).

2. China and New Zealand Expand the FTA

China and New Zealand signed an expansion of the China-New Zealand Free Trade Agreement at a virtual ceremony (26th January). The initial deal was signed in 2008 and was last upgraded in November 2019.

Key points of the upgraded deal (read more):

It reduced compliance costs for New Zealand exports. Additional benefits for exporters of perishable goods such as seafood and forestry products.

Expand market access to China for New Zealand-based services exporters. Industries to benefit include advertising and education.

Commitments to promote environmental protection and environmental standards cannot be lowered for protectionist trade purposes.

Tariff-free access for 99% of New Zealand’s wood and paper trade to China (Worth $2.15 billion) and phased tariff elimination on dairy, wood products, and paper products

Chinese investors can participate in a greater range of industries in New Zealand, such as marketing, human resources, and tourism.

New Zealand will not investigate Chinese government-backed investors with investments less than $71.82 million or non-government investors with investments no more than $143.64 million.

New Zealand Trade Minister Damien O’Connor stated that “China is one of New Zealand’s most important relationships” and that the updated deal will deepen the relationship between the two countries (read more).

State media outlet Global Times said that the FTA serves as a model for New Zealand’s neighbor Australia (read more).