The Century’s Metamorphosis. Time and tides are with us: Monetary Stability, Infrastructure Stimulus, Hong Kong Listings, Development Cooperation, a Special Weekend Edition

Intelligence and Insights on China's government actions, foreign policy, economy and the capital market

“The world is in a once-in-a-century metamorphosis, and time and tides are with us.” China’s President Xi Jinping addressed his Party cadres, governors and ministers, in a major speech at the Central Party School this week. “We must lucidly realize, now and in the coming period, although the development of our nation is still in a phase of vital strategic opportunities, opportunities and challenges are evolving anew, with opportunities overweighting challenges.”

Referring to the coming Biden administration, Mr. Xi’s message speaks not of relief but confidence: on January 20, China will be in a stronger position than 2016, and this week’s headlines allow us to appreciate the why better.

Leading the world’s recovery, China has shifted its policy priorities from recovery to a more cautiously optimistic pursuit of a sustainable framework to its growth momentum. Thus the tenets of China’s 2021 economic policies emphasize risk management and financial stability. In continuity with 2020, public infrastructure is at the center stage to fuel growth and development. Domestic consumption commands steadfast government support. In sharp contrast to previous years, antitrust gains coordinated support to enable more digital market competition and better consumer protection.

The last days of the current US administration wreaked havoc on Chinese public companies. Apart from the looming threat of delistings, chip and tech companies are blacklisted on national security grounds. The corporates sought out mitigating measures. As a result, this week saw Baidu, Trip.com, and Bilibili join the club of Chinese companies onboarding the Hong Kong Stock Exchange.

Lastly, with the Democratic Republic of Congo and Botswana joining the Belt and Road Initiative, China further consolidates its presence in Africa. Its International Development Cooperation White Paper proclaimed the advent of a new era, promising a non-interventionist, infrastructure-centered, and commercially-focused development alternative, consistent with China’s own path.

Macro

China’s December CPI Up 0.2%. Food Price Rose.

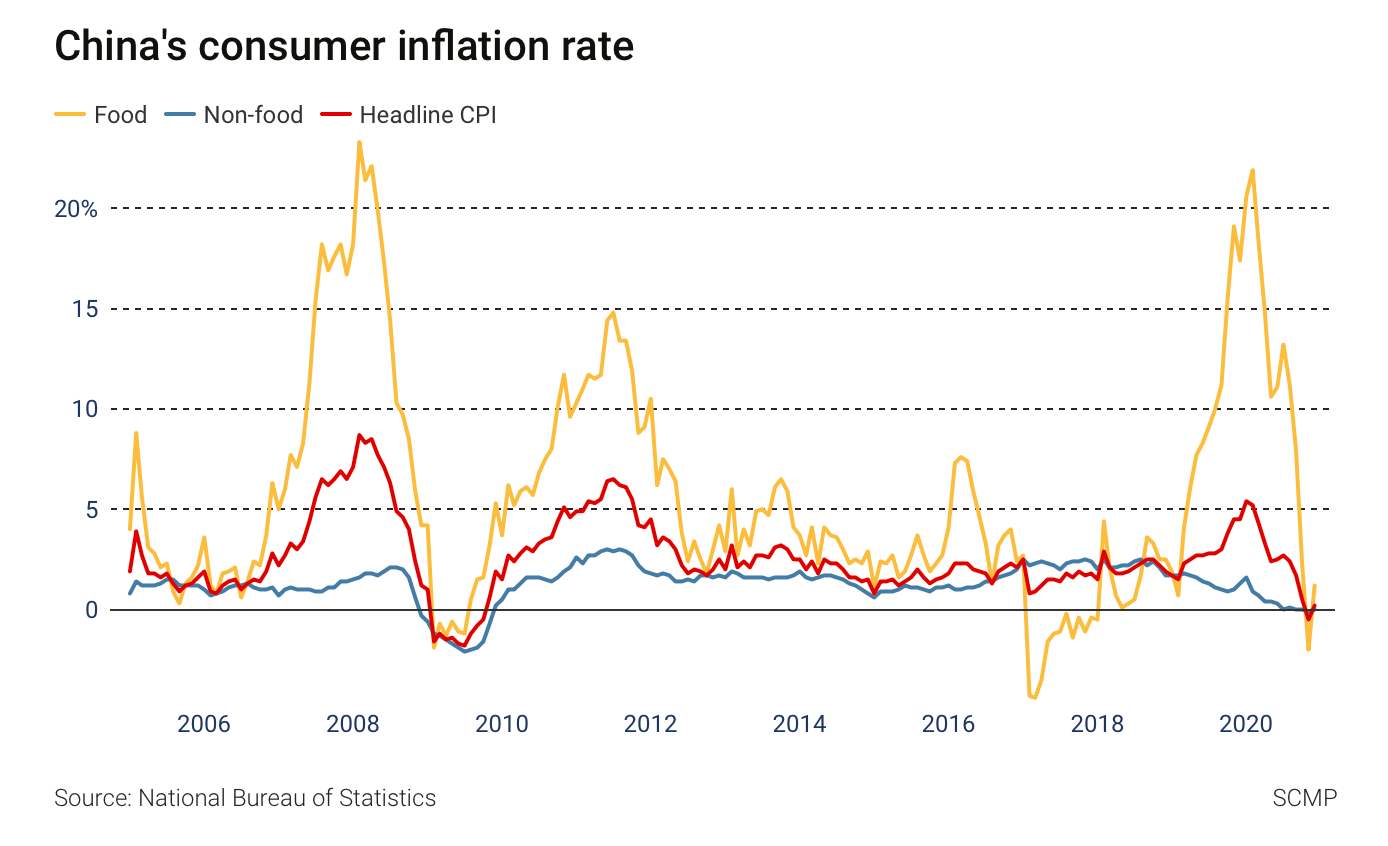

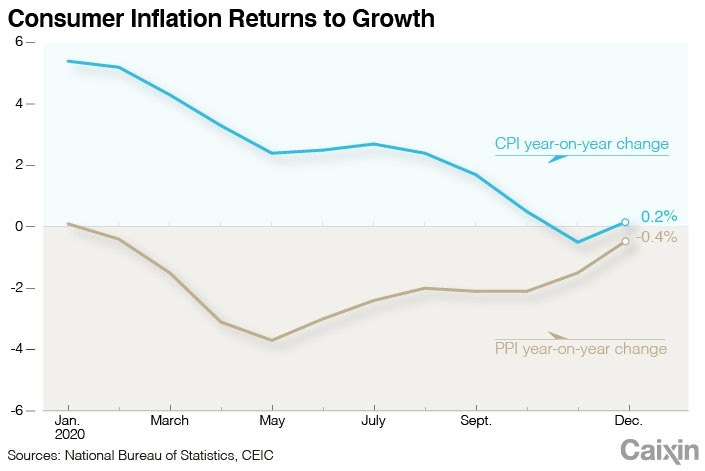

China’s consumer price index (CPI) rose by 0.2% YoY in December, up from -0.5% in November. The good news is that China narrowly escaped the deflationary territory. The not-so-good news is that CPI is once again supported by food inflation. The food price index rose 2.8% in December, putting pressure on both urban and rural consumers.

Food prices, the main driver of the CPI, went up due to the extreme cold weather and the rising transportation costs.

The price of pork went up 6.5%, compared to a 6.5% decline in November. The price rise can be attributed to the rising consumer demand ahead of the holiday season. (read more in Chinese)

CPI for 2020 Rose 2.5%

In 2020, CPI rose 2.5% and stayed in the 2% range for the third consecutive year. However, that is below the government's 3.5% inflation target for 2020.

In May, Premier Li Keqiang confirmed that China would not set an economic growth target in 2020 as China has witnessed an economic contraction of 6.8% in 2020Q1. (read more)

CPI in 2020 exhibited a decreasing trend, with a peak of 5.4% in January and falling all the way down to -0.5% in November before rebounding to positive territory in December.

Easy Monetary Policy Has Induced both Consumption Downgrade and Upgrade

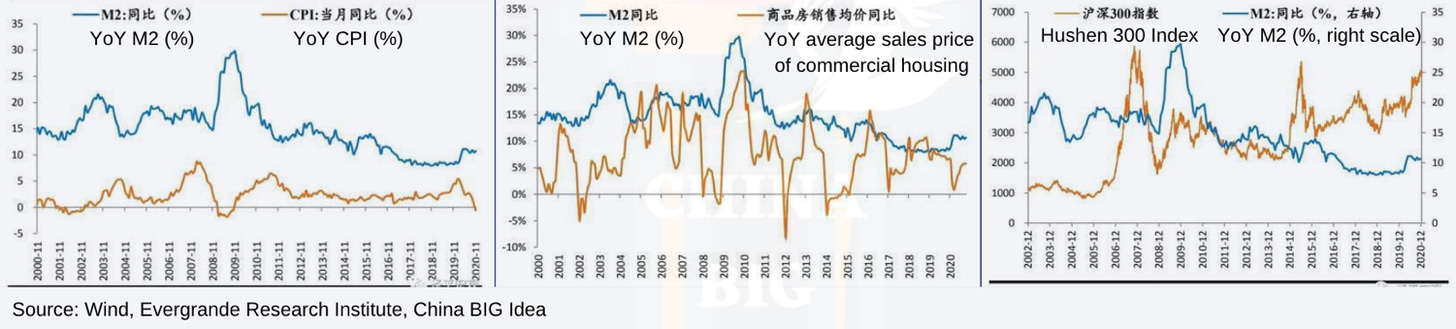

Easy monetary policy and low-interest rates, though not causing severe inflation in the real economy, have led to the surge in the asset prices in the stock market and the real estate market. Furthermore, this has led to wider inequalities in income and wealth distributions. (read more in Chinese)

CPI Expected to Remain At a Stable, Moderate Level in 2021

The network effect may cause CPI to show negative growth in Q1 2021. In Q2, demand recoveries will likely turn CPI positive again. Inflation is expected to remain at a reasonably steady and moderate level throughout 2021. (read more in Chinese)

PPI Continued to Show Industrial Sector Rebounds

China’s producer price index (PPI) improved to -0.4% YoY in December, compared with -1.5% in November, and continued to show some impressive rebounds in the industrial sector.

Steady domestic demand recoveries and rising global commodity prices have driven the prices of the industrial products up.

PPI will continue to improve in anticipation of increases in global production, trade, and investment growth. PPI is expected to enter a positive growth territory in March or April. (read more in Chinese)

China's Monetary Policy to Prioritize Stability in 2021

1. China will prioritize stability in its monetary policy in 2021.

“2021年货币政策要‘稳’字当头,保持好正常货币政策空间的可持续性。”

Yi Gang, governor of the People's Bank of China

China will keep its macroeconomic policies consistent, stable, and sustainable in 2021, with a prudent monetary policy that is flexible, precise, reasonable, and moderate.

China will use a comprehensive range of monetary policy tools. It will maintain liquidity at a reasonably high level and ensure that the money supply (M2) and social financing growth to match the nominal economic growth rate.

The financial system will step up efforts to effectively support the real economy.

In 2020, financial institutions reallocated 1.5 trillion yuan of revenue to the real economy by lowering the corporate borrowing cost.

China will keep its macro leverage ratio broadly stable in 2021.

Yi predicted that the ratio of the country's total liabilities to its GDP would get back to a standard of basic stability.

China will deepen the interest and exchange rate liberalization.

PBOC will further facilitate the transmission channel that allows the lending rate to be market-priced based on the prime rate (LPR) rate. It will also promote the gradual liberalization of the deposit interest rates by deepening the LPR reform. (read more in Chinese)

Yi has also admitted that thanks to the RMB's improved flexibility, exchange rates would play a beneficial role as an automatic stabilizer in the macroeconomy and the international balance of payments.

“2020年人民币汇率弹性增强,较好地起到了宏观经济和国际收支自动稳定器的作用,提高了货币政策自主性。”

China will provide more financial support in three areas.

1. To small and micro-sized businesses

In 2020, PBOC deferred payments of principals and interests for loans worth more than 6 trillion yuan.

It also granted inclusive loans worth more than 3 trillion yuan for SMEs, benefitting more than 30 million business entities.

Commercial banks will be encouraged to expand loans for agriculture, rural areas, and farmers, for small and micro-sized businesses and the manufacturing sector.

2. To the green finance development

According to Yi, China's green finance system has been granted a relatively sound foundation. China's outstanding green lending has exceeded 11 trillion yuan ($1.69 trillion), the largest globally, while its green bonds totaled 1.2 trillion yuan ($186.2 billion), the second-largest in the world.

“中国的绿色金融起步较早,已经有了比较好的基础。目前,中国绿色贷款余额超过11 万亿元,居世界第一。绿色债券余额1万多亿元,居世界第二。”易纲表示,下一步,关键是做好绿色金融政策设计和规划,发挥出金融支持绿色发展的三大功能——资源配置、风险管理、市场定价。

Green finance is becoming more common in investment portfolios, and it could play a major role in driving China’s carbon-neutral goal. (read more)

3. To technological innovation

Technological self-reliance is at the heart of China’s economic plans, said Vice Premier Liu He. (read more)

Innovation and monetary policy should focus on preventing the “stranglehold” (“卡脖子”) on key technologies. (read more in Chinese)

More efforts should be made to bolster the financial sector's regulatory system and ensure that the risks are addressed in compliance with the laws and the regulations.

Government in Action

Infrastructure Stimulus Remains Policy Priority in 2021

The first weeks of 2021 have already seen a wave of vibrant large-scale infrastructure activities across China. Infrastructure investment was the leading growth driver for the Chinese economy in 2020. China continues to stimulate the economy through major infrastructure initiatives in 2021, and throughout the 14th Five-Year Plan. (read more)

Major infrastructure starts

Shanghai: On Jan 4, 64 major infrastructure projects, in the total investment of $42 Billion (RMB 270 billion), started on the same day. Projects cover integrated circuits, biotech, AI, digital economy, aerospace and aviation, rental housing, and sewage treatments.

Zhengzhou, Henan: 209 major infrastructure projects, each above $150 Million in size, commenced on the same day. Infrastructure is connected to the Yellow River Basin's green development, industrial upgrade, new infrastructure, and public infrastructure.

Xianyang, Shaanxi; Jingzhou, Hubei; Yibin, Sichuan; Changsha, Hunan; and Zhongshan, Guangdong have all commenced major infrastructure projects at the start of the year.

Focus strategies in Infrastructure stimulus 2021

1. Municipal special-purpose bonds

据介绍,为应对外部环境变化及新冠肺炎疫情带来的冲击,2020年我国新增地方政府专项债券3.75万亿元,较2019年增加1.6万亿元,同时提高了专项债券可用作项目资本金的比例,重点支持既促消费惠民生又调结构增后劲的“两新一重”建设,以及地方公共卫生和防疫体系建设等。

RMB 3.75 Trillion municipal special purpose bonds were issued in 2020, more than double the 2019 scale. Special purpose bonds can be applied directly to local infrastructure developments, particularly in the “ Two New, One Major” projects ( this definition was covered in our July report) and public health system.

Special purpose bonds for the local governments will continue to be proactively allocated in 2021.

2. Expand the untapped consumer demand

Infrastructure development should focus on supply-side upgrade, demand-side management. All policies should be centered on the expansion of domestic consumption and domestic economic circulation. Ning Jizhe (宁吉喆), Deputy Chairman, NDRC

On the supply side, infrastructure must focus on high-end core technology breakthroughs, new industrial cluster developments, food security, and seed independence.

On the demand side, infrastructure should focus on renovations and upgrades of old communities and neighborhoods, Chengdu-Tibet Railway, the Western Land-Sea Passage, national water grid, and water diversion projects.

New consumption will focus on regional consumption centers and rural consumption.

“2021年将重点围绕新型消费、区域消费中心建设、农村消费、消费供给等方向,推出一系列具有针对性的举措。

3 PPP in infrastructure

A multi-layered infrastructure financing mechanism should incorporate PPPs, municipal special-purpose bonds, corporate bonds, and newly approved Infrastructure REITs.

China’s International Development Cooperation White Paper

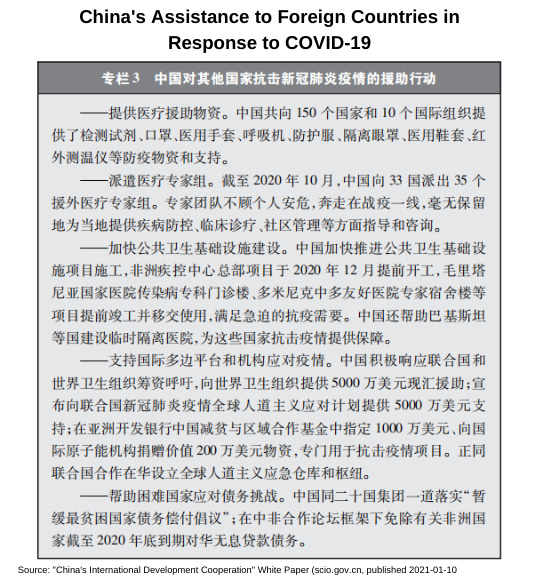

On January 10th, the State Council Information Office released the “China’s International Development Cooperation in the New Era” White Paper. This official document emphasized China’s achievements and future aspirations with initiatives like the BRI. It aims to promote unimpeded trade, financial connectivity and enhance people-to-people exchanges. (read more)

Key points of the White Paper:

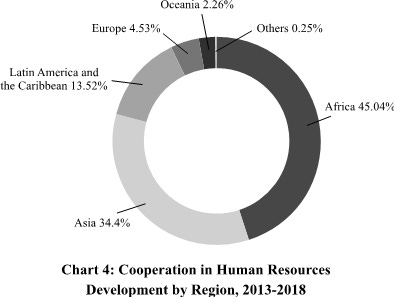

1. China’s Progress in International Cooperation for Development

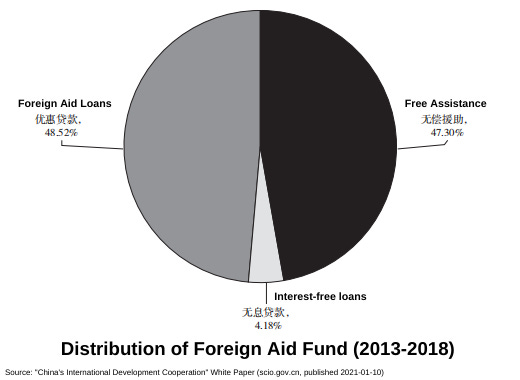

From 2013 to 2018, China assisted 122 countries and 20 international and regional multilateral organizations in Asia, Africa, Latin America, and the Caribbean, Oceania, and Europe. Among these, 30 countries in Asia, 53 countries in Africa, 9 countries in Oceania, 22 countries in Latin America and the Caribbean, and 8 countries in Europe.

Over this time period, China’s foreign aid amounted to RMB 270.2 billion, of which RMB 127.8 billion was provided for free assistance to developing countries, accounting for 47.30% of the total foreign aid. The total sum also includes RMB 11.3 billion in interest-free loans, accounting for 4.18% of the total foreign aid, and foreign aid loans of RMB 131.1 billion yuan, accounting for 48.52% of total foreign aid.

2. Co-construction of the “Belt and Road” Initiative

Since the BRI was put forward, China has actively carried out development corporations. It has played a role in:

Connecting the six corridors and six routes.

To support the China-Pakistan Economic Corridor, China participated in the upgrading and expansion of the Peshawar-Karachi Motorway and the Karakoram Highway.

China invested in infrastructures such as highways, bridges, and tunnels in Bangladesh, Myanmar, Laos, and Cambodia, promoting connectivity and integrated development between Southeast Asia and South Asia.

China supported Kyrgyzstan’s North-South highway, and Tajikistan’s road renovation project on the China-Central Asia-West Asia Economic Corridor has improved the local transport conditions.

China Railway Express to Europe connects over 100 cities across more than 20 countries in Europe and Asia.

China financed the Friendship Port expansion project in Mauritania;

China has assisted Pakistan, Nepal, Maldives, Cambodia, Zambia, Zimbabwe, and Togo to upgrade and expand its airports.

Promote investment in developing countries.

China assists worth RMB60 billion to launch more projects to improve people’s wellbeing in the following three years;

Provide emergency food aid worth RMB2 billion;

Make an additional contribution of US$1 billion to the SSCAF;

Launch 100 “happy home” projects, 100 poverty alleviation projects, and 100 health care and rehabilitation projects; and

Provide relevant international organizations with US$1 billion.

Invite 10,000 representatives to visit China;

4. Implementation of UN 2030 Agenda for Sustainable Development

China has and will continue to support poverty elimination nationally and internationally, fostering agricultural development, promoting educational equity, improving infrastructure, and advancing industrialization.

supporting “six 100 projects” – 100 poverty reduction projects, 100 agricultural cooperation projects, 100 aid for trade projects, 100 ecological conservation and climate change response projects, 100 hospitals and clinics, and 100 schools and vocational training centers;

In support of international cooperation against Covid-19, China pledged:

to provide an assistance fund of US$2 billion over two years;

to work with the UN to set up a global humanitarian response depot and hub in China;

to establish a cooperation mechanism for its hospitals to pair up with 30 African hospitals;

to make Covid-19 vaccines available as a global public good once they have been developed and applied in China; and

5. Joint Responses to Global Humanitarian Challenges

As global humanitarian challenges become more severe, China continues to adhere to a common, comprehensive, cooperative, and sustainable security concept, providing support to other countries within its capacity and contributing to the response to challenges concerning public health, natural disasters, and immigration while constantly upgrading its global governance.

6. Supporting Developing Countries to Enhance Economic Self-Reliance

China continues to increase its assistance in technology and human resources development cooperation. So far, China has helped improve governance capabilities and planning, industry development capabilities, and technical and educational capabilities.

From 2013 to 2018, China held more than 7,000 training sessions and seminars for foreign officials and technical personnel and in-service education programs, training a total of some 200,000 people. Such projects cover more than 100 subjects in 17 fields, including politics and diplomacy, public administration, national development, poverty reduction through agricultural development, medical and health care, education and scientific research, culture, and sports, and transport.

7. Prospects for China’s International Development Cooperation

China will continue to support the World Health Organization and related institutions to eliminate COVID-19. It ultimately supports and works towards achieving the goals set by the United Nations 2030 Sustainable Development Agenda, continuing to strengthen international cooperation for future global development.

Policy

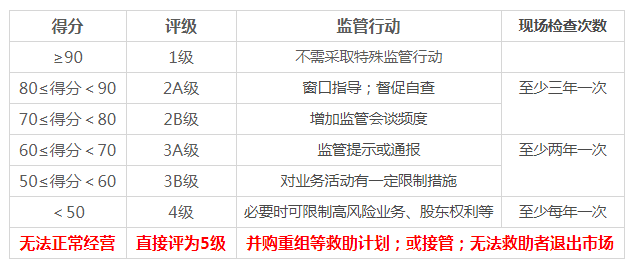

China Releases New Measures on Supervising Consumer Finance Companies

China Banking and Insurance Regulatory Commission (CBIRC) recently released the Measures (trial implementation) on the supervision and rating of consumer finance companies (《消费金融公司监管评级办法(试行)》).

The Purpose of Consumer Finance Companies

Consumer finance companies are non-bank financial institutions established within the territory of the People's Republic of China and approved by the China Banking Regulatory Commission. They are not allowed to absorb public deposits but provide individuals with small-sum and convenient consumer credit-based loans. Through extensive cooperation with merchants, consumer finance companies offer personalized consumption loans for diversified consumption needs and enrich China’s financial institutions. (read more in Chinese)

消费金融公司是指经银监会批准,在中华人民共和国境内设立的,不吸收公众存款,以小额、分散为原则,为中国境内居民个人提供以消费为目的的贷款的非银行金融机构。

消费金融公司被认为充分发挥了其“小、快、灵”的特点,通过与众多商户开展广泛合作,开发出独具特色的个人消费贷款产品,满足了不同群体消费需要,丰富了我国的金融机构类型。

By the end of June 2020, 26 consumer finance companies served some 140 million clients in China. Their total assets stood at about $70.35Billion (c. RMB 486.2Billion). (read more)

To date, there are 27 consumer finance companies. 24 will participate in the first round of regulatory rating. Ping An Consumer Finance (平安消费金融公司), Beijing Sunshine Consumer Finance (北京阳光消费金融公司), and Xiaomi Consumer Finance (小米消费金融公司) will not participate in the rating this year as they were established in less than one year.

Significance of the Measures

The Measures mark the first regulatory rating mechanism in the consumer finance industry.

It offers institutional support for efficient and classified supervision of consumer finance companies.

It offers guidance on strengthening risk prevention and control.

It marks a new attempt to ensure the financial sector better serve the real economy.

It prevents the risk of reserve selection when “bad money drives out the good.” (read more in Chinese)

《办法》的发布和实施,进一步完善了消费金融公司监管规制,为强化分类监管提供了制度支撑,有利于提升监管工作效能,引导消费金融公司强化风险防控,发挥特色功能,加快向高质量发展转变,更好地服务实体经济。

How the Ratings Work

Weighted allocation of rating elements:

corporate governance and internal control (28%)

capital management (12%)

risk management (35%)

professional service quality (15%)

information technology management (10%)

各评级要素的标准权重分配如下:公司治理与内控(28%),资本管理(12%),风险管理(35%),专业服务质量(15%),信息科技管理(10%)。

The full score is 100 points, divided into Levels 1 to 5. The lower the score, the greater the institutional risk, and the closer regulatory attention is required. (read more in Chinese)

Level 1 (score ≥90): no regulatory action required

Level 2A (80~89): window guidance and more self-examination

Level 2B (70~79): more regulatory meetings

Level 3A (60~69): regulatory notice

Level 3B (50~59): restrictions on operational activities

Level 4 (score < 50): restrictions on high-risk business or shareholder’s equity when necessary

Level 5 (fails normal operation): rescue plan, takeover, or market exit

消费金融公司监管评级得分满分为100分,根据具体评级得分,分为1级、2级(A、B)、3级(A、B)、4级和5级,数值越大表示机构风险或问题越大,需要监管关注的程度越高。

监管评级得分在90分(含)以上为1级;70分(含)至90分为2级,其中:80分(含)至90分为2A级,70分(含)至80分为2B级;50分(含)至70分为3级,其中:60分(含)至70分为3A级,50分(含)至60分为3B级;50分以下为4级;无法正常经营的直接评为5级。

Technology

Ant Group Considers Financial Holding Company under Regulatory Scrutiny

Following the regulatory issues that have arisen since the failed listing of Ant Group, the fintech unicorn may be considering creating a financial holding company. The Chinese regulators-led by the People’s Bank of China—expect Ant to incorporate its wealth management, insurance businesses, and its stake in the online lender MYBank, all into a financial holding company.

What remains to be seen is the fate of Alipay, Ant Group’s digital payments business. Alipay is the second biggest contributor to Ant Group’s revenue after consumer lending.

What does it mean for Ant’s business model and valuation?

The creation of a holding company where all Ant’s businesses are required to have a financial license—requested by the PBoC—would drastically lower the staggering $315 billion valuation at which investors valued Ant before its IPO fiasco. The fintech unicorn presented itself to the world as a technology company, which resulted in a far more generous valuation than if it had been received as a financial institution.

As a financial institution, Ant will have to increase the cash reserve on its balance sheet to meet the requirements set out by the PBoC regarding capital adequacy and risk control requirements.

The market is now afraid that tighter regulation will curb the growth of Ant as one of the requirements elaborated by the regulatory authorities requires Ant Group to fund 30% of the consumer loans that it offers in collaboration with its partner financial institutions. Roughly 98% of the loans offered by Ant’s consumer lending business—which are worth 1.7 trillion yuan—are either underwritten by other banks or raised through asset-backed securitization. Hence, Ant Group would have to replenish 87bn RMB($13.4 billion) in cash, assuming that the unicorn will lend at the current scale. In this case, Ant would still be profitable, but not as much as it used to be.

Even in the remote scenario that the 2.1 trillion RMB in loans are to be held on the company’s balance sheet, Ant would still survive. If the risk weight chosen is 100%, Ant’s Tier 1 Capital Ratio would equal 10%, 4% lower than the Tier 1 Ratio of the biggest Chinese bank, ICBC. Yet, this would substantially decrease Ant Group’s growth prospects and its stock appeal. As some Refinitiv data show, ICBC and its comparable companies are trading at book value, thus valuing Ant at a comparable $33bn.

Capital Markets

Chinese Companies Shuns US market for HKEX

Several Chinese companies have opted for secondary listings on HKEX, including the search engine Baidu, the video-sharing app Bilibili, and Trip.com (formerly Ctrip), a leading integrated travel service. In 2020, Chinese firms listed in the U.S. raised approximately US$17 billion in Hong Kong through secondary listings, partly as a result of the current U.S.-China tensions.

Baidu’s second IPO on HKEX

Baidu, which was on the Nasdaq in 2005, is planning a second listing in Hong Kong that could raise in the region of US$3.5 billion. The firm has selected Goldman Sachs and CLSA, the equity brokerage subsidiary of CITIC, the state-owned investment company, to arrange a secondary listing in Hong Kong on January 7th.

Baidu’s listing could raise at least $3.5 billion, based on its latest market capitalization of nearly $70 billion. More banks could join in the future, and details, including the offering's timing and size, could eventually change.

Baidu

In the third quarter of 2020, Baidu achieved revenues totaling $4.35 billion (28.2 billion RMB), up 1% year on year basis, up 8% on a quarter on quarter basis. Baidu’s

shares have risen to more than 3% after the IPO news.

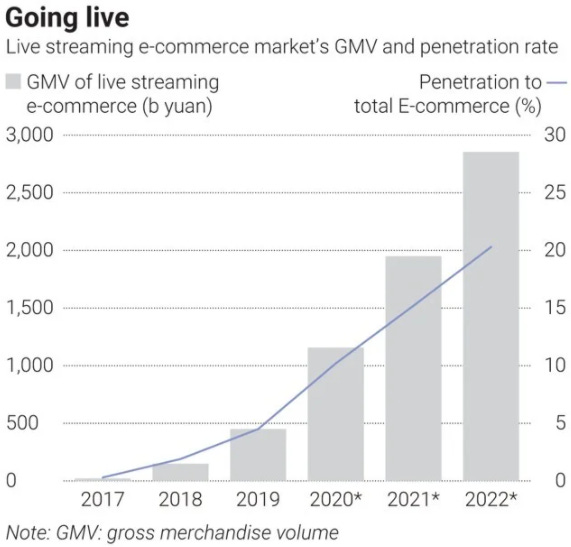

Kuaishou and Bilibili Seek Listings in Hong Kong

Kuaishou Technology and Bilibili are two Chinese video-sharing apps that have recently requested approval for a primary and secondary listing, respectively. The appetite of investors for Chinese entertainment platforms has increased since the coronavirus pandemic outbreak, which enticed many brands to go digital and use influencers to promote their products during live streams.

It is important to note that China is the country with the largest mobile internet population, which is expected to reach a staggering 1.1 billion by 2025. In addition, Chinese netizens are projected to increase the time they spend surfing on mobiles from 4.73 hours per day in 2019 to 5.73 hours in 2025. All this contributes to a positive outlook of the live streaming e-commerce industry in China, growing and will reach almost RMB3,000bn in GMV.

Source: South China Morning Post

As some analysts at investment bank Jefferies noticed, the entertainment industry will see an increase in the importance of video-sharing platforms thanks to the substantial user base and its time spent watching videos and opportunities for monetization.

Trip.com Second Listing in HK in the first half of 2021

Trip.com (formerly Ctrip), listed on the NASDAQ in 2003, was reported to have plans to

raise at least $1 billion through

a secondary listing in Hong Kong in the first half of this year. Ctrip has

approached China International Capital Corp, JPMorgan and Morgan Stanley about

plans to sell shares in Hong Kong, according to four people familiar with the

matter.

Ctrip's secondary listing in Hong Kong is expected to require a lengthy process of high

coordination complexity. Based on its latest NASDAQ market capitalization of $20.6 billion, the

Hong Kong listing would raise at least $2 billion.

Ctrip

Ctrip is a leading integrated travel service company in China, providing a full range of

travel services including wireless applications, hotel booking, air ticket

booking, travel and vacation, business and travel management and travel

information. The main company is Shanghai Ctrip Commerce Co, with a total of

116 member enterprises.

Ctrip's first-quarter results last year were hit by the COVID-19 outbreak, with net

operating revenue down 42% from a year earlier.

Net operating revenue in the third quarter of last year was $805 million, down 48% from the same period last year, marking the third consecutive quarter of decline in revenues. Nevertheless, net profit attributable to Ctrip's shareholders reached $234 million, up 102% year on year, marking the first quarterly profit after the outbreak of the epidemic.

Guangzhou Sets up New Futures Exchange

The latest planned Guangzhou Futures Exchange will be China’s first new futures exchange in 14 years. This is part of China’s efforts to hit its goal of carbon neutrality by 2060.

The exchange will specialise in trading financial instruments linked to green development, such as carbon futures. This is yet a further step in the government’s mission of capital market reforms. These changes will help increase innovation and competitiveness. However it still needs to tackle the relevant regulatory framework.

The Chinese mainland currently consists of two stock exchanges and four futures exchanges, which are under the CSRC’s supervision to ensure that they are run on a non-profit basis. Five of the aforementioned six exchanges are run under a membership system, where fees are charged to its members (predominantly brokerages). However, the China Financial Futures Exchange (CFFEX) was built as a company with funding drawn from the other five exchanges.

A structural reform China’s exchanges need

Financial exchanges in China face an unusual problem. What should exchanges do with their residual income? Although the funds belong to the shareholders of the exchanges, under Chinese law, exchanges cannot distribute profits amongst members. Members of the exchanges pay to participate in transactions, but the profits generated over the years are technically state assets.

According to the revised Securities law, this revenue, which comes from commissions of transactions and interests from margin deposits, should be used to maintain exchange operations and improve the exchanges.

Currently, futures trading regulation prohibits for-profit futures exchanges, which means that unless the rules change, the Guangzhou Futures Exchange will not be able to distribute profits to any of its shareholders. Ultimately, the adoption of a more corporate-like structure will be called for.

The annual revenue, combining Dalian Commodity Exchange, Zhengzhou Commodity Exchange, and Shanghai Futures Exchange, reaches approximately $1.55 billion (10 billion RMB).

International Relations

US Delists SMIC; Shelves Blacklisting of Alibaba, Tencent, Baidu

The US has made several moves against Chinese companies this week, by delisting SMIC from the US OTC market and adding 9 additional companies to the US defense blacklist while sparing Alibaba, Tencent, and Baidu.

SMIC Delisted from the US OTC Market

On January 6th, SMIC received notice from the OTCQX market operators that, according to the executive orders and related regulatory guidelines, the company will be withdrawn from the OTCQX market at the close of the deal. Consequently, the company's securities (SIUIF, SMICY) will no longer be qualified for quotations or trading on the OTC Link ATS.

On January 6th, SMIC's Hong Kong shares suddenly soared up more than 19%. In terms of demand, the rise of the new downstream applications such as 5G and the new energy vehicles gives the company strong revenue prospects.

On January 7th, China Unicom, Nanjing Panda Information Industry Group, and SMIC shares were also reported to be removed right from the start of the trading day from the FTSE Global Equity Index Series and the FTSE China A-share index.

US Shelves Blacklisting Alibaba, Tencent, Baidu

The US defense blacklist added 9 additional Chinese companies deemed to have links with the Chinese military, including China’s second-largest smartphone maker Xiaomi.

Alibaba, Tencent, and Baidu narrowly escaped the defense blacklist this time (source). The three companies were shortlisted to be included in the Defense Department’s list (source).

Members of the National Security Council, State Department, and Pentagon agreed to classify the three companies as linked to the Chinese military, intelligence, and security services (source). However, Treasury Secretary Mnuchin opposed this move, fearing selloffs and consequent economic fallouts (source).

Brian Deese, newly-appointed director of the US National Economic Council, has spoken at the CES tech expo, underscored how Biden would strive for tech supremacy by investing in the domestic technology sector revitalizing alliances rather than imposing restrictions on China. He commented on Trump’s transactional approach, saying that it soured ongoing tensions and led to huge revenue losses for American tech firms (source).

However, no insight transpired on the possibility of Biden lifting the newly imposed restrictions.

DRC and Botswana Signed MOUs on BRI

From January 4th to 9th, Wang Yi, Chinese State Councilor and Foreign Minister, has visited Nigeria, the Democratic Republic of the Congo, Botswana, Tanzania, and Seychelles following the Chinese foreign minister’s long-standing tradition (31 years) of choosing Africa for their first overseas visit each year. (read more)

During the visit, DRC and Botswana signed MOUs with China on the Belt and Road Initiative. Given that, there are only 9 African countries that have not signed the BRI yet. (read more; read more)

The year’s trip is unique as:

The COVID-19 pandemic has pushed Africa into a recession, making African countries apply for debt relief from the G20, including China. (read more)

Analysts foresee China will be more cautious, and it will slow down the lending for the belt and road projects. (read more)

The global campaign of COVID-19 vaccines has started as discussions around its distribution are in full swing. (read more)

2021 is the final year for implementing the results and the solutions elaborated during the China-Africa Cooperation Beijing Summit. (read more)

Zhao Lijian, the Chinese foreign ministry spokesperson, shared that this trip shows the great importance China attaches to Africa. China will continue to support Africa’s infrastructure development and develop the African Continent Free Trade Area to strengthen China – Africa cooperation. (read more)